For Financial Producer use only. Not to be reproduced or shown to clients.

T H E N E W P RO D U C T F RO N T IE R

No-Load

Indexed UL

Long-Term Care – UNIVERSITY | MARCH 9-11 / 2

Sam Rocke

SVP, PROTECTION

TODAY’S CO-PRESENTER

Sam Rocke is driven to provide the best possible results

for individuals, families, and businesses as they acquire

insurance coverage. As leader of the life insurance sales

support teams at Ash Brokerage, his teams help advisors

navigate product recommendations, objectively evaluate

existing coverage, and craft planning recommendations

for their clients.

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 2

Thomas Losher

Life Insurance Specialist,

Ash Brokerage

TODAY’S CO-PRESENTER

Thomas is a recent Indiana University graduate from The

Kelley School of Business. He is an Advanced Markets Analyst

on the Advanced Markets team.

Thomas is focused on providing retirement efficiency

strategies to the advisors he works with.

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 3

4

I. Indexed Universal Life Insurance

II. Why Use Indexed UL?

III. Introduction of a New IUL

TODAY’S AGENDA

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 4

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 5

Life Insurance as a Tax Diversification Tool

Taxable

Cash and Equivalents

Stocks/Bonds

Non-Qualified Mutual Funds / ETFs

Tax-Deferred

IRA/401k (IRS Limits)

Tax-Free

Roth IRA/401k (IRS Limits)

Life Insurance

I. Indexed Universal Life Insurance

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 6

Indexed Universal

Life Insurance

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 7

Defining IUL

Fixed Indexed Universal Life

• No investment directly in index

• Carrier invests general account interest to acquire options

• Highly dependent on general account yield

Credits have a Floor and Cap

• Floor is typically 0%-1%

• Cap is set by the carrier, typically 9-12%

Less Overall Volatility than VUL, more than Whole Life

Indexed Universal

Life Insurance

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 8

IUL Mechanics

0%-12%

Credited Interest

0%

Credited Interest

$100,000 in Index

5% interest from

general account

S&P Options

$5,000 Invested

Options Expire

Worthless

Options are

“In the Money”

Positive MarketNegative Market

Indexed Universal

Life Insurance

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 9

Example of How IUL Credits Interest

-50.00%

-40.00%

-30.00%

-20.00%

-10.00%

0.00%

10.00%

20.00%

30.00%

40.00%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

S&P 500 Point to Point

II. Why Use Indexed UL?

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 10

Why Indexed UL?

Advantages of Indexed UL

Flexible Product Chassis – Universal Life Offers:

• Easy withdrawal to cost basis

• Death benefit reductions to manage net amount at risk

• Overloan Protection Riders

Upside Market Exposure:

• Market gains up to cap

• Uncapped strategies available

Downside Protection:

• 0% floor means no “recovery” of market losses

• Beware of asset charges

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 11

Why Indexed UL?

Why Indexing?

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 12

If you invested $100,000 on Jan 1, 2000 …

“Hedged” 12% Cap

Low: $100,000

High: $351,118

EOY 2019: $351,118

Actual Plus Dividend

Low: $62,392

High: $324,133

EOY 2019: $324,133

-40.00%

-30.00%

-20.00%

-10.00%

0.00%

10.00%

20.00%

30.00%

40.00%

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

"Hedged"

Actual Plus Dividend

Why Indexed UL?

Growth of $100,000 – Year-by-Year

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 13

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

"Hedged"

Actual Plus Dividend

2009

-$72,401

2018

-$66,991

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 14

But …

Why Indexed UL?

Common Concerns of Indexed UL

Lack of Transparency

High Fees

Confusing

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 15

III. Introducing a New IUL

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 16

Introducing a

New IUL

The New Indexed UL Product

No Premium Loads or Commissions

No “Per Thousand” Charge

No M&E

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 17

Introducing a

New IUL

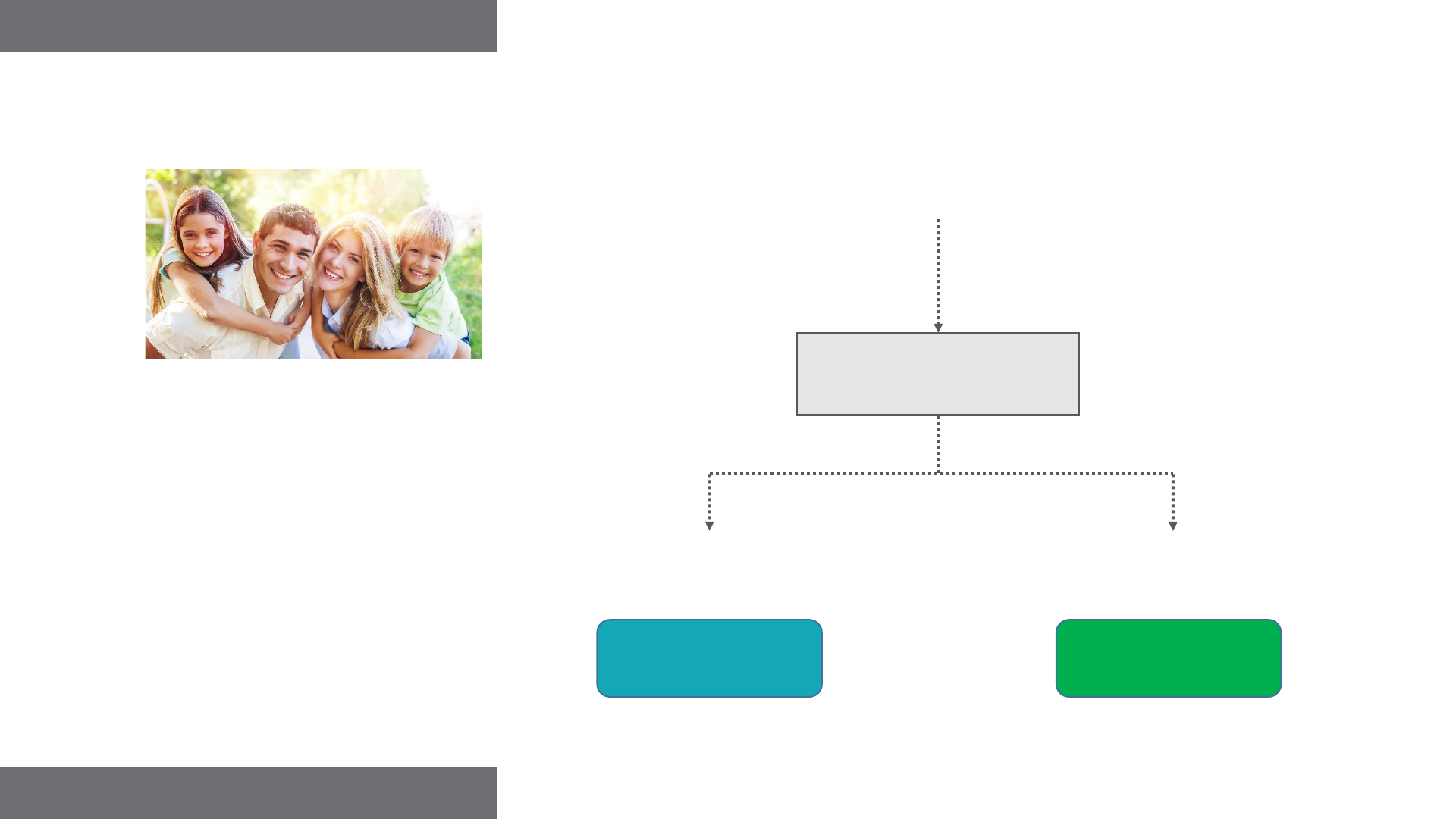

It’s This Simple

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 18

Client Premium

Cost of

Insurance & $60

Policy Fee

-

No Premium Loads

No Commissions

Index Credits

+

No Bonuses

No Multipliers, etc.

Account Value

=

Introducing a

New IUL

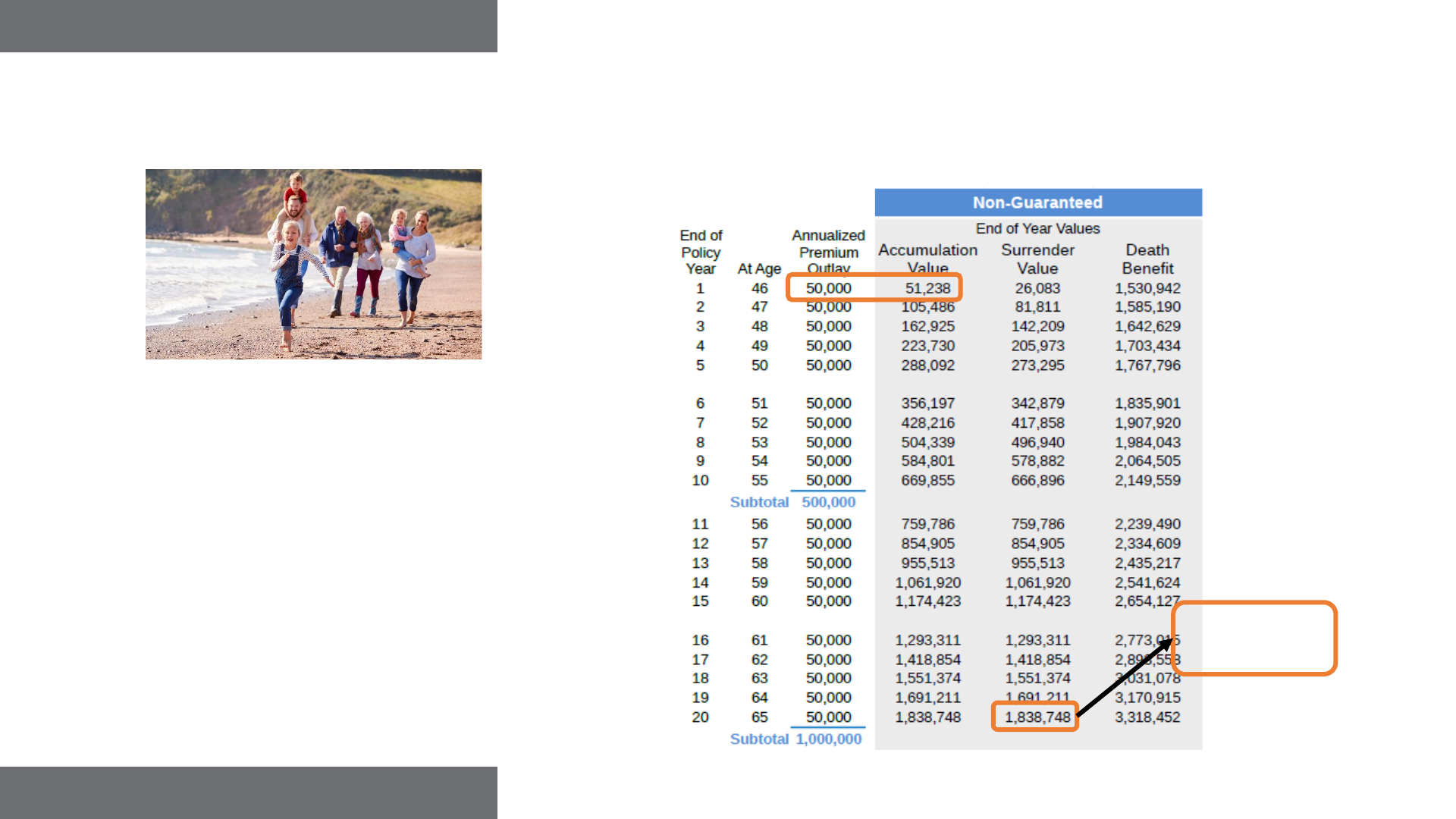

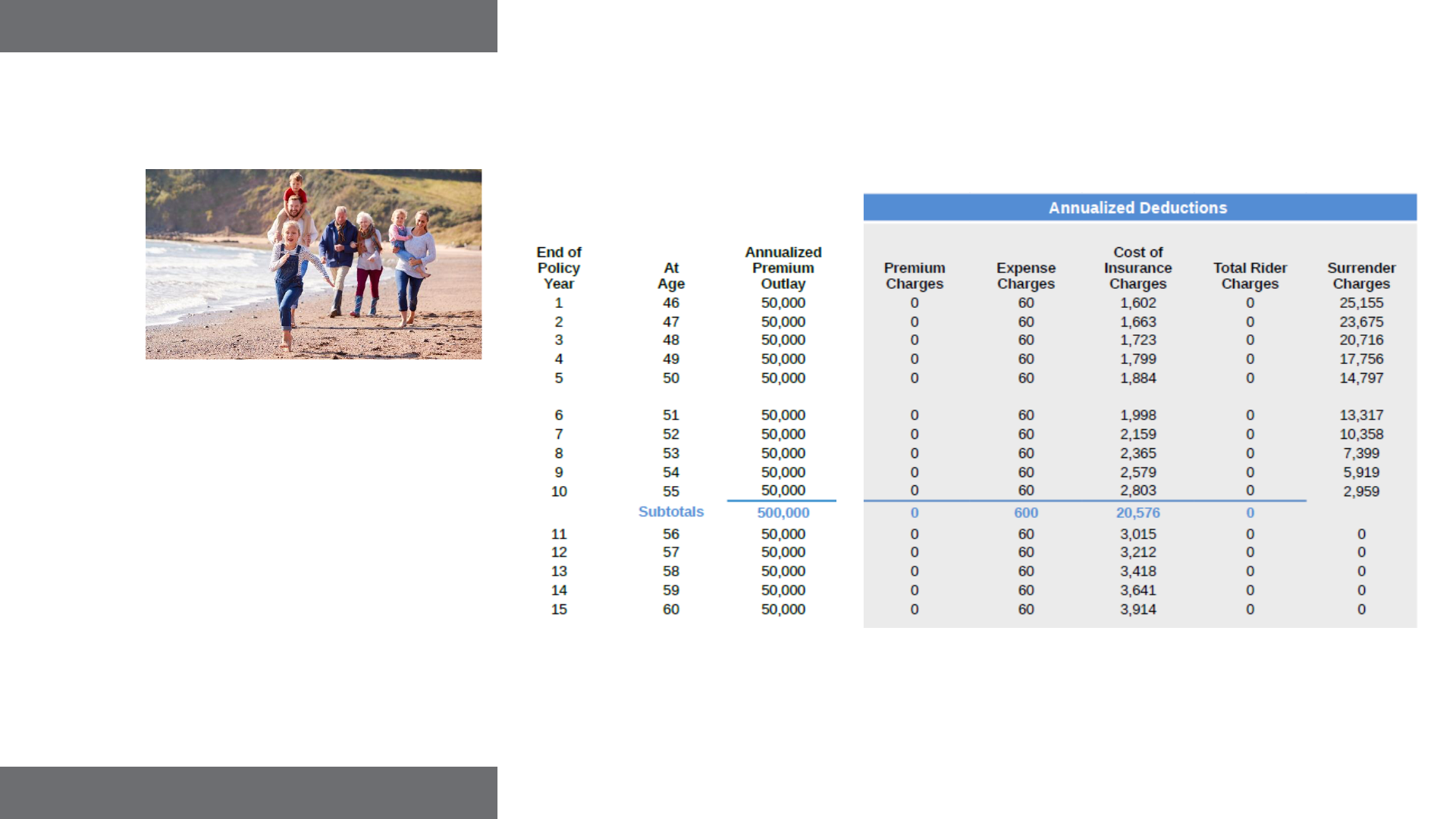

How Does it Look?

• Male, age 45

• $50,000 Annual Savings

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 19

• ~$1.5M in Net Death Benefit

• 6% Index Return

5.5% NET

IRR

Introducing a

New IUL

Expenses are Key

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 20

Introducing a

New IUL

But, How to Derive Revenue

Fees charged based on the assets in the policy

No commissions or fees come FROM the policy

Data feeds to be sent by Ash Brokerage

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 21

Introducing a

New IUL

Applications

High Income, High Saver

Underperforming Policy Review

Asset Protection

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 22

Case Study – Underperforming Whole Life

No-Load Indexed UL, The New Product Frontier | LIFE INSURANCE / 23

(800) 589-3000

www.ashbrokerage.comFor Financial Producer use only. Not to be reproduced or shown to clients.

Questions

(800) 589-3000

www.ashbrokerage.comFor Financial Producer use only. Not to be reproduced or shown to clients.

Thank you for attending

TH E N E W P RODUCT F RONTIE R

No-Load

Indexed UL