THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any

doubt as to the action you should take, you are recommended to seek your own independent financial

advice from a stockbroker, bank manager, solicitor, accountant or other financial adviser authorised

under the Financial Services and Markets Act 2000.

If you are a member and have sold or otherwise transferred all of your Ordinary Shares in JJB Sports plc

("JJB") please send this document, together with the accompanying documents (but not the personalised

Proxy Form), as soon as possible to the purchaser or transferee, or to the stockbroker, bank or other agent

through whom the sale or transfer was effected, for delivery to the purchaser or transferee.

This document does not constitute or form any part of any offer or invitation to sell or issue, or any solicitation

of any offer to acquire any Ordinary Shares or other transferable securities in JJB. Any reproduction of this

document, in whole or in part, and any disclosure of its contents, except to the extent such information is

otherwise publicly available, or use of any information it contains for any purpose other than considering the

resolutions is prohibited.

JJB SPORTS PLC

and

BLANE LEISURE LIMITED

and

each of their CVA CREDITORS (as defined herein)

COMPANY VOLUNTARY ARRANGEMENTS

(under Part I of the Insolvency Act 1986)

This document has been prepared solely to inform creditors and members of JJB and Blane of proposals for

company voluntary arrangements. Nothing in this Proposal should be relied upon for any other purpose. Your

attention is drawn to Paragraphs 12 and 13 of Part I (Introduction) of this document describing the desirability

of the Proposal for creditors and recommending why members should vote in favour of the Proposal.

The action required to be taken by you is set out in Part II (Action to be taken by CVA Creditors and Members).

Formal notices of the creditors' meetings and members' meetings to approve each company voluntary

arrangement and Proxy Forms for voting at these meetings, which are to be held at 11:00 a.m. on 27 April

2009 (in the case of each creditors' meeting) and at 11:00 a.m. on 29 April 2009 (in respect of each members'

meeting), are included within this Proposal. For creditors, please complete and return the relevant Voting &

Notice of Claim(s) sent to you with this Proposal in accordance with the instructions set out in it.

A creditor who is a Closed Premises Landlord may not receive a Payment in respect of a Voting &

Notice of Claim filed after the Claims Date. See Paragraph 10.3 of Part I (Introduction) for an

explanation of the Claims Date.

Issue Date: 6 April 2009

2

IMPORTANT NOTICE

DIRECTORS

This Proposal has been prepared by the Directors of each Company pursuant to Part I of the Insolvency Act

solely to inform creditors and members of each Company of proposals for a company voluntary arrangement.

Nothing in this Proposal should be relied upon for any other purpose including in connection with any

investment decision in relation to the debt, securities or any other financial interest of any company in the

Group, including for the avoidance of doubt, any decision to buy or sell or not to buy or sell any debt, securities

or other financial interest. Any parties making such investment decisions should rely on their own enquiries

prior to making such decisions. This Proposal is made in relation to each Company by the Directors of that

Company. Creditors and members should review this Proposal in detail. If you are in any doubt as to the action

you should take in connection with the Proposal, or the tax or other consequences of the proposed

Arrangements for you, you should contact your legal, tax or other professional advisers.

Section 1, Parts I to VI of this Proposal set out a general description of the Proposal and provide a brief

summary of the terms of this Proposal. The binding terms of the Proposal are set out in Section 2, Part VII

(Terms of the Company Voluntary Arrangements).

It is possible that the CVAs may not be approved by the requisite majorities of creditors of the relevant

Companies concerned. The Directors make no representation or warranty and give no undertaking that the

CVAs in the form described in this Proposal will be implemented within the proposed timescale outlined in this

Proposal or at all or that the proposed CVAs may not be amended, revoked or suspended.

Nothing in this Proposal may be taken as an admission of any fact or matter relating to any of the Companies

or relied upon in any litigation involving the Companies or any of them or constitutes any admission on the part

of any Company with respect to any asset to which it may be entitled or with respect to any claim by or against

it.

The contents of this document are not to be construed as legal, business or tax advice. Each creditor and

shareholder should consult his own independent legal, financial or tax adviser for legal financial or tax advice.

This Proposal contains certain statements and statistics that are or may be forward-looking. The accuracy and

completeness of such statements is not warranted or guaranteed. These statements typically contain words

such as "intends", "expects", "anticipates", "estimates" and words of similar import. By their nature, forward-

looking statements involve risk and uncertainty because they relate to events and depend on circumstances

that will occur in the future. Although the Directors believe the expectations reflected in such statements are

reasonable, no assurance can be given that such expectations will prove correct.

Without limiting the generality of the immediately preceding paragraph, all statements contained in this

Proposal in relation to estimated outcomes for creditors, whether as a consequence of the Proposal being

approved or otherwise, are illustrative only. As they are based on assumptions that necessarily involve a

subjective analysis of the matters referred to in this Proposal, they cannot be relied upon as guidance as to the

actual outcomes for creditors.

Unless otherwise indicated, the statements contained in this Proposal are made as at 3 April 2009, being the

latest practicable time before publication, and reflect the circumstances and the information of which the

Directors were aware at that time.

King Sturge LLP has given and not withdrawn its written consent to the inclusion in this document of references

to the advice that it has provided to the Companies and references to its name in the form and context in which

it appears herein.

None of the Directors have authorised any person to make any representations concerning the CVAs which

are inconsistent with the statements contained herein, and if such representations are made, they may not be

relied upon as having been so authorised.

3

NOMINEES

The Nominees in relation to the JJB CVA are Richard Dixon Fleming of KPMG LLP, 8 Salisbury Square,

London, EC4Y 8BB and Brian Green of KPMG LLP, St James' Square, Manchester, M2 6DS.

The Nominees in relation to the Blane CVA are Richard Dixon Fleming of KPMG LLP, 8 Salisbury Square,

London, EC4Y 8BB, Brian Green of KPMG LLP, St James' Square, Manchester, M2 6DS and Blair Carnegie

Nimmo of KPMG LLP, 191 West George Street, Glasgow G2 2LG.

In accordance with section 2 of the Insolvency Act, the Nominees have reviewed the Proposal and reported to

the Court or Scottish Court (as appropriate) that, in their opinion:

(a) the Proposal has a reasonable prospect of being approved and implemented;

(b) meetings of the Companies and their creditors should be summoned to consider the Proposal;

(c) the meetings of creditors of each of the Companies to consider the Proposal should be held at 11:00

a.m. on 27 April 2009 at the Royal Horticultural Halls and Conference Centre, 80 Vincent Square,

London SW1P 2PE; and

(d) the meetings of members of each of the Companies to consider the Proposal should be held at 11:00

a.m. on 29 April 2009 at the Royal Horticultural Halls and Conference Centre, 80 Vincent Square,

London SW1P 2PE.

The Nominees are unable to warrant or represent the accuracy or completeness of any information

contained within this document, or any information provided by any third party. The Nominees have

not authorised any person to make any representations concerning the CVAs, and if such

representations are made, they may not be relied upon as having been so authorised.

4

SUMMARY OF THE PROPOSAL

The following summary of the Proposal should be read as an introduction to this document only.

Any decision as to how to vote should be based on consideration of this document as a whole and

not just this summary.

Creditors and shareholders of JJB and Blane have been sent a pack of documents in relation to the

proposed company voluntary arrangements announced on 25 March 2009. In addition, JJB

shareholders have been sent a shareholder circular relating to a proposed issue of warrants to BoS.

The main objectives of the proposed CVAs are to:

● compromise claims of landlords of approximately 140 closed retail stores and certain related

contingent claims (such as claims of former tenants and guarantors, but not including rates on

those closed stores)

● enable landlords of those closed retail stores to make a claim against a total aggregate fund of

£10 million, with payments from that fund in two instalments (the first instalment of £5,000,001

on 30 September 2009 and the balance of £4,999,999 on 31 December 2009)

● vary temporarily the terms of leases of the open retail stores, approximately 250 stores in total,

such that rent will be paid on a monthly rather than quarterly basis for a period of twelve months

from the next quarter date

The CVAs do not affect either Company's obligations to Fitness Club Premises Landlords insofar as

those obligations relate to Fitness Club Premises.

JJB and Blane will remain liable for rates on the closed stores until those stores are surrendered /

forfeited or assigned, which shall be at the landlord's discretion. The landlords of the open retail

stores will not be able to claim against the £10 million fund and will not otherwise be paid a fee in

relation to the CVAs. Save as set out above, the CVAs will not seek to compromise claims of any

other creditors.

Throughout the CVA process, JJB and Blane shall continue trading under the control of their

respective directors, operating as going concerns. JJB and Blane are not in and will not be in

administration as a result of commencing the CVA process.

To become effective, the JJB CVA requires the approval of the requisite majority of JJB CVA

Creditors and the Blane CVA requires the approval of the requisite majority of Blane CVA Creditors.

It is a condition of each CVA that it will only become effective if the Implementation Date for both

CVAs occurs.

A company voluntary arrangement also requires the approval of more than 50 per cent. in value of

the company's members present in person or by proxy and voting at a meeting on the resolution to

approve the company voluntary arrangement. However, in accordance with section 4(A)(2) of the

Insolvency Act, if the outcome of the meeting of members differs from the outcome of the meeting

of the company's creditors, the decision of the creditors will prevail, subject to the right of any

member to apply to the Court (in the case of JJB) or Scottish Court (in the case of Blane) to

challenge the approval of the company voluntary arrangement

The CVAs are not conditional upon shareholders of JJB approving the issue of the Warrants to BoS

and the CVAs can proceed if the issue of the Warrants to BoS is not approved.

If the CVAs are approved at the relevant Creditors' meetings and are not then the subject of any

successful challenge, the new financing arrangements will be available to the Group.

5

If the CVAs are not approved at the relevant meetings or, if approved but subject to any

challenge, the Standstill may terminate, all outstanding amounts under the Group's existing

debt facilities will become due and payable and the new financing arrangements will not

become available to the Group. In these circumstances, it is likely that JJB and the other

entities within the Group will no longer be able to trade as going concerns which is likely to

result in the appointment of liquidators or administrators.

Your vote on the Proposal is very important. Please take the time to consider the documents that

have been sent to you and take appropriate action, including the return of the relevant Proxy Form.

DOCUMENTS RECEIVED

You will have received the following documents:

1. a letter from the Nominees of JJB and Blane

2. a Voting & Notice of Claim for each Company

3. a Proxy Form for each Company

4. this Proposal, including notices of meetings and, within its annexes, a Summary Statement

of Affairs for each Company

5. the Nominees' comments on the Proposal

There are different coloured and numbered Proxy Forms for the various creditors' meetings and

members' meetings convened to vote on the CVAs. The following Proxy Forms will be in use at

those meetings:

• Green

Proxy Forms apply to JJB members and bear number "1"

• Red

Proxy Forms apply to JJB creditors and bear number "2"

• Pink

Proxy Forms apply to Blane members and bear number "3"

• Yellow

Proxy Forms apply to Blane creditors and bear number "4"

NEXT STEPS

If you are a creditor of JJB or Blane, please complete and submit your Voting & Notice of Claim to

KPMG LLP at St James' Square, Manchester, M2 6DS (attention: Brian Green) by 24 April 2009.

If you are a creditor of JJB or Blane and are unable or do not wish to attend your relevant creditor

meeting, submit your Proxy Form(s) to KPMG LLP at St James' Square, Manchester, M2 6DS or

alternatively fax: 0161 246 4040 (in either case mark for the attention of Brian Green) by 11:00 a.m.

on 24 April 2009.

If you are a member of JJB and are unable or do not wish to attend your relevant member meeting,

submit your Green Proxy Form to Capita Registrars at Proxy Department, The Registry, 34

Beckenham Road, Beckenham, Kent, BR3 4TU by 11:00 a.m. on 27 April 2009.

WHERE TO FIND HELP

If you have not received a Voting & Notice of Claim or Proxy Form for the meeting at which you

wish to vote, please ring the CVA helpline on 0844 815 6067.

Details of how to vote at the meetings and how to make a claim for payments are contained in Part

II (Action to be taken by CVA Creditors and Members) and Part VII (Terms of the Company

Voluntary Arrangements) of this Proposal.

6

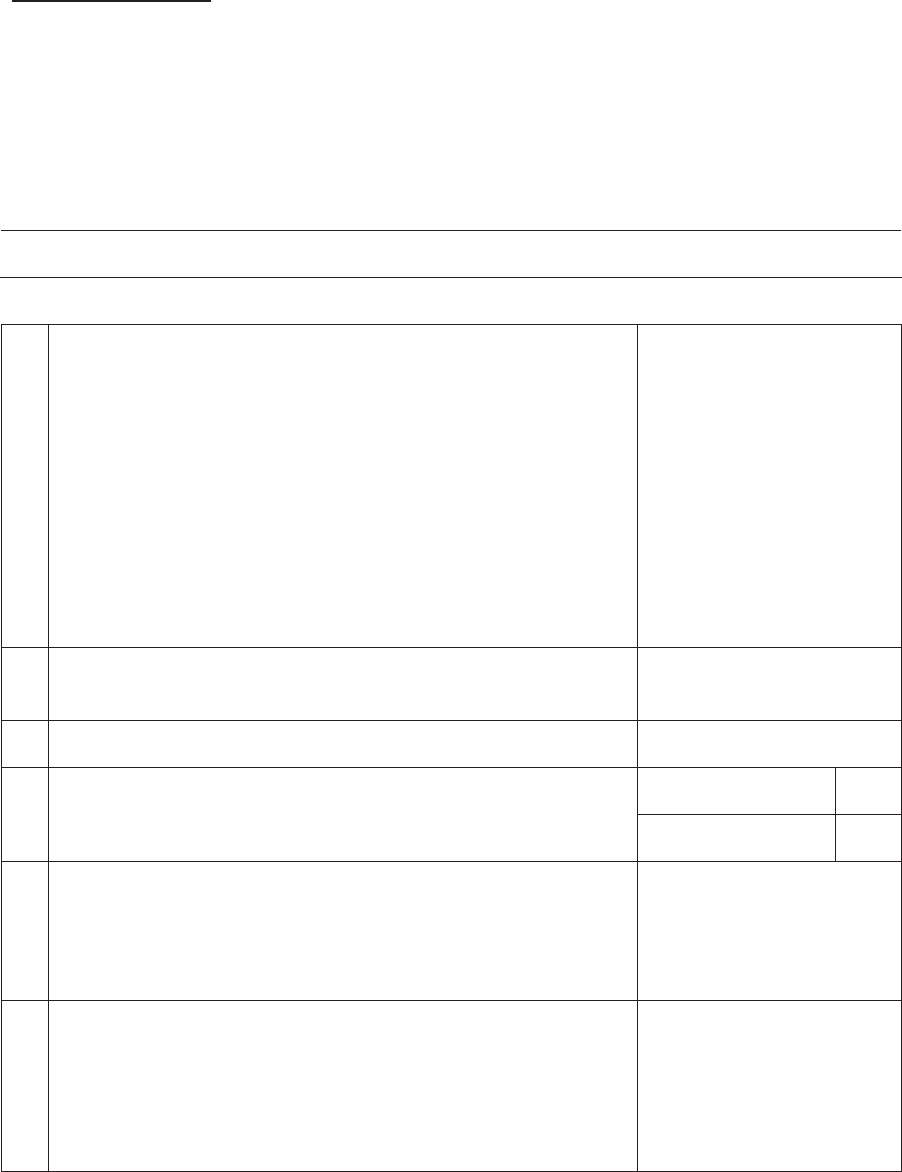

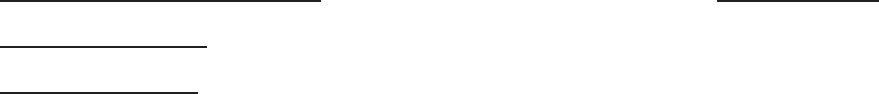

TABLE OF CONTENTS

Headings Page

SECTION 1: PROPOSAL.................................................................................................................. 9

KEY DATES AND EXPECTED TIMETABLE OF KEY EVENTS...................................................... 9

PART I: INTRODUCTION................................................................................................................ 10

1. DIRECTORS' PROPOSAL .......................................................................................... 10

2. BACKGROUND TO AND REASONS FOR THE PROPOSAL.................................... 11

3. DEFINITIONS AND INTERPRETATION..................................................................... 12

4. CONTENTS ................................................................................................................. 12

5. WHAT IS A COMPANY VOLUNTARY ARRANGEMENT?......................................... 13

6. WHY ARE COMPANY VOLUNTARY ARRANGEMENTS REQUIRED? .................... 14

7. CONTINUATION OF OPERATIONS........................................................................... 15

8. OBJECTIVE................................................................................................................. 15

9. SUPPORT OF LANDLORDS....................................................................................... 16

10. CLAIMS AND DISTRIBUTIONS.................................................................................. 17

11. WORKING CAPITAL STATEMENT ............................................................................ 17

12. DESIRABILITY OF THE PROPOSAL ......................................................................... 18

13. RECOMMENDATION TO MEMBERS AND CREDITORS.......................................... 19

PART II: ACTION TO BE TAKEN BY CVA CREDITORS AND MEMBERS.................................. 20

1. ARRANGEMENTS FOR VOTING AT CREDITORS' MEETINGS .............................. 20

2. VOTES IN RELATION TO INTER-COMPANY DEBTS............................................... 21

3. VOTES IN RELATION TO LANDLORDS.................................................................... 21

4. ARRANGEMENTS FOR VOTING AT MEMBERS' MEETINGS ................................. 21

5. CREDITORS AND MEMBERS WITH QUERIES ........................................................ 22

PART III: STATUTORY INFORMATION, BACKGROUND AND FINANCIAL

INFORMATION............................................................................................................ 23

1. CORPORATE INFORMATION.................................................................................... 23

2. HISTORY..................................................................................................................... 23

3. ASSETS AND LIABILITIES ......................................................................................... 24

4. CLAIMS BY A LIQUIDATOR ....................................................................................... 26

5. THIRD PARTY PROPERTY ........................................................................................ 26

6. PROPOSED DURATION OF THE CVAS.................................................................... 26

7. PAYMENTS TO NOMINEE ......................................................................................... 27

8. APPLICATION OF FUNDS.......................................................................................... 27

7

PART IV: KEY TERMS OF THE PROPOSAL ................................................................................ 28

1. TERMS OF THE ARRANGEMENTS........................................................................... 28

2. PREFERENTIAL AND SECURED CREDITORS........................................................ 32

PART V: ESTIMATED OUTCOMES FOR CREDITORS ................................................................ 33

1. ESTIMATED OUTCOMES FOR CREDITORS............................................................ 33

2. WORKED EXAMPLES OF THE METHODOLOGY FOR VALUING THE

CVA CLAIM OF A CLOSED PREMISES LANDLORD................................................ 34

PART VI: TAX INFORMATION AND TAX DISCLAIMER............................................................... 36

1. TAX INFORMATION AND TAX DISCLAIMER............................................................ 36

SECTION 2: TERMS OF THE PROPOSAL.................................................................................... 37

PART VII: TERMS OF THE COMPANY VOLUNTARY ARRANGEMENTS .................................. 37

1. DEFINITIONS AND INTERPRETATION..................................................................... 37

2. APPLICATION OF THE CVAS.................................................................................... 37

3. IMMEDIATELY EFFECTIVE PROVISIONS OF THE CVAS....................................... 37

4. CONDITIONS PRECEDENT TO THE CVAS.............................................................. 37

5. OPERATION OF THE COMPANIES........................................................................... 38

6. MORATORIUM............................................................................................................ 38

7. ESTABLISHING ALLOWED CVA CLAIMS ................................................................. 39

8. EFFECT UPON EXISTING UNSECURED LIABILITIES OF A COMPANY................ 39

9. EFFECT UPON PROPERTY LIABILITIES OF A COMPANY..................................... 39

10. CPL PAYMENT AMOUNTS......................................................................................... 39

11. APPLICATION OF THE CPL PAYMENT AMOUNT.................................................... 40

12. COMPROMISE OF THE LIABILITY DUE TO CLOSED PREMISES

LANDLORDS............................................................................................................... 40

13. PAYMENT OF ALLOWED CLOSED PREMISES CLAIMS......................................... 43

14. BLANE LEASES GUARANTEED BY JJB ................................................................... 43

15. OSC PARENT GUARANTEES.................................................................................... 44

16. DISPUTED CLAIMS OF CLOSED PREMISES LANDLORDS.................................... 45

17. COMPROMISE OF THE CONTINGENT PROPERTY CREDITORS CVA

CLAIM .......................................................................................................................... 46

18. DEALING WITH CLOSED PREMISES ....................................................................... 46

19. OPEN PREMISES LANDLORDS................................................................................ 47

20. ASSETS....................................................................................................................... 48

21. FULL AND FINAL SETTLEMENT ............................................................................... 48

22. PAYMENT OF DISPUTED DISTRIBUTIONS AND MISCELLANEOUS

DISTRIBUTION PROVISIONS.................................................................................... 48

8

23. CURRENCY OF PAYMENT ........................................................................................ 50

24. SECURITY................................................................................................................... 50

25. POWERS AND INTENTIONS OF THE CVA SUPERVISORS.................................... 50

26. THE CVA SUPERVISORS' REMUNERATION ........................................................... 53

27. NO CREDITORS' COMMITTEE.................................................................................. 53

28. NO WARRANTIES OR REPRESENTATIONS............................................................ 53

29. RECORDS................................................................................................................... 54

30. VACANCY IN OFFICE OF SUPERVISORS................................................................ 54

31. VARIATION.................................................................................................................. 54

32. SET-OFF...................................................................................................................... 55

33. ASSIGNMENTS........................................................................................................... 55

34. TERMINATION OF THE CVAS................................................................................... 55

35. NOTICES..................................................................................................................... 56

36. NO PERSONAL LIABILITY.......................................................................................... 56

37. GOVERNING LAW AND JURISDICTION ................................................................... 57

38. EC REGULATION ON INSOLVENCY PROCEEDINGS............................................. 57

ANNEX 1: DEFINITIONS AND INTERPRETATION ....................................................................... 58

ANNEX 2: STATUTORY INFORMATION....................................................................................... 67

ANNEX 3: LIST OF FITNESS CLUBS PREMISES ........................................................................ 69

ANNEX 4: LIST OF CLOSED PREMISES...................................................................................... 73

ANNEX 5: LIST OF OPEN PREMISES........................................................................................... 80

ANNEX 6: OUTCOME STATEMENTS............................................................................................ 95

ANNEX 7: CLOSED PREMISES LANDLORD ASSUMPTIONS.................................................... 97

ANNEX 8: CVA SUPERVISORS AND ADDRESS FOR NOTICE.................................................. 98

ANNEX 9: LIST OF GUARANTEES................................................................................................ 99

ANNEX 10: AVERAGE KPMG CHARGE OUT RATES ............................................................... 101

ANNEX 11: LIST OF SECURITY................................................................................................... 102

ANNEX 12: NOTICE OF MEETINGS............................................................................................ 109

ANNEX 13: FORMS OF PROXY................................................................................................... 114

ANNEX 14: VOTING & NOTICE OF CLAIM................................................................................. 118

ANNEX 15: NOTICE OF IMPLEMENTATION DATE.................................................................... 124

ANNEX 16: NOTICE OF TERMINATION...................................................................................... 126

ANNEX 17: TERMS OF RENT CONCESSION AGREEMENT..................................................... 128

ANNEX 18: SUMMARY STATEMENT OF AFFAIRS ................................................................... 130

9

SECTION 1: PROPOSAL

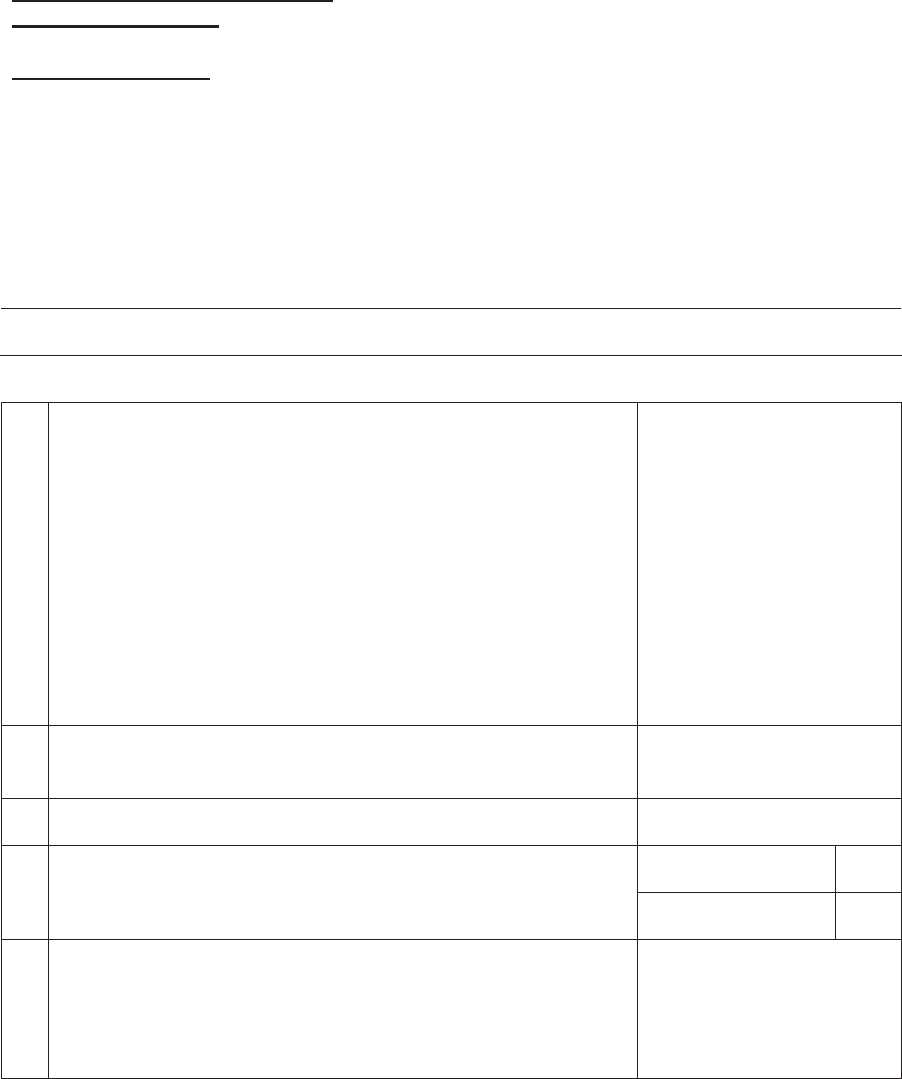

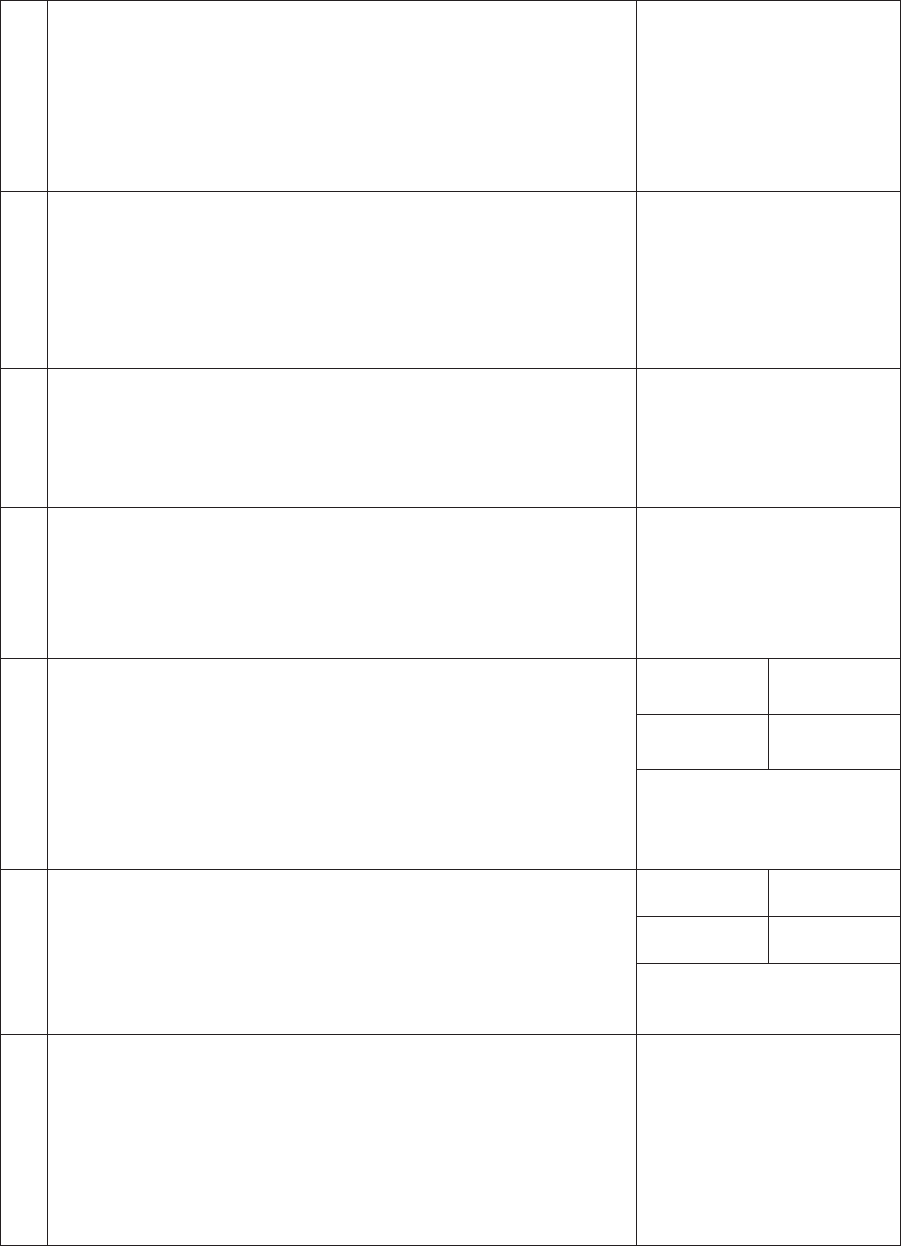

KEY DATES AND EXPECTED TIMETABLE OF KEY EVENTS

Event Date

Announcement of the Disposal and the CVA Proposal 25 March 2009

Dispatch of CVA documents, Proxy Forms and notices of meetings to

the CVA Creditors and members

6 April 2009

Latest date for return of Proxy Forms and Voting & Notice(s) of Claim for

the purpose of voting at the Creditors' meeting

24 April 2009

Date of CVA Creditors' meeting 27 April 2009

Latest date for return of Proxy Forms for the purpose of voting at the

Members' meeting

27 April 2009

Date of CVA members' meeting 29 April 2009

Anticipated date for chairman of CVA Creditors' and members' meetings

to file reports with the Court or Scottish Court under section 4(6) of the

Insolvency Act

30 April 2009

Earliest Implementation Date of the CVA (representing the end of the 28

day challenge period under section 6(3)(a) of the Insolvency Act)

28 May 2009

Earliest anticipated Claims Date (being the last date for the filing of

Voting & Notices of Claim)

25 June 2009

Earliest anticipated payment date for the first payment to Closed Store

Landlords (this date may be later depending on the circumstances at the

relevant time, including the existence of any application to challenge the

CVAs under section 6(3)(a) or (b) of the Insolvency Act)

15 October 2009

Earliest anticipated payment date for the second payment to Closed

Store Landlords (this date may be later depending on the circumstances

at the relevant time, including the existence of any application to

challenge the CVAs under section 6(3)(a) or (b) of the Insolvency Act)

15 January 2010

Earliest anticipated CVA Termination Date (this date may be later

depending on the circumstances at the relevant time, including the

status of any Disputed Claims)

28 February 2010

Notes:

(1) If any of the above dates change, the revised dates will be notified by announcement through the Regulatory

Information Service of the London Stock Exchange.

(2) All references in this document are to London times unless otherwise stated.

10

PART I: INTRODUCTION

1. DIRECTORS' PROPOSAL

1.1 Messrs. Beever, Benzie, Jones, Lane-Smith, Manning and Williams, the directors of JJB

and Messrs. Jones, Manning and Williams, the directors of Blane (together the "Directors"),

propose that the Companies enter into company voluntary arrangements pursuant to Part I

of the Insolvency Act.

1.2 The main objectives of the proposed CVAs are to:

1.2.1 compromise claims of landlords of approximately 140 closed retail stores and

certain related contingent claims (such as claims of former tenants and guarantors,

but not including Rates on those closed stores);

1.2.2 enable landlords of those closed retail stores to make a claim against a total

aggregate fund of £10 million, with payments from that fund in two instalments

(the first instalment of £5,000,001 on 30 September 2009 and the balance of

£4,999,999 on 31 December 2009); and

1.2.3 vary temporarily the terms of leases of the open retail stores, approximately 250

stores in total, such that rent will be paid on a monthly rather than quarterly basis

for a period of twelve months from the Next Quarter Date.

1.3 To become effective, the JJB CVA requires the approval of the requisite majority of JJB

CVA Creditors and the Blane CVA requires the approval of the requisite majority of Blane

CVA Creditors. It is a condition of each CVA that it will only become effective if the

Implementation Date for both CVAs occurs.

1.4 A company voluntary arrangement also requires the approval of more than 50 per cent. in

value of the company's members present in person or by proxy and voting at a meeting on

the resolution to approve the company voluntary arrangement. However, in accordance with

section 4(A)(2) of the Insolvency Act, if the outcome of the meeting of members differs from

the outcome of the meeting of the company's creditors, the decision of the creditors will

prevail, subject to the right of any member to apply to the Court (in the case of JJB) or

Scottish Court (in the case of Blane) to challenge the approval of the company voluntary

arrangement.

1.5 The Nominees in relation to the JJB CVA are Richard Dixon Fleming of KPMG LLP, 8

Salisbury Square, London, EC4Y 8BB and Brian Green of KPMG LLP, St James' Square,

Manchester, M2 6DS.

1.6 The Nominees in relation to the Blane CVA are Richard Dixon Fleming of KPMG LLP, 8

Salisbury Square, London, EC4Y 8BB, Brian Green of KPMG LLP, St James' Square,

Manchester, M2 6DS and Blair Carnegie Nimmo of KPMG LLP, 191 West George Street,

Glasgow, G2 2LG.

1.7 The purpose of this document is to provide you with information about the background to

and reasons for the proposed entry into company voluntary arrangements pursuant to Part I

of the Insolvency Act, including information about the terms of such arrangements, to

explain why the Directors consider the arrangements to be desirable for creditors and in the

best interests of each Company and its shareholders as a whole.

11

2. BACKGROUND TO AND REASONS FOR THE PROPOSAL

2.1 On 25 March 2009, JJB announced, inter alia, the disposal of the Fitness Clubs Business, a

summary of the proposed CVAs and the key terms of new financing arrangements to be

provided by the Continuing Lenders.

2.2 The Board has been actively pursuing a strategy of returning JJB's core retail sports

business to profitability by a number of measures, including reducing stock levels, reducing

costs and the disposal of the Fitness Clubs Business. JJB signed an agreement for, and

completed, the disposal of the Fitness Clubs Business on 25 March 2009. Notwithstanding

this, given the current retail environment, the Board considers that JJB's future viability is

dependent upon the entry into an arrangement involving the compromise and release of

certain long term liabilities. JJB is currently paying approximately £12.5 million per annum in

rent and service charges in relation to closed retail stores and Blane is currently paying

approximately £4.8 million per annum in rent and service charges in relation to closed retail

stores per annum. Annex 18 (Summary Statement of Affairs) sets out further details of

these and other liabilities of JJB and Blane. The Directors have therefore proposed the

CVAs to the unsecured creditors of JJB and Blane. If the CVAs proceed, landlords of closed

retail stores will be entitled to make a one-off claim against a total aggregate fund of £10

million and JJB and Blane will be relieved of their liabilities to such landlords. Annex 6

(Outcome Statements) sets out the likely impact of the CVAs on landlords.

2.3 In order to provide the Group with access to working capital during the period in which the

CVAs are considered by the unsecured creditors and shareholders of JJB and Blane, JJB's

existing facilities are currently available until 17 June 2009 pursuant to the revised standstill

arrangements agreed on 25 March 2009 with JJB's existing lenders, Barclays, BoS (a

wholly-owned subsidiary of Lloyds) and Kaupthing. The Lenders have the right to

accelerate the standstill expiry date from 17 June 2009 in the event that either they are not

satisfied with the progress of the CVAs or the CVAs are not approved or effected before

that time. The Lenders also have the right to accelerate the standstill expiry date if, inter alia,

they are not satisfied with the trading performance of JJB or if the deferred consideration for

the disposal of the Fitness Clubs Business is not paid in accordance with the terms of the

transaction documentation.

2.4 Whilst JJB has entered into New Facilities with each of the Continuing Lenders, the New

Facilities are still conditional and not yet available to JJB. Pursuant to the terms of the

Barclays Facility, Barclays will make a short term £25 million loan available to JJB until 31

August 2009 and pursuant to the terms of the BoS Facility, BoS will make a medium term

£25 million working capital facility available until 30 September 2010. The New Facilities will

only be available to JJB, inter alia, if the CVAs are approved at the relevant meetings

and are not then the subject of any successful challenge. Upon drawdown, the New

Facilities will replace JJB's existing bi-lateral facilities.

2.5 JJB has paid an initial arrangement fee of £125,000 to Barclays in connection with the

Barclays Facility. A further fee of £125,000 is payable prior to first utilisation. In exchange

for the continuing support of BoS pursuant to the BoS Facility, JJB intends to issue warrants

to BoS (or an affiliate of BoS) entitling the holder to subscribe for new ordinary shares

representing 4.5% of the current issued share capital of JJB, subject to shareholder

approval. In the event that shareholder approval for the issue of warrants is not obtained,

the BoS Facility would not terminate but JJB would pay an arrangement fee to BoS of

£500,000 on the final maturity date of the BoS Facility.

12

2.6 The CVAs are not conditional upon shareholders of JJB approving the issue of the warrants

to BoS and the CVAs can proceed if the issue of the warrants to BoS is not approved. If the

CVAs are approved at the relevant Creditors' meetings and are not then the subject of any

successful challenge, the New Facilities will be available to the Group.

3. DEFINITIONS AND INTERPRETATION

3.1 Expressions defined in Part A of Annex 1 (Definitions and Interpretation) which are used in

the terms of the CVAs shall have the meanings specified in Part A of Annex 1 (Definitions

and Interpretation) unless the context otherwise requires and Part B of Annex 1 (Definitions

and Interpretation) shall apply as if set out in full in this Paragraph 3.

3.2 Section 1, Parts I to VI of this Proposal set out a general description of the Proposal and

provide a brief summary of the binding terms of this Proposal. The binding terms of this

Proposal are set out in Section 2, Part VII (Terms of the Company Voluntary Arrangements).

3.3 Unless otherwise stated, references to:

3.3.1 Paragraphs are references to Paragraphs in Part I (Introduction) to Part VI (Tax

Information and Tax Disclaimer) and to Paragraphs in each of the Annexes; and

3.3.2 Clause numbers are to Clauses in Part VII (Terms of the Company Voluntary

Arrangements).

4. CONTENTS

4.1 The Proposal deals with the following matters:

Part I Introduction: which explains what a company voluntary arrangement is and

which includes a summary of the Proposal;

Part II Action to be taken by CVA Creditors and Members: which contains information

for creditors and members regarding the voting procedure at the meetings

convened for the purpose of approving the Arrangement;

Part III Statutory Information, Background and Financial Information: which includes

details about each Company and its current financial position and information

required by the Insolvency Act;

Part IV Key Terms of the Proposal: which explains the key commercial terms of the

Arrangements;

Part V Estimated Outcome for CVA Creditors: which contains estimated outcomes for

the CVA Creditors on the basis that (i) the CVAs succeed, (ii) the Companies

were liquidated and (iii) the Companies were placed into administration;

Part VI Tax Information and Tax Disclaimer: which contains an important notice in

respect of tax; and

Part VII Terms of the Company Voluntary Arrangements: which sets out the binding

terms of the compromises and other arrangements under the CVAs.

13

5. WHAT IS A COMPANY VOLUNTARY ARRANGEMENT?

5.1 A company voluntary arrangement is a procedure under Part I of the Insolvency Act. It is a

formal procedure which enables a company to agree with its creditors a composition in

satisfaction of its debts or a scheme of arrangement of its affairs which can determine how

its debts should be paid and in what proportions. It requires the approval of a majority in

excess of 75 per cent. in value of the company's creditors present in person or by proxy and

voting at a meeting on the resolution to approve the arrangement.

5.2 If a company voluntary arrangement is validly approved, it binds all the company's creditors

who were entitled to vote at the meeting (whether or not they so voted) or would have been

so entitled had they received notice of the meeting.

5.3 A resolution, however, will be invalid if those creditors voting against it include more than

half in value of the creditors, for these purposes counting only those creditors:

5.3.1 to whom notice of the meeting was sent;

5.3.2 whose votes were not left out of account due to no written Voting & Notice of

Claim having been received at or prior to the meeting, or where the claim or part

of it is secured (including on a current bill of exchange or promissory note); and

5.3.3 who are not, to the best of the chairman of the meeting's belief, persons

connected with the relevant Company.

5.4 A company voluntary arrangement also requires the approval of more than 50 per cent. in

value of the company's members present in person or by proxy and voting at a meeting on

the resolution to approve the company voluntary arrangement. However, in accordance with

section 4(A)(2) of the Insolvency Act, if the outcome of the meeting of members differs from

the outcome of the meeting of the company's creditors, the decision of the creditors will

prevail, subject to the right of any member to apply to the Court (in the case of JJB) or

Scottish Court (in the case of Blane) to challenge the approval of the company voluntary

arrangement.

5.5 Creditors who are based in the European Union (including the U.K.) should note that by

virtue of the EC Regulation on Insolvency Proceedings, the courts of the European Union

member states (other than Denmark) are obliged to recognise a company voluntary

arrangement for a company which is determined to have its centre of main interests in the

United Kingdom.

5.6 Any creditor entitled to vote at a meeting to approve a company voluntary arrangement may

apply to the relevant Court or Scottish Court on one or both of the following grounds:

5.6.1 that a company voluntary arrangement unfairly prejudices the interests of that

creditor; or

5.6.2 that there has been some material irregularity at or in relation to the meetings

called to approve the company voluntary arrangement.

Any such application must be made by a creditor within 28 days of the chairman of the

relevant meeting of creditors reporting the result of the meeting to the relevant Court or

Scottish Court, or, if the creditor was not given notice of the relevant meeting of creditors,

such application must be made within 28 days of the creditor becoming aware that the

14

relevant creditors' meeting had taken place.

6. WHY ARE COMPANY VOLUNTARY ARRANGEMENTS REQUIRED?

6.1 As described in further detail in Paragraph 11 (Working Capital Statement) below, the

Directors are of the opinion that the Group does not have sufficient working capital for their

present requirements, that is, for at least 12 months from the date of posting of the Proposal.

6.2 The Fitness Clubs Disposal completed on 25 March 2009. The estimated total

consideration payable by Dave Whelan Sports Limited (the "Purchaser") for the Fitness

Clubs Business and related stock is approximately £83.4 million. This comprises

approximately £40 million of initial consideration, subject to completion adjustments, paid on

completion, approximately £33.9 million of deferred consideration to be paid into an escrow

account on 16 April 2009 and approximately £9.5 million of consideration for the stock in the

Fitness Clubs Business as at completion to be paid on 1 May 2009. The deferred

consideration of approximately £33.9 million will, after deduction of certain costs, expenses

and other agreed amounts, be released to JJB from the escrow account as and when

landlord's consent is obtained to the assignment of the relevant leasehold properties.

Payments will not be made from the escrow account until an agreed number of leases have

been assigned. The Directors expect the process of assignment of all of the leases to be

completed over the next six months. In connection with the Fitness Clubs Disposal, the

parties have agreed to a number of customary restrictions to protect their respective

interests. Subject to certain exceptions, JJB has agreed not to own or operate a fitness club

in the United Kingdom for a period of 36 months from completion.

6.3 Notwithstanding the receipt of the proceeds from the Fitness Clubs Disposal, the Group

require the continued support of the Lenders. Accordingly, the Companies entered into the

Standstill in order to allow them to proceed with the Proposal. The Standstill ensures that,

subject to certain conditions, the Existing Facilities remain available to the Group whilst the

Proposal is being considered by each of the members and creditors of the Group.

6.4 If the Proposal is:

6.4.1 approved by the requisite majority of each of the Company's creditors; and

6.4.2 the Implementation Date occurs,

the Existing Facilities and the Standstill will terminate and the New Facilities, subject to the

satisfaction of customary conditions precedent, will become available to the Group.

6.5 Having regard to the principal terms of the New Facilities agreed with the Continuing

Lenders, the Directors believe that the funds that will be available to the Group under the

New Facilities will, as further described in Paragraph 11 (Working Capital Statement) below,

assist in providing the additional working capital thought by the Directors to be necessary to

enable the Group to continue to trade.

6.6 If the Proposal is rejected by the CVA Creditors and the Implementation Date does

not occur, the New Facilities will not become available to the Companies and, as a

result, it is unlikely that either Company will be able to continue to trade as a going

concern. Therefore, the failure to achieve the approval of the Proposal and the

subsequent Implementation Date is likely to result in each Company going into

administration or liquidation. Please refer to Paragraph 11 (Working Capital

Statement) below for a more detailed discussion of the Group's working capital

15

position.

6.7 Outcome Statements in respect of JJB can be found at Part A of Annex 6 (Outcome

Statements) and Outcome Statements in respect of Blane can be found at Part B of

Annex 6 (Outcome Statements). Those statements indicate that the return to

creditors generally (and to Closed Premises Landlords in particular) is likely to be

significantly lower if either Company is placed into administration or liquidation than

if the Arrangement is approved.

7. CONTINUATION OF OPERATIONS

Unlike many company voluntary arrangements, which provide for the realisation of all or

part of a company's assets and the application of the proceeds of realisation in discharge of

that company's liabilities, the Proposal will see the businesses of the Companies continue

to trade in the ordinary course and meet their liabilities as they fall due (subject to the

compromises described herein). This means that the amounts due to Preferential Creditors

and Secured Creditors and other creditors (other than CVA Property Creditors and Open

Premises Landlords) will continue to be met by the relevant Company as they fall due.

8. OBJECTIVE

8.1 The objective of the Proposal is to restore the viability of each Company's business model

and to assist in a return to profitability. Key terms of the Proposal are contained in Part IV

(Key Terms of the Proposal) of this document. In summary, to achieve that objective, the

following compromises and arrangements are provided for:

8.1.1 in relation to Open Premises Leases and Open Premises Landlords, the

Companies shall:

(A) continue to trade (or where the Open Premises are not yet

open, commence trading) from the Open Premises and pay

amounts due under the Open Premises Leases; but

(B) from the Next Quarter Day and for the period of 12 months

thereafter, the Companies will not be obliged to pay the Open

Premises Rent at the times specified in those leases and will

instead during that period pay the annual rent in 12 equal

monthly instalments in advance;

8.1.2 in relation to Contingent Property Creditors, compromise and release any

Contingent Property Creditor Liability due from either Company to the Contingent

Property Creditor for £1. The nature of the contingencies applicable to such

payments are such that there is no certainty that a Contingent Property Creditor

would make any recovery in a liquidation of the Companies and therefore it is

appropriate that all such claims be compromised at £1;

8.1.3 in relation to Closed Premises Leases and Closed Premises Landlords, the

Companies shall:

(A) cease to have any obligation to make any payments to Closed

Premises Landlords pursuant to the terms of any Closed

Premises Lease;

16

(B) pay (on the dates provided for in the CVAs) to Closed

Premises Landlords with Allowed CVA Claims the amount

provided for in the CVAs in respect of their Allowed CVA Claim;

(C) agree to the surrender, forfeiture, irritancy or assignment of the

Closed Premises Lease at the option of the relevant Closed

Premises Landlord (subject to each party meeting its own legal

fees in respect of such surrender, forfeiture or assignment);

(D) where liable, pay any Rates payable by the Companies in

respect of a Closed Premises until the relevant Closed

Premises Lease expires (by exercise of a break clause or

passage of time) or is surrendered, forfeited, irritated or

assigned; and

(E) pay to the Closed Premises Landlords any amounts received

by the Companies from Sub-Tenants; and

8.1.4 in relation to OSC Parent Guarantees, OSC Premises Leases and OSC Premises

Landlords:

(A) compromise and release any Liability due from JJB to the OSC

Premises Landlord pursuant to an OSC Parent Guarantee or

an OSC Premises Lease; and

(B) pay (on the dates provided for in the CVAs) to OSC Premises

Landlords with Allowed CVA Claims the amount provided for in

the CVAs in respect of their Allowed CVA Claim.

8.2 Consequences of the CVAs for other creditors

8.2.1 All Unsecured Creditors of each of the Companies (other than CVA Property

Creditors and Open Premises Landlords) shall continue to be paid in full.

8.2.2 The CVAs do not affect the rights of any Secured Creditor. The Secured Creditors

will continue to be paid in full.

8.2.3 All Preferential Creditors shall be paid in full.

8.2.4 The CVAs do not affect the rights of Fitness Club Premises Landlords insofar as

those rights relate to Fitness Club Premises.

9. SUPPORT OF LANDLORDS

9.1 The Directors have informally approached a number of the Companies' major landlords to

gauge whether they would be prepared to vote in favour of a company voluntary

arrangement in similar terms to that set out in the Proposal.

9.2 The initial indications given by those landlords is that they would, in principle, be prepared

to vote in favour of a company voluntary arrangement in similar terms to that set out in the

Proposal.

17

10. CLAIMS AND DISTRIBUTIONS

10.1 Other than Existing Unsecured Creditors only those CVA Creditors with Allowed CVA

Claims will receive a Payment from the Companies.

10.2 CVA Creditors who wish to participate in Payments and who have not submitted a Voting &

Notice of Claim for the purpose of voting at the creditors' meetings, must submit details of

their CVA Claims to the CVA Supervisors as soon as possible after the approval of the

CVAs, and in any event no later than the Claims Date by completing and submitting a

Voting & Notice of Claim.

10.3 A Closed Premises Landlord or OSC Premises Landlord who submits a Voting & Notice of

Claim after the Claims Date may lose any right to receive Payment save in exceptional

circumstances (see Clause 12.8 of Part VII (Terms of Company Voluntary Agreements)).

The "Claims Date" is the date falling 28 days after the Implementation Date.

11. WORKING CAPITAL STATEMENT

11.1 The Company is of the opinion that the Group does not have sufficient working capital for its

present requirements, that is, for at least 12 months from the date of this document.

11.2 The Company remains dependent on the continuing support of its Lenders to continue

trading. Accordingly, in order to allow it to proceed with the Proposal (as described in detail

above), the Company has agreed the Standstill with the Lenders until 17 June 2009. The

Lenders will have the right to accelerate the Standstill expiry date from 17 June 2009 in the

event that either they are not satisfied with the progress of the CVAs or the Proposal is not

approved or effected before that time. The Lenders will also have the right to accelerate the

Standstill expiry date if, inter alia: (i) they are not satisfied with the trading performance of

the Company; (ii) if the deferred consideration for Fitness Clubs Disposal is not paid into an

escrow account on or before 16 April 2009; or (iii) if they are not satisfied with the progress

of the assignment of leases in respect of the Fitness Clubs Business.

11.3 The Company has also agreed and entered into the New Facilities with the Continuing

Lenders. The New Facilities will, subject to certain customary conditions precedent, become

available to the Company if the Proposal is approved at the meetings of creditors and is not

then the subject of any challenge within 28 days of such approval having been reported to

the Court (the "Challenge Period"). On the date the New Facilities becomes available

(after the expiry of the Challenge Period expected to be on or about 28 May 2009) each of

the Existing Facilities will be repaid in full and the Standstill will be terminated.

11.4 Whilst the Directors are firmly of the view that the Proposal and the CVA process in general

will facilitate a better outcome for creditors than would occur if the Company were placed

into liquidation or administration, the success of the CVA process is dependent upon voting

by creditors.

11.5 If the Standstill is terminated or if the Proposal is not approved at the meetings of creditors

or, if it is approved but is then the subject of any challenge within the Challenge Period

(expected to end on or about 28 May 2009), the New Facilities will not become available to

the Company and it is likely that each of the Companies will no longer be able to trade as

going concerns which is likely to result in the appointment of receivers, liquidators or

administrators.

18

11.6 As outlined above, under the terms of the New Facilities, initial committed facilities of £50

million will be made available to the Group upon the expiry of the Challenge Period

(assuming there has been no challenge or the Standstill has not otherwise terminated within

that time). The Barclays Facility will be repaid progressively as the deferred consideration

proceeds from the disposal of the Fitness Clubs Business are received and must be repaid

in full by the end of August 2009. The BoS Facility will be committed through until the end of

September 2010. On the basis of this level of facility, the Company is of the opinion that it

will not have sufficient working capital for its then present requirements, that is for the 12

months from the date of this document and a shortfall is likely to occur sometime towards

the end of 2009.

11.7 In considering the working capital thought to be necessary for the Group and in determining

the shortfall, the Directors have assumed that: (i) largely all of the deferred consideration of

approximately £33.9 million payable, after the deduction of certain costs, expenses and

other agreed amounts, by the Purchaser to the Company is released from escrow to the

Company by no later than 31 August 2009; (ii) the Company's new business strategy is

executed in accordance with its latest business plan for the Group; (iii) the Company

executes its objective of reducing the working capital required by the business as its funding

position stabilises; and (iv) volatility in the foreign exchange markets does not substantially

impact margins.

11.8 The Company proposes to provide the necessary working capital thought by the Directors

to be necessary through a number of initiatives, developed in consultation with the Lenders,

including:

11.8.1 reduction in discretionary capital expenditure on existing stores, including the

rescheduling of proposed store refurbishments;

11.8.2 further business restructuring, including streamlining business processes;

11.8.3 negotiation of improved terms of trade;

11.8.4 sale and leaseback of all or part of the Company head office site; and

11.8.5 sale of one or more of the Company's remaining non-core assets which include

the two remaining fitness clubs in Ireland and brands that the Company no longer

wishes to develop itself.

11.9 Work on these initiatives has already commenced and initial indications are encouraging. In

due course, the Company intends to explore other sources of finance.

11.10 To the extent that such actions are not successful and the Company is unable to secure

further support from the Continuing Lenders or other sources of finance the Company will

no longer be able to trade as a going concern which would be likely to result in the

appointment of receivers, liquidators or administrators.

12. DESIRABILITY OF THE PROPOSAL

12.1 The Directors had been actively pursuing a recovery programme to return the core sports

retail business of the Companies to profitability by reducing costs, closing underperforming

outlets, selling businesses, improving the management team, reducing stock levels and

developing new formats. Despite those initiatives, the Directors have concluded that the

current and projected sales could not support the current cost base of the business, in

19

particular the high rent roll.

12.2 The Directors are of the opinion that company voluntary arrangements would be of benefit

to the creditors of the Companies because it is anticipated that, under the terms of the

Arrangements, the Unsecured Creditors will receive a greater return on the amount owed to

them than they would do if the Companies were to be subject to any other form of

insolvency proceedings.

12.3 For an analysis of the anticipated outcomes of the Proposal as opposed to the outcomes of

an administration or liquidation of the Company and details of why the Proposal results in a

more advantageous outcome for creditors, please refer to Part IV (Key Terms of the

Proposal) and Part V (Estimated Outcomes for Creditors).

12.4 The CVAs present the best outcome for the Companies and the CVA Creditors (including

Closed Premises Landlords) given that if the Companies entered into a formal insolvency

procedure (liquidation or administration) it is very unlikely that any sale of the business of

the Companies as a going concern would include Closed Premises (on the basis that they

are already closed). Also, before any dividend would be payable to Unsecured Creditors,

the Preferential Liabilities and Secured Creditors would have to be repaid in full.

12.5 The CVAs would permit the continued trading of the Companies' respective businesses.

12.6 Any payment under the CVAs will be paid earlier than any dividend which would be payable

in an administration or liquidation and (for the reasons already stated) for a sum greater

than that which would be payable in an administration or liquidation.

12.7 The Directors are of the opinion that a company voluntary arrangement is a more suitable

procedure for dealing with the affairs and assets of the Companies, being more flexible and

efficient than a formal administration or liquidation and allowing the Companies to continue

to trade under the control of existing management which would not be possible in

administration or liquidation.

12.8 It is the Directors' belief that the Arrangements will be to the advantage of the CVA

Creditors for the following reasons:

12.8.1 if approved, the CVAs would give certainty over returns to CVA Creditors;

12.8.2 absent the approval of the CVAs, it is likely that the Directors will have no other

choice other than to place the Companies into administration or liquidation; and

12.8.3 the Directors are of the opinion that administration or subsequent liquidation will

produce a lesser return for creditors generally than the return which they would

otherwise receive under the Arrangements.

13. RECOMMENDATION TO MEMBERS AND CREDITORS

13.1 The Board considers the Proposal is in the best interests of JJB, its creditors and its

shareholders as a whole and Blane, its creditors and its shareholder.

13.2 The Board unanimously recommends that both creditors and shareholders vote in favour of

the Proposal as the Directors intend to do in respect of their own beneficial holdings in JJB

which amount in aggregate to 694,751 ordinary shares representing approximately 0.28%

of the existing issued ordinary share capital of JJB (excluding treasury shares).

20

PART II: ACTION TO BE TAKEN BY CVA CREDITORS AND MEMBERS

1. ARRANGEMENTS FOR VOTING AT CREDITORS' MEETINGS

1.1 At the creditors' meetings, CVA Creditors will vote on resolutions to approve the

Arrangements. The form of each of the resolution is set out in the Notice of Meetings.

1.2 A person wishing to vote at a creditors' meeting, will need to submit a Voting & Notice(s) of

Claim before the relevant creditors' meeting or bring the Voting & Notice of Claim with them

to the meeting.

1.3 A Voting & Notice of Claim to be completed is enclosed with the Proposal.

1.4 It is intended that, except for the formal business of voting, all of the creditors' meetings for

the CVA Companies will be held concurrently so that everyone claiming to be a CVA

Creditor may hear the Nominee's comments and their answers to questions from the floor.

However, for the purposes of voting, persons claiming to be CVA Creditors will be asked to

vote in each CVA for each Company of which that person claims to be a CVA Creditor.

1.5 Voting is by value alone and is based on the value of a CVA Creditor's debt as at the date

of the creditors' meeting as ascertained by the chairman of the meeting in accordance with

Paragraphs 1.6, 1.7 and 3 below.

1.6 In respect of JJB, the Nominee will act as the chairman of the creditors' meeting. The

chairman will have the power, under Rule 1.17A of the Insolvency Rules, to ascertain the

entitlement of persons wishing to vote and to admit or reject their claims accordingly. The

chairman will base his decision on the books and records of the Companies and such other

evidence he considers appropriate. The figure accepted for voting purposes at the meetings

of creditors will not necessarily be the same as the figure which is ultimately accepted for

payment of claim purposes or any other purpose. Rule 1.17 of the Insolvency Rules

provides for a debt of an unliquidated amount or any debt whose value is not ascertained to

be valued at £1 unless the chairman of the creditors' meeting agrees to place a higher value

on it.

1.7 In respect of Blane, the Nominee will act as the chairman of the creditors' meeting. The

chairman will have the power, under Rule 1.15B of the Insolvency (Scotland) Rules, to

ascertain the entitlement of persons wishing to vote and to admit or reject their claims

accordingly. In order for a person to have their claim admitted they are required to produce

written evidence to vouch for their claim although the chairman may dispense with that

requirement on the basis of the books and records of Blane and such other evidence as he

considers appropriate. The figure accepted for voting purposes at the meetings of creditors

will not necessarily be the same as the figure which is ultimately accepted for payment of

claim purposes or any other purpose. Rule 1.15B of the Insolvency (Scotland) Rules

provides for a debt of an unliquidated amount or any debt whose value is not ascertained to

be valued at £1 unless the chairman of the creditors' meeting agrees to place a higher value

on it.

1.8 Proxy Forms are enclosed with the Proposal for use if a person wishes to vote by proxy.

Any person seeking to vote as a proxy for a person claiming to be a CVA Creditor must

have a copy of the proxy available at the meeting.

1.9 If a person claiming to be a CVA Creditor wishes to appoint the chairman of the meetings to

be his proxy, the Proxy Form must specifically direct the chairman to vote either for, or

21

alternatively against, the relevant proposal and any modification thereto. Failure to give a

specific direction to the chairman will result in the Proxy Form being invalid and the person

claiming to be a CVA Creditor not being entitled to vote at the meeting.

1.10 If any person wishes to represent a corporation pursuant to a resolution authorising him to

do so under section 323 of the Companies Act 2006 he must produce a copy of the

resolution to the chairman of the relevant creditors' meeting. The copy should be certified as

a true copy by a director or secretary of the corporation.

1.11 In order to expedite the procedure for voting at the creditors' meetings, persons wishing to

vote at the creditors' meetings are requested to return their Voting & Notice(s) of Claim and

Proxy Form(s) to the address shown on the forms as soon as possible and in any event by

no later than 11:00 a.m. on Friday 24 April 2009. However, persons wishing to vote at the

meetings may instead bring their Voting & Notice(s) of Claim and Proxy Form(s) with them

to the meetings.

2. VOTES IN RELATION TO INTER-COMPANY DEBTS

Subject always to the provisions of Paragraph 5.3 of Part I (Introduction) which will impact

on the weighting of associated voting, it is the intention of the Directors to vote all Inter-

Company Debts owed to that Company in favour of each relevant CVA.

3. VOTES IN RELATION TO LANDLORDS

3.1 In relation to the procedure for admission of creditors' claims for voting purposes, Landlords

are not distinguished from other CVA Creditors and accordingly, Rule 1.17A of the

Insolvency Rules (in respect of JJB) and under Rule 1.15B of the Insolvency (Scotland)

Rules (in respect of Blane) applies to ascertain the entitlement of Landlords wishing to vote

and the chairman has the power to admit or reject their claims accordingly.

3.2 Claims for future rent, dilapidations and other sums which may be due in respect of

Premises and Fitness Clubs Premises are unliquidated and unascertained. Accordingly

Rule 1.17(3) of the Insolvency Rules (in respect of JJB) and Rule 1.15A of the Insolvency

(Scotland) Rules (in respect of Blane) applies and the chairman of the meeting shall value

the claim of each Landlord (for voting purposes) at £1, unless he agrees to put a higher

value on it.

3.3 The chairman will not speculate on and is not obliged to investigate landlord's claims.

However, it is intended that for voting purposes, the claims of all Landlords will be

calculated on the basis on which the total Allowed CVA Claim of each Closed Premises

Landlord will be calculated in accordance the Proposal, less a discount to reflect the nature

of the test set out in Rule 1.17(3) of the Insolvency Rules (in respect of JJB) and Rule 1.15A

of the Insolvency (Scotland) Rules (in respect of Blane).

4. ARRANGEMENTS FOR VOTING AT MEMBERS' MEETINGS

4.1 At each members' meeting the relevant members of the Companies will vote on a resolution

to approve the Proposal. The form of the resolution is set out in the Notice of Meeting.

Voting by a member is in accordance with the rights attaching to the members' shares. A

member is nevertheless entitled to vote either for or against the Proposal, or any

modification to it.

4.2 JJB, which is the sole member of Blane, has undertaken to vote in favour of the Proposal at

22

the members' meeting for Blane.

5. CREDITORS AND MEMBERS WITH QUERIES

5.1 It is anticipated that the creditors' meetings and members' meetings will be well attended

and you are therefore strongly advised to raise any queries you have ahead of those

meetings so as to ensure a considered response.

5.2 Creditors wishing to raise queries should call the CVA helpline on 0844 815 6067.

Alternatively, creditors may raise queries by letter addressed to KPMG LLP, St James'

Square, Manchester M2 6DS and marked for the attention of Brian Green.

23

PART III: STATUTORY INFORMATION, BACKGROUND AND FINANCIAL

INFORMATION

1. CORPORATE INFORMATION

The statutory information in respect of each Company's:

1.1.1 date of incorporation;

1.1.2 prior registered names;

1.1.3 registered number;

1.1.4 registered office; and

1.1.5 principal trading address,

can be found at Annex 2 (Statutory Information).

2. HISTORY

2.1 Background

2.1.1 JJB is one of the UK's leading sports retailers. JJB was originally formed in 1971

to acquire the business of a single sports store in Wigan. The original store was

established by JJ Broughton in the early 1900s and was then bought by JJ

Braddock and then JJ Bradburn. When David Whelan bought the store from John

Bradburn he maintained the JJB name. Trading from four stores in 1976, the store

portfolio grew to 120 stores in 1994, at which point JJB was floated on the main

market of the London Stock Exchange.

2.1.2 In 1998, JJB acquired the business of Sports Division, which was JJB's largest

competitor at the time. The acquisition then made JJB the largest sports retailer in

the UK. Since 1998, the Sports Division business has been fully integrated within

the JJB group. JJB now operates from approximately 190 retail stores and Blane

from a further 60 retail stores.

2.1.3 JJB acquired Blane in 1998 and JJB is Blane's sole shareholder. Blane trades

under the JJB name and, like JJB, Blane stores focus on sales of sports footwear,

clothing and equipment.

2.1.4 Following a period of substantial losses as a consequence of difficult high street

trading conditions, on 19 February 2009 joint administrators were appointed to two

of JJB's wholly owned subsidiaries, Original Shoe Company Limited ("OSC") and

Qubefootwear Limited ("Qube"). The appointment of joint administrators to OSC

and Qube was provided for in the terms of the Standstill and did not directly affect

any of the Group's other trading businesses. The joint administrators of both OSC

and Qube are Richard Dixon Fleming, David Costley-Wood and Blair Carnegie

Nimmo of KPMG LLP.

24

3. ASSETS AND LIABILITIES

3.1 The following financial information, so far as within the Directors immediate knowledge, and

otherwise on the basis set out there, can be found in Annex 18 (Summary Statement of

Affairs):

3.1.1 In relation to JJB:

(A) details of JJB's assets, with an estimate of their respective

values; and

(B) the nature and amount of JJB's liabilities.

3.1.2 In relation to Blane:

(A) details of Blane's assets, with an estimate of their respective

values; and

(B) the nature and amount of Blane's liabilities.

3.2 Secured Creditors

3.2.1 The Companies are parties to the Existing Facilities granted by the Lenders.

3.2.2 As at 29 March 2009, the following amounts were outstanding under those

facilities:

(A) Barclays – £29,657,293

(B) BoS – £8,469,000

(C) Kaupthing – £11,276,000

3.2.3 The Lenders have the benefit of security, details of which can be found at Part A

of Annex 11 (List of Security) over all of the assets of the Companies.

3.2.4 Whilst JJB has entered into New Facilities with each of the Continuing Lenders,

the New Facilities are still conditional and not yet available to JJB. Pursuant to the

terms of the Barclays Facility, Barclays will make a short term £25 million loan

available to JJB until 31 August 2009 and pursuant to the terms if the BoS Facility,

BoS will make a medium term £25 million working capital facility available until 30

September 2010. The New Facilities will only be available to JJB, inter alia, upon

the occurrence of the Implementation Date. Upon drawdown, the New Facilities

will replace JJB's existing bi-lateral facilities.

3.3 Other Security

3.3.1 As part of its acquisition of Blane in 1998, JJB issued to the vendors of Blane (the

"Blane Noteholders") loan notes (the "Loan Notes") pursuant to a loan note

instrument dated 11 September 1998. The Blane Noteholders now include the

vendors of Blane and certain of their affiliates. In 2001, JJB undertook to deposit

and maintain cash collateral and to grant cash collateral charges in favour of the

Blane Noteholders. The amount of cash collateral is equal to the principal amount

of the Loan Notes from time to time together with interest due or owing but unpaid.

The amount of cash collateral is currently approximately £168,117,000.

3.3.2 Details of other security granted by the Company in favour of the Blane

Noteholders can be found in Part B of Annex 11 (List of Security).

25

3.4 Preferential Creditors

All Preferential Creditors will continue to be paid in full.

3.5 Unsecured Creditors

3.5.1 The total claims of Unsecured Creditors as advised by the Directors in the

Summary Statement of Affairs in respect of JJB are £373,482,000.

3.5.2 The total claims of Unsecured Creditors as advised by the Directors in the

Summary Statement of Affairs in respect of Blane are £57,184,000.

3.5.3 Voting of the Ordinary Unsecured Creditors at the meetings of creditors is

weighted on the basis of one vote per £1 of outstanding debt owed by the

Companies.

3.5.4 Voting of the CVA Property Creditors and Open Premises Landlords at the

meetings of creditors will be determined by the chairman of the meeting in

accordance with Rule 1.17A of the Insolvency Rules (in respect of JJB) and under

Rule 1.15B of the Insolvency (Scotland) Rules (in respect of Blane).

3.5.5 Ordinary Unsecured Creditors (other than CVA Property Creditors and Open

Premises Landlords) and Excluded Creditors shall continue to be paid in full. The

Liabilities of Closed Premises Landlords, Contingent Property Creditors and Open

Premises Landlords shall be compromised in accordance with the terms of the

Arrangement.

3.6 Connected creditors

It is necessary for the Proposal to set out details of Connected Creditors. The meaning of

Connected Creditors is set out in the section 249 of the Insolvency Act. The following are

Connected Creditors to JJB, together with where available, the approximate debt:

3.6.1 Blane: £148,772,136.

3.6.2 Sports Division (Eirann) Limited: £22,371,124.

3.6.3 KooGa Rugby Limited: £106.

3.6.4 Source Lab Limited: £3,500.

3.6.5 All amounts due from either or both of the Companies to Connected Creditors will

continue to be paid in full in accordance with the terms of the Arrangement.

3.7 Guarantees

3.7.1 A list of guarantees given by each of the Companies can be found at Part A and

Part B of Annex 9 (List of Guarantees).

3.7.2 The list indicates where such guarantees have been granted to a Connected

Creditor.

3.7.3 No guarantee for any Liabilities will be offered by or granted to a Director pursuant

to the Arrangements.

3.8 Prescribed Part

26

3.8.1 The prescribed part is a proportion of floating charge realisations set aside for

unsecured creditors pursuant to section 176A of the Insolvency Act (the

"Prescribed Part"). The Prescribed Part applies to all floating charges created on

or after 15 September 2003.

3.8.2 In respect of JJB, the Directors estimate, to the best of their knowledge and belief,

that if JJB entered liquidation:

(A) the value of the Prescribed Part would be £600,000; and

(B) the value of the JJB's net property would be £8,143,000.

3.8.3 In respect of Blane, the Directors estimate, to the best of their knowledge and

belief, that if Blane entered liquidation:

(A) the value of the Prescribed Part would be £536,000; and

(B) the value of Blane's net property would be £2,665,000.

3.9 The CVAs disapply the Prescribed Part requirement as the CVAs do not involve the

realisation of Assets and the distribution of those proceeds of realisation to creditors.

Instead the CVAs permit the continuation of the Companies' businesses as going concerns.

4. CLAIMS BY A LIQUIDATOR

4.1 The Directors, to the best of their knowledge and belief, do not believe that there are any

circumstances giving rise to the possibility, in the event that the Companies should go into

liquidation, of an application to: (i) (in respect of JJB) the Court for an order in respect of

any transaction which is or may be at an undervalue, a preference, an extortionate credit

transaction or a void floating charge under sections 238, 239, 244 and 245 of the

Insolvency Act or (ii) (in respect of Blane) the Scottish Court for an order in respect of any

transaction which is or may be a gratuitous alienation (i.e. a transaction at an undervalue

under Scottish law), unfair preference, an extortionate credit transaction or a void floating