Contents

Author Bios 3

3rd Generation Planning Tools Introduion 4

Abacum 7

Aerys 8

Causal 9

Cube 10

Datarails 11

Farseer 12

Finmark 13

Forecar 14

Jirav 15

Mosaic 16

OnPlan 17

Phocas Soware 18

Pigment 19

Stratify 20

Vareto 21

Vendor Comparison Tables 22

• Planning Funions Supported 23

• Core Produ Funionality 24

• Indury Focus and Target Cuomer 25

• Soware Integrations 26 – 28

Produs to Watch 29

Conclusion 33

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

2

Paul Barnhur A.K.A “The FP&A Guy” is the CEO and founder of The FP&A Guy. He has over

a decade of experience in finance and FP&A working in travel, banking, SaaS and more. He is

recognized as a thought leader and influencer within the field of FP&A and CFOTech. He has

met with over 50 CFOTech companies in the la year eaking to founders, senior leaders, and

participating in produ demos. He hos the popular podca FP&A Today. He is an advisory board

member at Born Capital where he helps identify and grow the next big thing in CFOTech. He also

provides training, consulting, and thought leadership for all things FP&A. Paul also enjoys reading

fiion, running, orts, and ending time outdoors and with his family.

linkedin.com/in/thefpandaguy/

Wouter Born is the founding partner at Born Capital, a venture capital firm ecializing in

#CFOTech: innovative technology for FP&A, Financial Close, Reporting and Finance Automation.

He is also the co-founder of CXO Soware (exit 2018) and former head of M&A at insightsoware.

Wouter has worked with FP&A technology companies for the pa 22 years. As consultant, sales,

entrepreneur, executive and inveor he has looked at the market from dierent angles. He uses his

deep underanding of the CFOTech indury to support the next generation of founders, to drive

innovation, to support other inveors (VC/PE) in making the right CFOTech invement decisions

and change the way the CFO oce drives value for every business. When he’s not busy working

on Born Capital deals or advising other entrepreneurs on how to grow their businesses. He’s

enjoying life with his lovely wife & two children. And, he loves windsurfing and cycling. You

can find him on LinkedIn sharing daily insights on CFOTech, FP&A and Entrepreneurship.

linkedin.com/in/wouterborn/

Anders Liu-Lindberg is the co-founder and a partner at the Business Partnering Initute. He has

thirteen years of experience in the finance funion at the global tranort and logiics company

Maersk. He’s the co-author of the book ‘Create Value as a Finance Business Partner’ and a long-time

Finance Blogger on LinkedIn with 100,000+ followers and 180,000+ subscribers to his blog. He’s

also an advisory board member at Born Capital where he helps identify and grow the next big thing

in CFOTech. Finally, he’s a member of the board of direors at PACE – Profitability Analytics Center

of Excellence where he supports the development of new analytics frameworks that can improve

profitability in companies around the world. Anders is a vivid soccer fan and ends time watching

matches with his local soccer team wherever possible. He’s also been a semi-professional bowler

for more than 25 years and apart from that enjoys ending time with his wife and two kids.

linkedin.com/in/andersliulindberg/

© Business Partnering Initute, 2022

|

bpidk.org

Authors

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

3

© Business Partnering Initute, 2022

|

bpidk.org

Would that lead to be possible results? I think you

know the answer – absolutely not.

The same approach is being used by companies,

ju doing accounting will only create insights aer the

financial period ends and then it’s typically too late to

change direion. So, companies work with Financial

Planning & Analysis (FP&A) teams to create financial

plans, monitor the execution, and advise the business

leaders to take correive measures. FP&A soware

helps businesses reamline this process.

FP&A soware makes life easier for finance and

accounting teams.

3rd Generation of FP&A soware

FP&A soware, originally referred to as Corporate

Performance Management (CPM) or Enterprise

Performance Management (EPM) soware has been

out there for the pa 40 years. So, to underand

what we mean by 3rd generation, let’s fir look at

the evolution of FP&A soware:

The Fir Generation of FP&A soware included

solutions such as Hyperion, SAP BPC, and TM1. These

are very powerful, sophiicated solutions, but were

heavy weight on-premises solutions that typically took

more than 6 months to implement and involved massive

hardware cos, making these solutions only available

to very large companies with deep pockets. For these

large enterprises the TCO could be more than

$1 million in the fir year alone.

Cloud-Based Second-Generation FP&A solutions

such as Anaplan, Planful, and Adaptive Insights had a

significantly lower TCO, were faer to implement, and

oered increased scalability. These solutions were much

more appealing to middle-market buyers. However, the

implementations oen ill required extensive technical

knowledge and the produs were oen only used by key

FP&A users. Deite being significantly less expensive

than fir-generation solutions, companies would typically

pay between $25,000 and $100,000 per year and more

than $25,000 for a basic implementation.

3rd Generation FP&A soware is delivered as a

service and oers a user-centric design, low co, shorter

implementation times, many self-service features, native

ERP integration, and a quick/high ROI. The typical annual

TCO of a third-generation FP&A solution is $15k to $25k,

with a one-time implementation fee of $10k or less.

These 3rd Generation tools made FP&A soware a viable

solution for small to midmarket businesses (SMBs)

Although Microso Excel is ill the mo used FP&A

tool, this la generation of produs help you with

overcoming readsheet issues in a variety of ways by

creating governance, business user collaboration and

oering full web-based modeling and reporting.

3rd Generation FP&A Soware

Imagine a soccer coach never being present at the match for his team. There is no plan, and

the coach can only evaluate the results aerwards with the team. And, during the match the

players would have to figure out on their own how to make the be decisions without guidance.

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

4

© Business Partnering Initute, 2022

|

bpidk.org

The 1 and 2nd generation vendors are ill out there,

they are ill innovating, they have some great soware

that has helped many companies improve their FP&A,

and own a significant part of the market. However, the

3rd generation vendors are built for a new type of user,

like agile companies, that are digitally native, preferring

point solutions over vendor andardization, that can

take quick decisions and are looking for a quick ROI.

If you recognize yourself in this profile, then you should

consider 3rd generation FP&A solutions when

making your buying decision.

Market Dynamics

The 3rd generation soware market is booming. For

this guide we longlied more than 40 FP&A vendors,

all founded in the pa few years. This group of vendors

is ill a fraion of what is out there, as new produs are

being launched daily. Why are so many entrepreneurs

building new solutions for FP&A? There is a simple

reason for it. The lower mid-market and SMB market

is gigantic and mo companies that could benefit

from an FP&A solution don’t own one.

The reason that this is happening now and not before

has to do with the evolution of technology and go to

market models. Until recently it was not possible to

build a sophiicated and powerful business solution

that required very lile implementation time. And, even

when this would have been possible it would have been

hard to sell such a produ without an enterprise sales

team running long sales cycles. Thanks to modern cloud

soware architeures and improved UI/UX techniques,

vendors can build more intuitive soware with a lower

learning curve and self-service features. These new

developments also allow for dierent go to market

models like produ led growth, try & buy, and short

proof of concepts.

The 3rd generation vendors are addressing a new

audience that has been traditionally underserved

and relied heavily on Microso Excel. They bring

the enterprise scale features to lower mid-market

and SMB companies.

The amount of venture capital flowing into this category

has been very significant. Many vendors in our market

guide have received significant funding which allows

them to inve in R&D and scale their operations.

Seleion Criteria and Survey Process

This guide is primarily meant to highlight those

solutions in the market that are not yet covered by

major market research firms like Gartner, Forreer, etc.

This guide won’t tell you what the be 3rd generation

solution is or rank any vendors, but guides potential

buyers in their seleion process.

We arted the seleion process by researching the

market and longlied more than 40 FP&A tools. Once

we had put together an initial li, we screened the tools

on the li, looking for tools that met the following criteria:

• The produ fits the 3rd generation definition

• Company has received significant funding or has

an innovative produ and is looking to scale

• Produ is a financial planning plaorm, not a financial

modeling tool or a planning plaorm for other

departments such as marketing or procurement.

Aer reviewing our initial li with the above

requirements, we narrowed the li down to ju

over 20 vendors. We reached out to contas at each

company and sent surveys and received reonses

from 17 vendors. Aer receiving the reonses, we

removed two vendors, one because it was not fully

cloud-based, and one due to produ maturity. We

finally included 15 in the guide aer reviewing the

survey reonses.

For the survey, we asked each vendor the same set

of queions, and the queions were used to help

write the guide and to provide comparison tables

highlighting dierences between each vendor. In addition

to conduing a survey with each vendor, we did a demo

of the produs. For mo produs, we ent time with

the founders/senior leadership learning about the vision

and ory behind the produ. We have tried to capture

not only what we like about the produ, but also the

ory behind the company.

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

5

Company Overview:

Julio & Jorge founded Abacum in 2020. Jorge had experienced a clear market gap during his time as a CFO of multiple companies

and set out to create the tool he wished he had. Aer conduing cuomer research with over 100 companies, the founder’s belief was

validated that a need exied for a rategic finance-focused planning plaorm. Abacum is not focused on creating a produ at parity

with other planning tools but on creating something fundamentally dierent from the other tools in the marketplace. Abacum is a

Y combinator Winter 2021 graduate and raised $25M in funding during its la round in Nov 2021. The company and produ were born

with collaboration in mind and heavily focused on empowering aive collaboration. That is why it created a ‘notebook-yle’ interface

modeled aer soware companies such as Notion and Jupyter Notebooks.

Produ Overview:

Abacum’s planning plaorm is built around collaboration with a rong focus on ensuring the business can collaborate with finance.

This can be seen throughout the produ from the ability to easily comment back and forth to easy sharing of presentations with

internal and external akeholders from within the tool. The tool is built using multi-dimensional modeling with no limit to the number

of dimensions or metrics one can have. The tool connes to traditional tools such as your ERP, CRM, HRIS as well as your data

warehouse, which allows one to drill down to the transaional level of data. Abacum has built several templates to eed up the

implementation process while focusing on making the tool flexible to meet the planning needs of dierent induries. The Abacum

produ oers three dierent plan tiers from arter to professional to meet the diverse needs of its cuomers.

What we like:

• Ability to easily share presentations with internal and external shareholders raight from the tool and the rong integration

with Google Slides

• The notebook experience in reporting creates a very collaborative experience among the teams

• The integration with readsheets, including the ability to support hybrid models with two-way Google Sheet integration

or Excel uploads

• Integration with collaboration tools such as slack

Founded: 2020

Founders: Jorge Lluch & Julio Martinez

Target Cuomer: SMBs – 50-2,000 employees, indury agnoic with rong tech presence

E Implementation Time*: 4 Weeks (2 phase process, 2-week Integration, 2-week plaorm training)

Abacum

www.abacum.io

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

7

Company Overview:

Acertys was founded by Martin Kratky and Hesam Ziaei with the goal of creating a unified data warehouse, planning, and reporting

application using the Microso technology ack. The founders ent over 20 years implementing planning tools, including TM1, and

saw an opportunity to embed a similar solution based on the Microso Azure ecosyem and utilizing Microso Power BI and Excel on

the frontend. Aerys set out to create a produ that integrated all this in one plaorm in a way that was easy to implement and could

serve the entire marketplace, from small businesses with pre-configured applications to large enterprises with the Aerys xP&A Suite.

The founders believe the traditional approach of separating data warehousing, planning, and reporting creates siloes and comes with

a heavy co.

Produ Overview:

Aerys is a unique produ in that it has dierent produ oerings for small business and enterprise business within the same

plaorm. The plaorm provides a unique oering built upon the Microso tech ack allowing write-back capability in Power BI and

Excel. The produ for small business is built around a marketplace oering of pre-built templates that integrate and build a data

model to over 80 common SaaS tools. The Enterprise produ oers a complete planning plaorm that includes the ability to

write-back data direly to the tool using 8 Aerys Power BI visuals as well as an Excel Add-in.

What we like:

• The tool combines your planning, visualization, and data warehouse tools together in one plaorm

• Plaorm is integrated seamlessly into the Microso tech ack (Excel, Power BI, Azure)

• Aerys Visual Planning allows you to update scenarios visually and write it back to the data warehouse

• Aerys Apps are pre-configured applications designed to get you up and running in minutes

Founded: 2015

Founders: Martin Kratky & Hesam Ziaei

Target Cuomer: All induries, 10M+ revenue, indury agnoic

E Implementation Time*: SMB oering 1 day, Enterprise version <= 1 Week

Aerys

www.aerys.com

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

8

Company Overview:

Causal was founded in 2019 by Taimur who udied math, and Lukas who comes from a tech background. Taimur was exposed to

readsheets as a data scienti aer school and kept running into the typical issues one experiences with models. He kept trying to

solve the problems with code, which eventually led to him and Lukas geing together to develop a modeling tool for the masses that

solved the problems one typically faces with readsheets like Excel and Google Sheets. Causal has set out to replace Excel as the

#1 used number-crunching app and raised $20M in a series A earlier this year to aid with that goal.

Produ Overview:

Causal, unlike other business planning plaorms, does not art by building a data model from your financial syem. Causal has

focused on building an intuitive number crunching app that allows companies to implement their models in Causal quickly. The

implementation process arts with Causal working alongside you to build your financial models and then has you import and map

he data to your financial models. This allows the implementation time to focus on learning how to model vs. ending time defining

your data model before using the syem. One works closely with the cuomer support team throughout the implementation process

to build the models necessary to support the planning process. The produ oers three pricing tiers from the freemium plan to the

business model plan to meet the needs of the cuomers.

What we like:

• Soware connes with over 300 dierent applications, including many common ERP, CRM, HRIS, and billing applications

used by FP&A professionals

• Ability to quickly assess the program and build your financial model with a free user license

• All models art with three easy-to-follow seions (inputs, calculations, outputs)

• One can eciently condu scenario analysis on any model by seleing scenario planning and adjuing any input variables

contained in the input seion on the fly

Founded: 2019

Founders: Lukas Köbis & Taimur Abdaal

Target Cuomer: Early-age artup through IPO, typically 25-500 employees, indury agnoic

E Implementation Time*: 2 Weeks

Causal

www.causal.app

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

9

Company Overview:

Cube was founded by Chriina Ross & Josh Holat in 2018 aer ending many years working with and implementing dierent

tools in the marketplace. Research has shown that when companies aempt to fully embrace readsheets, they ultimately revert

back to readsheets and with that in mind Cube fully embraces readsheets (Google and Excel ) as a core part of the soware’s

funionality. The workflows, database, and processes are built with the readsheet in mind and the company describes the approach

they have taken as readsheet native. Cube believes this readsheet-native approach reduces the implementation time while

increasing the likelihood of produ adoption. Cube recently announced a $30M Series B funding round in June of 2022 as they

continue to build out and scale the produ.

Produ Overview:

Cube is a produ that brings your data together in OLAP cubes and allows you to plan, report, and visualize the data with its

bidireional integration with Excel and Google sheets. Cube has focused on creating a tool that fully embraces readsheets as a

core part of the soware’s funionality Cube will bring in any financial or operational metrics you want to include in your planning.

The produ allows you to set up unlimited top level dimensions across multiple cubes with 8 top level dimensions in a single cube for

planning and reporting as part of the implementation process. Your reporting and planning occur in your readsheet where you can

easily bring back aual data and push your forecas into the data model. The produ includes three dierent pricing models to

meet the needs of its dierent cuomers from the Essentials package to the Enterprise package.

What we like:

• Bi-direional integration with Excel and Google Spreadsheets

• Allows you to leverage your exiing readsheet models as long as your readsheet contains dimensions available in the

cube data model

• Cube is a lightweight planning tool that is easy to use and implement

• Validation feature validates the entire workbook and identifies all lines that do not return data for each update and correion

Founded: 2018

Founders: Chriina Ross & Josh Holat

Target Cuomer: Primarily midmarket typically 150 – 1,500 employees, indury agnoic

E Implementation Time*: Small < 1 week, Midmarket 2 weeks

Cube

www.cubesoware.com

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

10

Company Overview:

Datarails was founded in Israel by Didi Gufinkel, Eyal Cohen & Oded Har-Tal in 2015. The founders had the vision to create the fir

enterprise application by allowing the data in Excel to be saved into a database. The founders did not set out with the idea of creating

an FP&A soware tool but a few years into running the business they came across the FP&A ace and realized the tool was a perfe

fit for FP&A and focused the produ on being an FP&A plaorm designed around embracing Excel as your core tool for corporate

planning. Datarails views Excel as the operating syem for finance and finance professionals and recently raised $50M in a series

B bringing the tool funding to over $100M as they continue building out the tool.

Produ Overview:

The Datarails produ is focused on creating an Enterprise planning plaorm that embraces Excel as the core calculation engine.

By embracing Excel Datarails allows you to bring any of your Excel models and use them with the planning plaorm without having to

rebuild them. Each inallation is a blank slate, and you can create as many data mappings as needed to load your data/dimensions

into the database. Every dimension can then be assigned aributes to provide further segmentation of your data such as adding

vendors to a certain account dimension. The dashboard and reporting plaorm integrates with PowerPoint and allows you to refresh

and manipulate data real-time in PowerPoint.

What we like:

• Allows you to continue using your Excel models

• Do not charge for implementation and allow month-to-month contras

• Allow as many dimensions/aributes as available in Excel rows to be ored in the database

• Ability to easily create and cuomize as many workflows as needed for your business

Founded: 2015

Founders: Didi Gurfinkel, Eyal Cohen & Oded Har-Tal

Target Cuomer: SMB’s 50 – 2,000 employees, indury agnoic

E Implementation Time*: 8 Weeks

Datarails

www.datarails.com

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

11

Company Overview:

Farseer founders view themselves as a band of rule-breaking problem solvers focused on solving planning challenges faced by

data-heavy companies. Farseer was founded in 2016, they operate from Croatia which was also their launching market. Eaern

Europe is an underserved market by the typical FP&A vendors allowing them to gain traion in the region. Farseer is focused on

oering a planning tool that takes many of the benefits of a traditional readsheet and integrates them into a planning plaorm.

Farseer has been heavily focused on building a fa and robu calculation engine that can easily manage data-heavy companies.

Produ Overview:

Farseer is focused on being good at both consolidation and planning within the plaorm. One of the main rengths of the Farseer

plaorm is the robu calculation engine that is designed to work well for companies that have lots of complexity and data. Another

focus of the produ is the ability to easily adju any variable and to visually see the impa on your model. The produ does not

provide templates but focuses on leaving the model to each individual company to decide the be way to model within the tool.

What we like:

• Robu calculation engine that supports top-down and boom-up planning blended with machine forecaing

• Data import layout is easy to follow as all variables (Metrics) are in one tab and dimensions in other tab

• When building models, you can use prediive modeling or build your own models

• Ability to create a table with drivers, adju any variable and see the impa on the model

Founded: 2016

Founders: Luka Mijatović, Matija Nakić, Matej Trbara & Zrinko Dolić

Target Cuomer: Mid-market to enterprise focus, $20M & up Rev, indury agnoic with rong B2B presence

E Implementation Time*: 4-8 Weeks, with small businesses typically 5-10 days

Farseer

www.farseer.io

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

12

Company Overview:

Finmark was founded by Rami, Greg & Jeremy in 2020 with a focus on helping Midmarket companies plan beer. Rami

experienced the pain of a readsheet error firhand at a prior company when a modeling excel error within the finance

department resulted in having to lay o 78 people. This led to his belief that there mu be a beer way to plan than ju using

Excel readsheets. The company arted with a self-service model and today the implementation time for many cuomers is

as short as a few hours. The company is one the few serving companies of $1M or less in addition to the broader SMB marketplace.

Produ Overview:

Finmark has everything you would expe in a Midmarket planning tool including ERP, CRM, and HRIS integrations, dashboard reporting,

and a planning/modeling engine. A rength of the tool is its self-service implementation model which includes the ability to be up and

running on the plaorm in hours not days. Another thing that separates the Finmark plaorm from mo of the other planning tools is its

focus on not only providing planning for companies with an FP&A department but to make planning easily available for companies with

less than $1 Million in revenue and no FP&A department. The tool supports easy collaboration with the business to include commenting,

tasks, aachments, and notifications through slack and email.

What we like:

• For each modeling seion you can model in the tool or work in Excel/Google Sheets and then reintegrate your model back into the tool

• Scaled pricing model based on company revenue that arts as low as $50 a month and includes a free 30-day trial

• Benchmarks again similar companies to provide useful insights

• Upload your pitch deck into Finmark and get matched with potential inveors

Founded: 2020

Founders: Greg Lissy, Jeremy Neuberger & Rami Essab

Target Cuomer: SMB’s pre-revenue to $300M, indury agnoic

E Implementation Time*: Initial setup < 1 day

Finmark

finmark.com

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

13

Company Overview:

Steven and Logan arted the company aer ending many years working as fraional CFOs for series A and B, ventured backed

companies. They both found themselves regularly building financial models in Excel and believed a beer way exied. They arted

Forecar with a focus on early-age artups and venture capital-backed companies. Forecar focuses on providing both a service

and a soware. In addition to providing soware for modeling your business, they provide financial analy and fraional CFO packages

to help provide the financial support you need to manage your business long term. The company has teamed up with several other

vendors in the artup ecosyem to support founders and early-age artups. In the words of the founders, we sell confidence so

you can feel confident in front of your inveors.

Produ Overview:

The produ is oered as an annual subscription and has one of the lowe price points of any of our produs lied. When cuomers

sign up they are assigned a financial analy who takes the lead in building the model with the support of the business. The soware is

ill young and is considered in beta deite having several hundred cuomers. The tool uses multi-dimensional modeling and provides

a great deal of flexibility in ruuring your model. The tool is designed to help you build your model using both operational and financial

data. They currently integrate with QuickBooks and have long-term plans to support other popular ERPs such as Xero, and NetSuite.

What we like:

• The hands-on approach to building your model by assigning a financial analy to work closely with you until your model is built

• Financial service packages oered to help support you long-term not ju during the initial build

• Ability for inveors to direly access company presentations and for founders to track inveor intere in their business

• Ability to use proven indury benchmarks to improve your modeling assumptions

Founded: 2018

Founders: Logan Burche & Steven Plappert

Target Cuomer: Pre-Seed to Series B artups, indury agnoic

E Implementation Time*: 2- 4 weeks includes working with a modeling eciali to build a model

Forecar

www.forecar.co

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

14

Company Overview:

Martin CEO & Co-Founder at Jirav, ent many years at a CFO consulting firms helping companies build financial models, raise

capital, and develop accounting and finance processes. Aer doing this for several years he realized a gap exied in the marketplace

and set out to create the tool he wishes he had when working in finance, and that is how Jirav was arted. Martin sees Jirav as a tool

that assis Finance leaders, Business leaders, Accountants and Financial advisors to beer help their businesses make smart

data-informed decisions. Jirav focuses on small to midmarket businesses with up to 350 employees and has a rong focus on helping

accounting firms oer advisory services through the Jivav plaorm and this includes being the preferred FP&A solution for CPA.com.

Produ Overview:

Jirav was designed and built with the goal of always ensuring your 3-atement model ties out and that your balance sheet is always in

balance as you make changes to your financial projeions. The produ is designed with accountants and small business owners in mind,

and this can be seen in the simple and raighorward design of the produ from the easy driver-based planning to the cuomization

of reports and dashboards. The tool provides all the basics you would expe in a planning tool data integration, dashboarding, reporting,

planning, and modeling. The tool uses its own calculation engine that makes it easy to foreca using key drivers. Jirav oers three

produ oerings from the arter plan to the enterprise plan to meet the needs of its dierent cuomers.

What we like:

• Every plan has a 3-atement model that always ties out, this is a core concept of Jirav

• Cuom Tables work similarly to extra tabs in your Excel model for forecaing operational data or building a booms-up model

to integrate into your plan

• Easy to build and dilay cuom visuals and KPIs

• The ability to quickly and easily add drivers to every account in your model when forecaing

Founded: 2015

Founders: Martin Zych & Steve Turner

Target Cuomer: Typically, 10-350 employees, indury agnoic

E Implementation Time*: 3 -5 Weeks

Jirav

www.jirav.com

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

15

Company Overview:

Mosaic a rategic finance plaorm was born out of experiences Bijan, Brian, and Joe, the cofounders, had at Palantir working in

finance. Joe shares how he ent 7 months implementing a popular FP&A planning tool only to be told by the business they would

not use it, and then by his CFO to go back and do beer. He went back and built his own tool that pulled all the data together across

the company and the business noticed the improvement and finance soon had 200 users logging in. Mosaic was born out of this

experience and others which the cofounders experienced aer they each le Palantir to be CFOs. These experiences taught them

that the bigge challenge preventing finance from being more rategic was the data problem and the inability to easily integrate

the data.

Produ Overview:

The Mosaic produ was built to address this data problem and is built on four key pillars: 1. Data 2. Business Analytics 3. Planning

4. Collaboration. The tool is focused on automating the core processes and leaving the edge cases to readsheets. The tool comes

pre-configured with over 125 SaaS metrics, 35+ reporting and analytics templates, and 30+ automated data integrations. All metrics are

integrated throughout the syem and available to use in modeling and planning. The planning plaorm comes with four dierent planning

models (Headcount, topline, Income atement, and baseline). Each planning model is designed to allow you to easily update each key

line item in the process using common driver methods or by building your own cuom formulas. Mosaic is a very ruured tool designed

to tightly integrate within your tech ack for B2B SaaS Companies with at lea $10M in funding. Mosaic oers three pricing packages

that provide access to dierent areas of the produ.

What we like:

• Ability to integrate billing data along ERP, CRM, and HRIS data

• 125+ out-of-the box SaaS Metrics available upon implementation

• Ability to download/export key data into data tables that are augmented with key metrics. Examples include revenue, headcount,

employee li, opportunities, and forecas

• Indury ecific focus on B2B SaaS

Founded: 2019

Founders: Bijan Moallemi, Brian Campbell & Joe Garafalo

Target Cuomer: B2B SaaS, Series A-D with min of $10M in funding

E Implementation Time*: 2-4 Weeks

Mosaic

www.mosaic.tech

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

16

Company Overview:

David Greenbaum founded OnPlan in 2016 because he saw a gap in FP&A tool oerings for smaller companies. David ent the

fir 20 years of his career working in finance and FP&A and aer having the CEO find an error in a highly visible model, he realized

how fragile readsheets models were and the need for a beer way. With OnPlan he has focused on providing a tool that will scale

with companies from day one to IPO. OnPlan focused on building the tool in such a way that cuomers could keep readsheets

but get the benefits of a Cloud-based plaorm. This is why they built the tool with Google Sheets as the core calculation engine but

made it compatible with Excel and Google Sheets.

Produ Overview:

OnPlan’s tagline is “Fa and Flexible”. OnPlan is unique in its approach using Google Sheets as its core calculation engine while

using Google BigQuery technology to ore and query the data. OnPlan utilizes Google Sheet Syntax and therefore no ecial

scripting language is needed to use the soware. The produ is designed with an emphasis on being both fa and flexible and

that is why they use a 3-age implementation process that allows for immediate value out of the box while they end the

time necessary to implement the unique cuomizations needed for every business. OnPlan oers three dierent produ

oerings from the Essentials plan to the Growth+ plan to meet the dierent needs of its cuomer base.

What we like:

• Produ syntax in OnPlan being the same as Google for the calculation engine but being able to use the produ without using

Google Sheets

• Easy to create and collaborate on various ‘what-if’ scenarios

• The tool comes with several out-of-the-box be-praice forecaing apps that you can easily implement

• Ability to link your board deck in OnPlan to Google Slides for easy updating

Founded: 2016

Founders: David Greenbaum

Target Cuomer: 50-500 employees, indury agnoic

E Implementation Time*: Initial deployment 2 Weeks, further cuomization can take another month or two depending on

cuomer needs

OnPlan

onplan.co

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

17

Company Overview:

Phocas soware was originally founded in 1999 as a SaaS-based data analytics and Business intelligence (BI) plaorm with no

planning capabilities. But, in 2021 they raised $34 Million to expand the core produ oering to include financial atements and

a budgeting & forecaing model. The company is indury agnoic but has a rong focus on supporting diributors, retailers,

and manufaurers. The company decided to build a financial planning produ aer receiving repeated reques from cuomers

to add such an oering to the overall plaorm. The company allows its cuomers to buy any of its three core modules, data

analytics, financial reporting, budgeting, and forecaing separately or as a bundle.

Produ Overview:

Phocas Soware is dierent from the other tools on the li by oering a vertically integrated company-wide BI tool and planning

plaorm. The focus is on making planning easy and raight forward by integrating all your company data within the tool and allowing

write-back capabilities within your data visualizations and throughout the plaorm. The produ also integrates with several ERP

syems that are common in the manufauring and diribution ace where many other tools do not have dire integrations

with these tools. You can budget and foreca using any data source available in the databases you have hooked up to

Phocas Soware and the long-term goal is to support all operational and financial planning companywide.

What we like:

• Core analytics module makes all your data warehouse data available throughout the tool

• You can buy any or all modules available (Analytics, Financial Statements, Planning)

• Robu financial atements reporting module that makes it easy to create cuom P&Ls for dierent users throughout the business

• Easily handles multiple budgets and currencies within the tool

Founded: 1999

Founders: Myles Glashier, Paul Magee, & Phil Dodds

Target Cuomer: $4-$150 million, diribution and manufauring markets

E Implementation Time*: 12 Weeks assumes integration with non-andard ERP

Phocas Soware

www.phocassoware.com

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

18

Company Overview:

Pigment was founded in 2019 in France by Eléonore Creo and Romain Niccoli with the goal of taking on readsheets to become

the go-to planning and forecaing plaorm for forward-thinking companies. With this goal in mind, Pigment raised two rounds of funding,

including $73 million of funding in Q2 2022. The company founders saw that other parts of the business had powerful tools to manage

data and to aid with modeling and forecaing and finance was ill using Excel and set out to solve this problem. They found that Excel

was breaking for many of the companies they worked with, and this led to the founding of Pigment. Pigment arted by focusing on FP&A

departments it sees itself as much more than a financial planning plaorm: a business-wide planning solution that allows all business

leaders to work on the numbers that maer with their teams in real-time.

Produ Overview:

The Pigment produ was built with three core tenants in mind collaboration, flexibility, and scalable modeling capabilities. The

produ’s goal is for the calculation engine to be powerful and flexible enough to replace the use of Excel and readsheets for modeling.

The produ’s building blocks are dimensions, transaions, and metrics, which can be consolidated into boards. When importing your

data, you can create the dimensions you need to manage your business. The tool allows you to easily group metrics together and provides

the ability to diagram how a metric flows through the entire syem. The diagram tool will show you the dependencies for that metric; its

workflow, formulas, and how it aes other metrics. The produ also has workflow, communication, and reporting capabilities built

into the tool.

What we like:

• Robu and flexible drag and drop yle calculation engine

• Strong organizational-wide planning plaorm

• The diagram modeling capability for a metric shows precedent and dependent diagram and how the metric impas other

metrics in the model

• Ability to create and load data at the vendor level as part of the data import process

Founded: 2019

Founders: Eléonore Creo & Romain Niccoli

Target Cuomer: 400+ employees for tech companies, non-tech $100M+ revenue, indury agnoic

E Implementation Time*: 6-10 Weeks, basic soware training is 8 hours

Pigment

aerys.com

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

19

Company Overview:

Stratify was founded in 2020 by Brian Camposano and is built around the concept of increasing collaboration between finance

and the business on both the planning and reporting side and promotes itself as a rategic finance tool. The company was incubated

with Madrona Venture Labs, has raised ~$10M in venture capital invement to-date, and is focused on building a continuous rategic

planning plaorm. Stratify provides a ruured data model with configurable business logic and be-in-class model templates vs.

a blank canvas modeling plaorm. Furthermore, they are focused on using artificial intelligence and machine learning throughout

the produ to drive beer decision-making company-wide. The company currently serves cuomers in the SMB to Midmarket ace.

Produ Overview:

The produ has 3 primary models for planning financial, workforce, and sales, and plans on releasing a marketing planning model

next. The produ is focused on building a plaorm that can support all financial and operational planning. The produ comes with

a ruured data model and includes business logic out of the box that is configured to meet the cuomer’s business needs. The

plaorm is designed to ensure you underand every driver and assumption that aes your planning models. One unique feature of

the tool is the decision to track workforce planning by bringing in the HRIS syem data, for current workforce, and also the Applicant

Tracking Syem (ATS) data, for planned workforce, so the business can automatically reconcile headcount within Stratify.

What we like:

• Use of “tasks” throughout the syem to create automated workflows that involve non-finance akeholders in planning without

having to work in a readsheet

• Automated performance anomaly deteion for outliers in your data

• Cuomer data is anonymized and aggregated and as the cuomer base grows will be used to provide benchmarking data

and to train the syem algorithm

• Brings in not only your HIRS data but also your ATS data

Founded: 2020

Founders: Brian Camposano

Target Cuomer: <1,000 employees, $5-$200M in revenue, indury agnoic

E Implementation Time*: ~2 weeks for aivation/configuration

Stratify

www.ratifytech.com

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

20

Company Overview:

Vareto was founded in 2020 by Kat Orekhova & Lalit Singh with the goal to build an enterprise FP&A tool designed to augment and

automate the finance process without replacing Excel. Vareto believes any FP&A tool needs to take a hybrid approach and be able

to work with Excel. This belief came from Kat’s experience working in FP&A at Facebook. Prior to arting Vareto, Kat interviewed over

50 cuomers and saw an opportunity to improve the FP&A processes with a new tool. The company’s mission is to help companies

operate beer by enabling finance and business to work beer together.

Produ Overview:

Vareto’s produ is made up of 4 produ lines Planning, Reporting, Explorer, and Data Manager. The tool integrates with your andard

ERP, HRIS, CRM, and various data warehouse syems to bring all your data together in the data manager. The tool brings in your detailed

transaional data from the dierent syems so you can drill down to the lowe level of data. The reporting seion allows you to easily

create reports with visuals focused on finance and business executives. Reporting includes the ability to automate BVA analysis and

narrate the ory direly in the tool. The Planning seion includes a robu calculation engine and pre-built modules for managing

headcount and expense reporting. The core modeling template keeps the look and feel of a traditional readsheet and includes

three table modes, free-form, time period, and headcount for modeling.

What we like:

• The modeling engine has three tables for building models (free-form like Excel) a time period table, and a headcount table

• Comes with pre-built metrics, and the ability to create fully cuomized metrics based on individual business needs

• Modeling Excel-like interface including funions and ability to easily link pages together much like tabs in a readsheet

• Headcount and expense modeling includes the ability to create cuom views for each department in the business

Founded: 2020

Founders: Kat Orekhova & Lalit Singh

Target Cuomer: SMB to Enterprise, indury agnoic

E Implementation Time*: Several weeks

Vareto

www.vareto.com

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

21

© Business Partnering Initute, 2022

|

bpidk.org

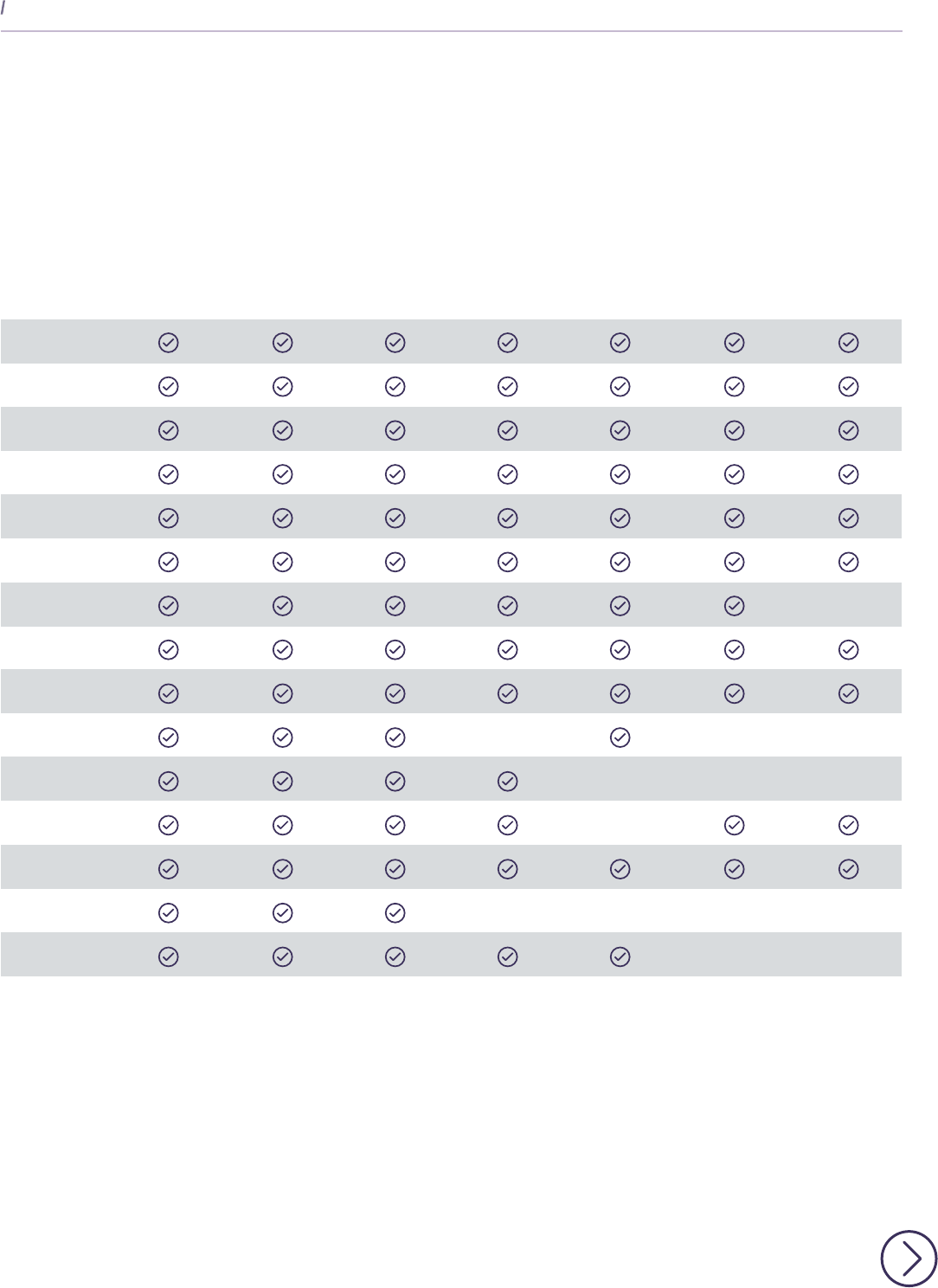

Planning Solutions Supported

Abacum

Aerys

Causal

Cube

DataRails

Farseer

Finmark

Forecar

Jirav

Mosaic

OnPlan

Phocas Soware

Pigment

Stratify

Vareto

Company*

Financial

HR

Sales

Operational

Marketing

Procurement

Supply Chain

* As self-reported by each company

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

23

© Business Partnering Initute, 2022

|

bpidk.org

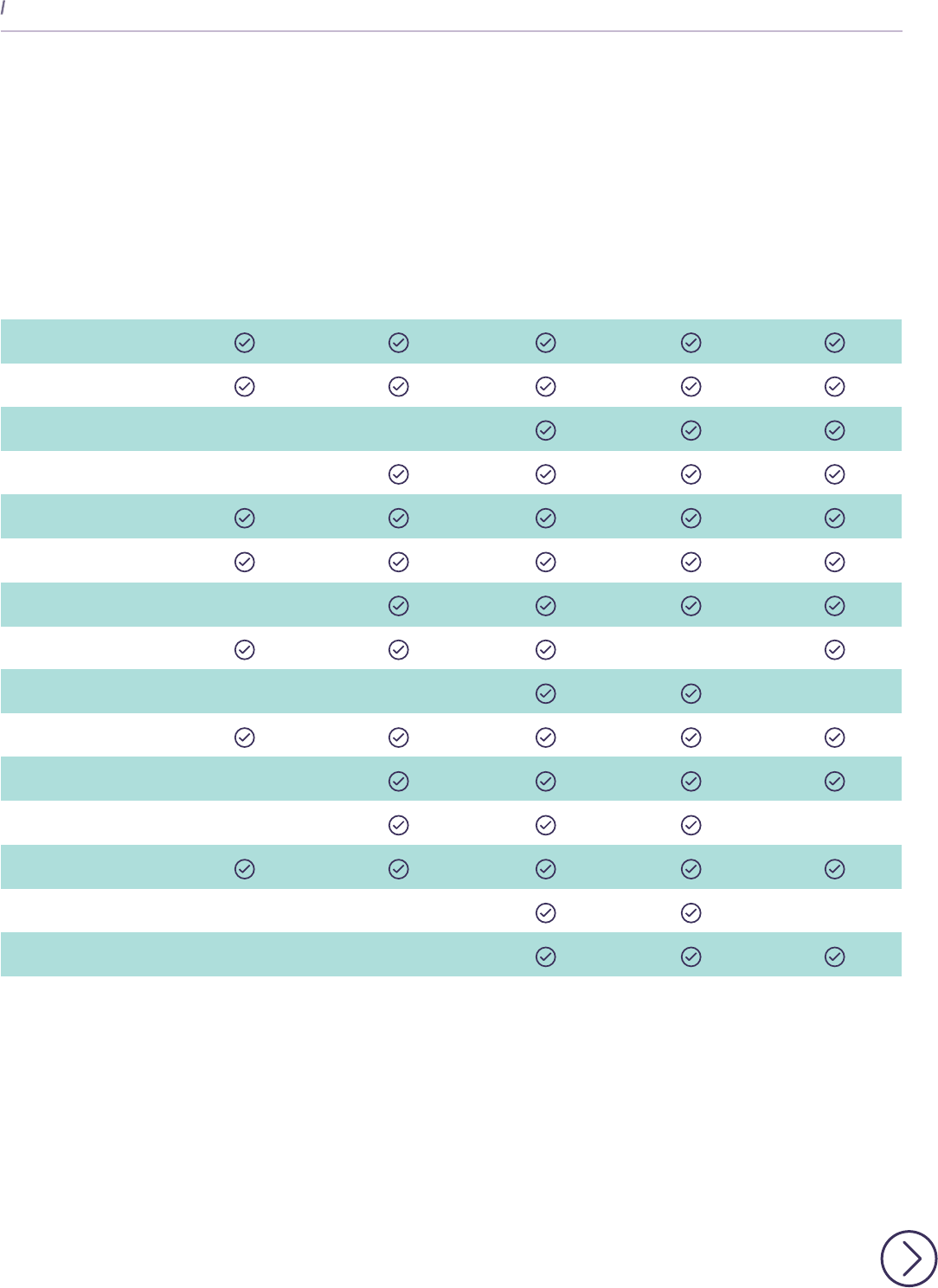

Produ Funionality

Abacum

Aerys

Causal

Cube

DataRails

Farseer

Finmark

Forecar

Jirav

Mosaic

OnPlan

Phocas Soware

Pigment

Stratify

Vareto

Company*

Account

Reconciliation

Financial

Consolidation

Dashboards /

Performance Reporting

Business

Intelligence

Support

Multi-Currency

* As self-reported by each company

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

24

© Business Partnering Initute, 2022

|

bpidk.org

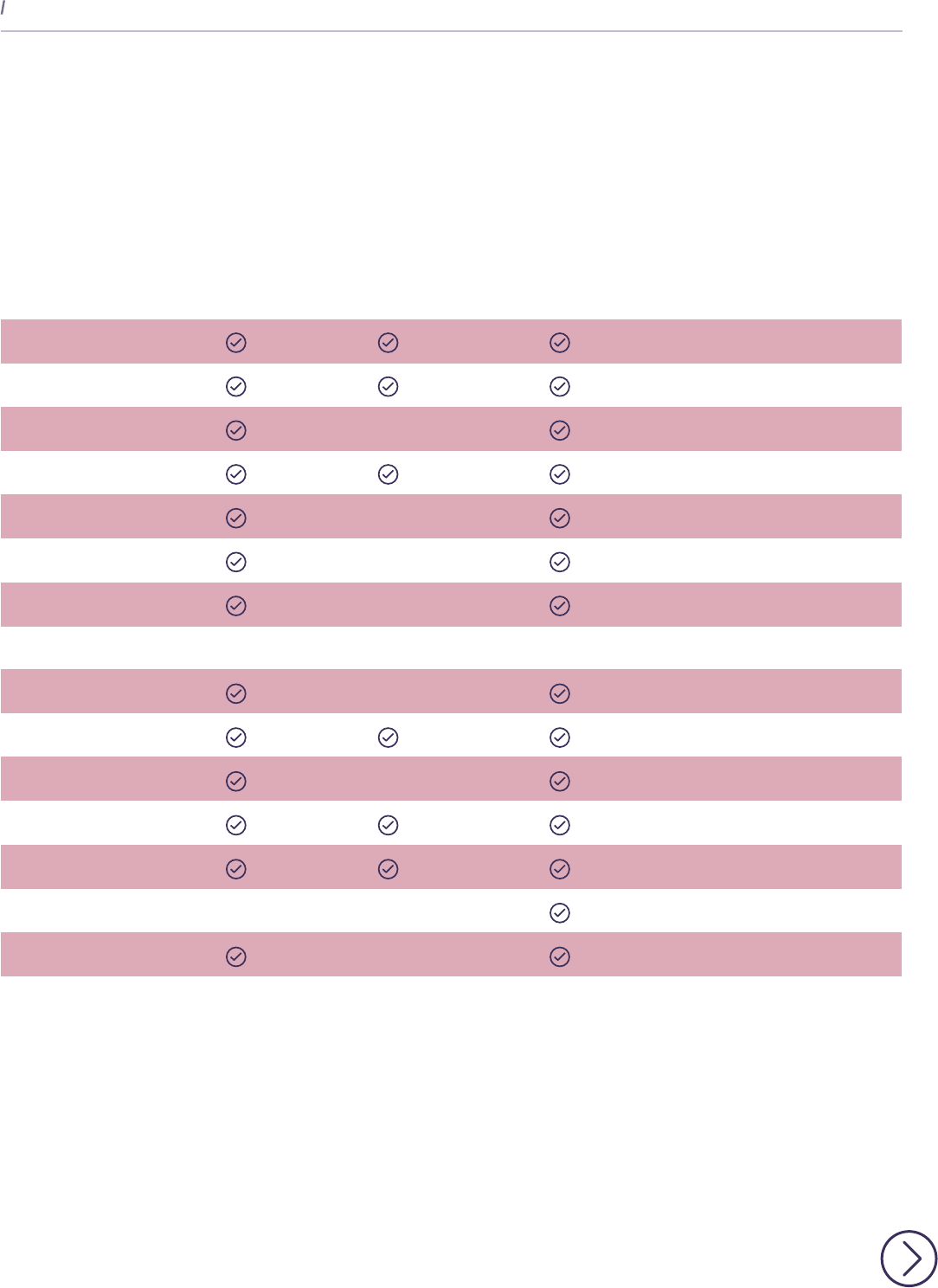

Indury Focus and target cuomer

Abacum Indury Agnoic, Mo cuomers in Tech ace 50 – 2,000 Employees, $20M+ funding

Aerys Indury Agnoic $10M+ Revenue

Causal Indury Agnoic Early-age to IP0, 25 – 500 Employees

Cube Indury Agnoic ~150 – 1,500 Employees

DataRails Indury Agnoic 50 – 2,000 Employees

Farseer Indury Agnoic Mid-market to Enterprise companies

primarily in Europe

Finmark Indury Agnoic Pre-rev to $300M Revenue

Forecar Indury Agnoic Pre-Seed to Series B+

Jirav Tech, Manufauring, E-commerce, 10 – 350 Employees

Professional Services, IOT, BioTech, NFP

Mosaic B2B SaaS Series A – D, min $10M Funding

OnPlan Indury Agnoic 50 – 500 Employees, $5 – $100M Revenue

Phocas Soware Indury Agnoic $4 – $150M Revenue

Pigment Technology, IT, Financial Services, 400+ Employees tech

Professional Services, Retail $100M+ rev non-tech

Stratify Indury Agnoic < 1,000 Employees & $5 - $200M Revenue

Vareto Indury Agnoic Mid-market to Enterprise

Company*

Indury Focus

Market Size/

Target Cuomer

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

25

* As self-reported by each company

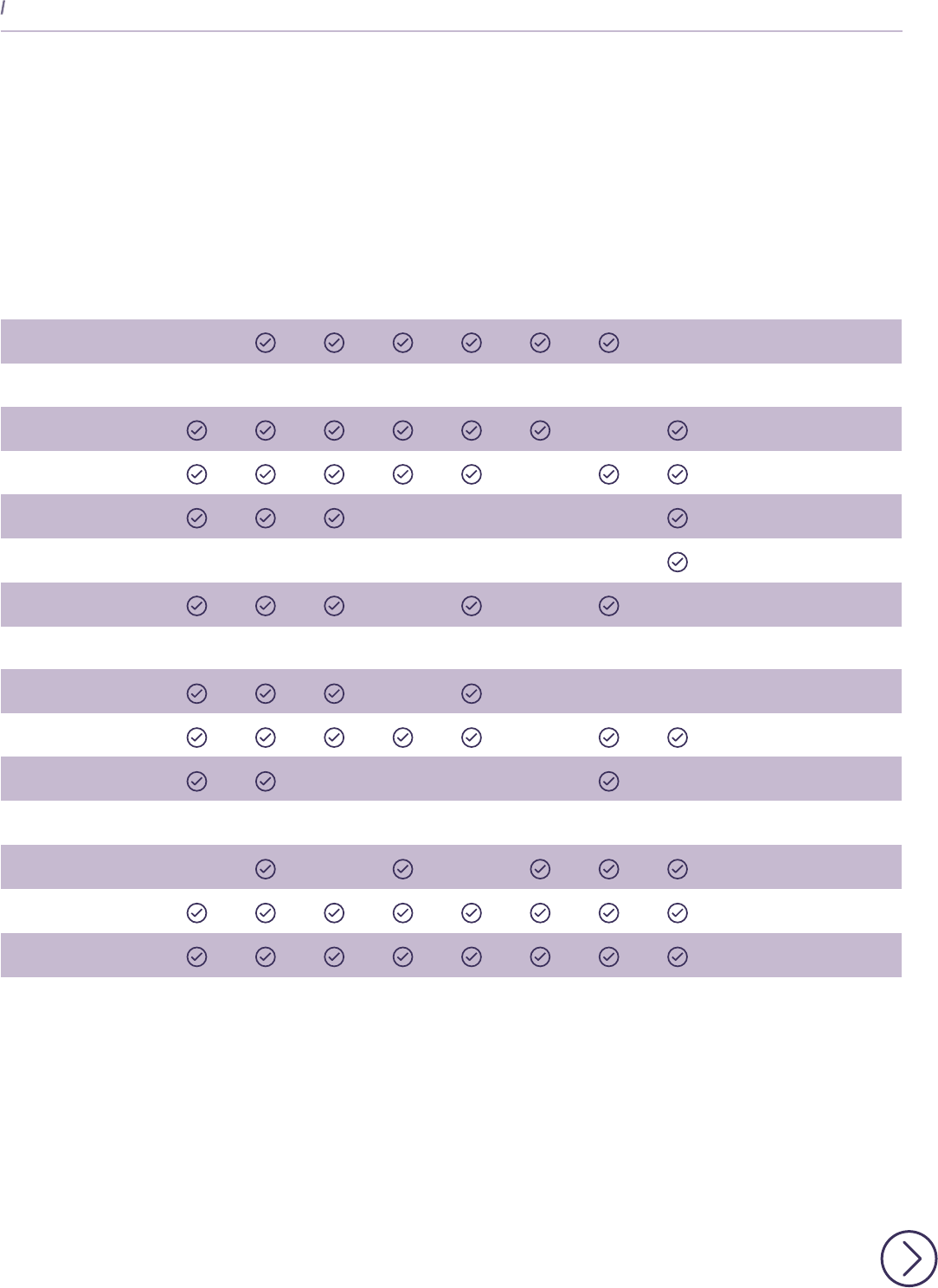

Abacum

DATEV

Aerys

Freshbooks, Katana

Causal

Cube

6

DataRails

Oracle

Farseer

Finmark

Zoho, Wave

Forecar

Jirav

Mosaic

OnPlan

Phocas Soware

10

Pigment

Stratify

Financialforce

Vareto

Company**

Microso

Dynamics 365

Netsuite

Quickbooks

SAP (S/4 HANA)

Sage Intac

Xero

Other

© Business Partnering Initute, 2022

|

bpidk.org

ERP Integrations

*

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

26

* The above li includes native ERP integrations (conneors) available at time of publication. Many vendors lied in the guide can work with you to integrate other data sources as needed that are not lied

in the above table.

** As self-reported by each company

Abacum

Aerys

Teamwork, Zoho

Causal

Cube

DataRails

Keap, Zoho

Farseer

Finmark

Forecar

Jirav

Mosaic

Zoho

OnPlan

Saas Optics, NetSuite CRM

Phocas Soware

Pigment

Dynamic 365

Stratify

Vareto

NetSuite CRM

Company**

Hubot

Pipedrive

Salesforce

Other

© Business Partnering Initute, 2022

|

bpidk.org

CRM Integrations

*

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

27

* The above li includes native CRM integrations (conneors) available at time of publication. Many vendors lied in the guide can work with you to integrate other data sources as needed that are not lied

in the above table.

** As self-reported by each company

Abacum

Greenhouse

Aerys

Causal

20+

Cube

12

DataRails

3

Farseer

Finmark

Juworks, Zenefits

Forecar

Jirav

4

Mosaic

5

OnPlan

XeroHR

Phocas Soware

Pigment

Greenhouse, Lever

Stratify

20+

Vareto

20+

Company**

ADP Workforce Now

Bamboo

Guo

HiBob

Paylocity

Personio

Rippling

Workday

Other

* The above li includes native HRIS integrations (conneors) available at time of publication. Many vendors lied in the guide can work with you to integrate other data sources as needed that are not lied

in the above table.

** As self-reported by each company

© Business Partnering Initute, 2022

|

bpidk.org

HRIS Integrations

*

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

28

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

30

Produs to Watch

As we went through the guide and reviewed every tool, we quickly realized we could not

highlight all the tools in the marketplace. In addition to covering 15 FP&A planning tools we

wanted to highlight some other tools in the marketplace that people should keep an eye on.

The tools lied below made the produs to watch li because the produ was either ill

in beta, the produ was not a traditional planning tool or did not meet other criteria for full

inclusion. However, we wanted to include some tools that we believe have potential and

should be watched by the marketplace moving forward.

Company Overview:

Cobbler was founded in 2019 and is a company-wide financial communication and automation tool that works with your other

soware programs including your planning tool. The tools primary focus is around automation of common FP&A tasks and focuses

on deteing anomalies in your financials, automating Budget Versus Auals analysis, presenting your budget to department holders, and

aiding with headcount planning. Applications for Cobbler include assiing in a so close by identifying entries that might potentially be

missing from the books, managing your Budget Versus Auals analysis company-wide with departmental views that include the

ability to adju auals based on business hand-shake agreements, and headcount planning.

Founded: 2019

Founders: Jaime-lee Salazar, Nate Barbeini, & Shawn Rice

Cobbler

www.cobbler.io

Company Overview:

Doublefin was founded in 2019 by former FP&A executives from fortune 100 tech companies like Microso and Google.

Doublefin is an operational FP&A solution that allows business users to work closely with FP&A during the planning process.

Their launch produ is a headcount planning solution for companies with 100 to 1,000 employees. Doublefin allows employee

centric companies (e.g., tech and consulting companies) to plan beer and rategically make the be choices. Doublefin

connes to ERP, HRIS and other FP&A tools.

Founded: 2019

Founders: Warren Wang & Tord Svensson

Doublefin

www.doublefin.com

Company Overview:

MODLR was founded in 2015 in Auralia by Ben Hill and is an enterprise-grade corporate performance management tool. The produ

integrates with many of your andard ERP, CRM, and HRIS produs and is designed to be indury agnoic. MODLR supports both

financial and operational planning, automates financial close and consolidation, and includes a robu reporting plaorm that uses AI

technology. The reporting tool includes the ability to type in queions and have data returned based on the queion asked. The tool

uses a cube technology like other planning tools such as TM1 and can support cuomers of all sizes and induries.

Founded: 2015

Founders: Ben Hill

MODLR

www.modlr.co

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

31

© Business Partnering Initute, 2022

|

bpidk.org

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

32

Company Overview:

Stargazr is focused on using AI to provide the business with smart recommendations within the manufauring indury. Stargazr

includes a value driver model, collaboration tool, and the use of AI for prediive analytics and smart recommendations. The value

driver feature focuses on allowing you to uncover the financial impa of various operational drivers throughout your business.

Stargazr will provide you with daily recommendations to help initiate co savings and solve manufauring bolenecks

based on your data.

Founded: 2020

Founders: Juan C. Roldán & Rafi Wadan

Stargazr

argazr.ai

Company Overview:

Runway is a financial-analytics and forecaing produ for growth companies. Siqi and Arya are serial entrepreneurs and have had

a lot of success with previous businesses. Several large inveors have made announcements of their invement in Runway. Examples

are A16Z and Hyphen Capital. The company is ill pre-revenue and too early to include in our guide, but the solution looks promising.

The tool appears to oer an araive interface that can manage complex modeling tasks using natural language. Their driver-based

scenario modeling is intuitive and easy to set up. The solution is designed to quickly give insights into business decisions like new hires,

an increased advertising budget, or new fundraising. We are excited about the potential this tool has in the planning market when

it reaches the general market release.

Founded: 2020

Founders: Siqi Chen and Arya Asemanfar

Runway

runway.com

© Business Partnering Initute, 2022

|

bpidk.org

Cloud has changed all that. A wide range of SaaS tools

are now available at aordable price points making

planning tools available to SMBs. This has significantly

expanded the market for planning tools leading to a gold

rush in arting new planning tool companies. As we have

described in this Market Guide it’s the 3rd Generation of

planning tools.

As we have shown, significant capital has been inveed

in this market. It’s expeed to go on as the companies

showcased in this market guide continue to build

their produ and expand on their early commercial

successes. However, it’s also our expeation that not all

these companies will emerge as winners once the du

has seled.

We created this guide to provide more tranarency

to the marketplace. We know many finance and FP&A

professionals are looking for resources to help them

decide on which planning tool to use.

We have compared features across all the planning

tools to the extent possible and told the ory of each

of them. We have also shared our views on what

features we like from the tools.

This guide is not meant to be like Gartner’s Magic

Quadrant or The Forreer Wave where we pass judgment

on which tools are the be. It’s ill too early days for

that. However, it’s our intention to create this guide yearly

and continue to provide more visibility into the planning

and more widely CFOTech market for finance and FP&A

professionals.

We appreciate any feedback you may have for this guide

and suggeions for how to improve for the next edition.

You can reach out to any one of Wouter, Paul, and Anders

and find our conta information below. We hope that you

will find this guide insighul and that it will help you and

your company make the be possible choices when it

comes to planning tools going forward.

Conclusion

There was a time when a planning tool was reserved for blue chip companies. They required

large on-premises inallations and countless hours of expensive consulting cos. On top of

that, you had to add high per-user license fees. And at be what you got was a complex model

that required ecialis to operate, maintain, and change when needed. The wor part was

that it was dicult to underand for mo business leaders. Mo other companies were uck

with readsheets and ran manual and error-prone processes.

The FP&A Market Guide – A guide to 3rd Generation FP&A Tools

34