ANNUAL REPORT 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 29, 2023

or

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-8207

THE HOME DEPOT, INC.

(Exact name of registrant as specified in its charter)

Delaware 95-3261426

(State or other jurisdiction of incorporation or organization)

(I.R.S. Employer Identification No.)

2455 Paces Ferry Road

Atlanta, Georgia 30339

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (770) 433-8211

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Trading Symbol Name of each exchange on which registered

Common Stock, $0.05 Par Value Per Share HD New York Stock Exchange

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted

pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller

reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒ Accelerated filer ☐Non-accelerated filer ☐Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the

effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the

registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the

registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based

compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of voting common stock held by non-affiliates of the registrant on July 29, 2022 was $308.0 billion.

The number of shares outstanding of the registrant’s common stock as of March 1, 2023 was 1,014,955,506 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for the 2023 Annual Meeting of Shareholders are incorporated by reference in Part III of

this Form 10-K to the extent described herein.

Table of Contents

TABLE OF CONTENTS

Commonly Used or Defined Terms ii

Forward-Looking Statements iii

PART I

Item 1. Business. 1

Item 1A. Risk Factors. 10

Item 1B. Unresolved Staff Comments. 22

Item 2. Properties. 22

Item 3. Legal Proceedings. 23

Item 4. Mine Safety Disclosures. 24

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities.

24

Item 6. Reserved. 25

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations. 25

Item 7A. Quantitative and Qualitative Disclosures About Market Risk. 32

Item 8. Financial Statements and Supplementary Data. 33

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. 62

Item 9A. Controls and Procedures. 63

Item 9B. Other Information. 65

Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections. 65

PART III

Item 10. Directors, Executive Officers and Corporate Governance. 65

Item 11. Executive Compensation. 66

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder

Matters.

66

Item 13. Certain Relationships and Related Transactions, and Director Independence. 66

Item 14. Principal Accountant Fees and Services. 66

PART IV

Item 15. Exhibit and Financial Statement Schedules. 67

Item 16. Form 10-K Summary. 71

SIGNATURES 72

Fiscal 2022 Form 10-K

i

COMMONLY USED OR DEFINED TERMS

ASU Accounting Standards Update

BODFS Buy Online, Deliver From Store

BOPIS Buy Online, Pickup In Store

BORIS Buy Online, Return In Store

BOSS Buy Online, Ship to Store

CDP The not-for-profit organization formerly known as the Carbon Disclosure Project

Comparable sales As defined in the Results of Operations section of MD&A

DIFM Do-It-For-Me

DIY Do-It-Yourself

EH&S Environmental, Health, and Safety

EPA U.S. Environmental Protection Agency

ESG Environmental, social, and governance

ESPP Employee Stock Purchase Plan

Exchange Act Securities Exchange Act of 1934, as amended

FASB Financial Accounting Standards Board

fiscal 2020 Fiscal year ended January 31, 2021 (includes 52 weeks)

fiscal 2021 Fiscal year ended January 30, 2022 (includes 52 weeks)

fiscal 2022 Fiscal year ended January 29, 2023 (includes 52 weeks)

fiscal 2023 Fiscal year ending January 28, 2024 (includes 52 weeks)

GAAP U.S. generally accepted accounting principles

IRS Internal Revenue Service

LIBOR London interbank offered rate

MD&A Management’s Discussion and Analysis of Financial Condition and Results of Operations

MRO Maintenance, repair, and operations

NOPAT Net operating profit after tax

NYSE New York Stock Exchange

PLCC Private label credit card

Pro Professional customer

Restoration Plans Home Depot FutureBuilder Restoration Plan and HD Supply Restoration Plan

ROIC Return on invested capital

SEC Securities and Exchange Commission

Securities Act Securities Act of 1933, as amended

SG&A Selling, general, and administrative

Term Definition

Table of Contents

Fiscal 2022 Form 10-K

ii

FORWARD-LOOKING STATEMENTS

Certain statements contained herein, as well as in other filings we make with the SEC and other written and oral

information we release, regarding our performance or other events or developments in the future constitute

“forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking

statements may relate to, among other things, the demand for our products and services; net sales growth;

comparable sales; the effects of competition; our brand and reputation; implementation of store, interconnected

retail, supply chain and technology initiatives; inventory and in-stock positions; the state of the economy; the state of

the housing and home improvement markets; the state of the credit markets, including mortgages, home equity

loans, and consumer credit; the impact of tariffs; issues related to the payment methods we accept; demand for

credit offerings; management of relationships with our associates, potential associates, suppliers and service

providers; cost and availability of labor; costs of fuel and other energy sources; international trade disputes, natural

disasters, climate change, public health issues (including the continuing impacts of the COVID-19 pandemic and the

related recovery), cybersecurity events, military conflicts or acts of war, supply chain disruptions, and other business

interruptions that could compromise data privacy or disrupt operation of our stores, distribution centers and other

facilities, our ability to operate or access communications, financial or banking systems, or supply or delivery of, or

demand for, our products or services; our ability to address expectations regarding ESG matters and meet ESG

goals; continuation or suspension of share repurchases; net earnings performance; earnings per share; dividend

targets; capital allocation and expenditures; liquidity; return on invested capital; expense leverage; changes in

interest rates; changes in foreign currency exchange rates; commodity or other price inflation and deflation; our

ability to issue debt on terms and at rates acceptable to us; the impact and expected outcome of investigations,

inquiries, claims, and litigation, including compliance with related settlements; the challenges of international

operations; the adequacy of insurance coverage; the effect of accounting charges; the effect of adopting certain

accounting standards; the impact of legal and regulatory changes, including changes to tax laws and regulations;

store openings and closures; financial outlook; and the impact of acquired companies on our organization and the

ability to recognize the anticipated benefits of any acquisitions.

Forward-looking statements are based on currently available information and our current assumptions, expectations

and projections about future events. You should not rely on our forward-looking statements. These statements are

not guarantees of future performance and are subject to future events, risks and uncertainties – many of which are

beyond our control, dependent on the actions of third parties, or currently unknown to us – as well as potentially

inaccurate assumptions that could cause actual results to differ materially from our historical experience and our

expectations and projections. These risks and uncertainties include, but are not limited to, those described in Part I,

Item 1A. Risk Factors, and elsewhere in this report and also as may be described from time to time in future reports

we file with the SEC. You should read such information in conjunction with our consolidated financial statements

and related notes and Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of

Operations in this report. There also may be other factors that we cannot anticipate or that are not described herein,

generally because we do not currently perceive them to be material. Such factors could cause results to differ

materially from our expectations. Forward-looking statements speak only as of the date they are made, and we do

not undertake to update these statements other than as required by law. You are advised, however, to review any

further disclosures we make on related subjects in our filings with the SEC and in our other public statements.

Table of Contents

Fiscal 2022 Form 10-K

iii

PART I

Item 1. Business.

INTRODUCTION

The Home Depot, Inc. is the world’s largest home improvement retailer based on net sales for fiscal 2022. We offer

our customers a wide assortment of building materials, home improvement products, lawn and garden products,

décor products, and facilities maintenance, repair and operations products. We also provide a number of services,

including home improvement installation services and tool and equipment rental. As of the end of fiscal 2022, we

operated 2,322 stores located throughout the U.S. (including the Commonwealth of Puerto Rico and the territories

of the U.S. Virgin Islands and Guam), Canada, and Mexico. The Home Depot stores average approximately

104,000 square feet of enclosed space, with approximately 24,000 additional square feet of outside garden area.

We also maintain a network of distribution and fulfillment centers, as well as a number of e-commerce websites in

the U.S., Canada and Mexico. When we refer to “The Home Depot,” the “Company,” “we,” “us” or “our” in this report,

we are referring to The Home Depot, Inc. and its consolidated subsidiaries.

The Home Depot, Inc. is a Delaware corporation that was incorporated in 1978. Our Store Support Center

(corporate headquarters) is located at 2455 Paces Ferry Road, Atlanta, Georgia 30339. Our telephone number at

that address is (770) 433-8211.

OUR BUSINESS

OUR STRATEGY

The retail landscape has changed rapidly over the past several years, with customer expectations constantly

evolving. In fiscal 2022, we continued to operate with agility to meet the challenges created by a fluid domestic and

global business environment, including supply chain disruptions, tight labor market conditions, and ongoing

inflationary pressures. Our ability to operate successfully and meet the needs of our customers was due in

significant part to our investments over the past several years aimed at creating an interconnected, frictionless

shopping experience that enables our customers to seamlessly blend the digital and physical worlds. Going forward,

we will leverage the momentum of these investments and continue to invest in our business in support of the

following goals:

• We intend to provide the best customer experience in home improvement;

• We intend to extend our position as the low-cost provider in home improvement; and

• We intend to be the most efficient investor of capital in home improvement.

We believe that these goals will help us grow faster than the market and deliver value to our shareholders. We are

steadfast in this commitment, while also recognizing that exercising corporate responsibility and being informed by

the needs of our other stakeholders, including our customers, associates, supplier partners, and communities,

creates value for all stakeholders, including our shareholders.

DELIVER SHAREHOLDER VALUE

We deliver on our objective to create shareholder value through our disciplined approach to capital allocation. Our

capital allocation principles are as follows:

• First, we intend to reinvest in our business to drive growth faster than the market.

• Second, after meeting the needs of the business, we look to pay a quarterly dividend, which we intend to

increase as we grow earnings.

• Third, after reinvesting in our business and paying our dividend, we intend to return excess cash to our

shareholders through share repurchases.

In fiscal 2022, we invested $3.1 billion in capital expenditures to support our business, advance our goals, and

continue to build an interconnected customer experience. We also focused on driving productivity throughout the

business to lower our costs. The combination of reinvesting in the business to drive higher sales and supporting

productivity to lower costs creates what we refer to as a virtuous cycle, which has allowed us to improve the

customer experience, increase our competitiveness in the market, and deliver shareholder value.

In fiscal 2022, we returned over $14 billion to shareholders in the form of cash dividends and share repurchases.

Our capital allocation is discussed further in Part II, Item 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations.

Table of Contents

Fiscal 2022 Form 10-K

1

OUR CUSTOMERS

We serve two primary customer groups — consumers (including both DIY and DIFM customers) and professional

customers — and have developed varying approaches to meet their diverse needs:

DIY Customers

These customers are typically homeowners who purchase products and complete their own projects and

installations. Our associates assist these customers both in our stores and through online resources and other

media designed to provide product and project knowledge. We also offer a variety of clinics and workshops both to

share this knowledge and to build an emotional connection with our DIY customers.

Professional Customers (or “Pros”)

These customers are primarily professional renovators/remodelers, general contractors, maintenance professionals,

handymen, property managers, building service contractors and specialty tradespeople, such as electricians,

plumbers and painters. These customers build, renovate, remodel, repair, and maintain residential properties,

multifamily properties, hospitality properties, and commercial facilities, including education, healthcare, government,

institutional, and office buildings.

We have a number of initiatives designed to drive growth with our Pros, including a customized online experience, a

dedicated sales force, an extensive delivery network, our Pro Xtra loyalty program, enhanced credit offerings, and

inventory management programs. Building on our historical strength as a destination for urgent purchase needs, we

are investing in capabilities that will help us better serve our Pros’ planned purchase needs (in-store or via our

dedicated sales team), including our expanded supply chain capabilities and advance ordering through our

interconnected digital platforms. We believe that focusing on meeting the Pros’ planned purchase needs, particularly

for larger renovator/remodeler Pros, will help us drive growth and deliver value to our shareholders.

We extended our reach in the MRO marketplace with our fiscal 2020 acquisition of HD Supply, a leading national

distributor and provider of MRO products and related value-added services to multifamily, hospitality, healthcare,

and government housing facilities, among others, and in fiscal 2021 we integrated our legacy Interline Brands

business into HD Supply. Our MRO operations use a distribution center-based model that sells products primarily

through a professional sales force and through e-commerce platforms and print catalogs.

We recognize the great value our Pros provide to their clients, and we strive to make their jobs easier and help them

grow their businesses. We believe that investments aimed at deepening our relationships with our Pros are yielding

increased engagement and will continue to translate into incremental sales to these customers.

DIFM Customers

Intersecting our DIY customers and our Pros are our DIFM customers. These customers are typically homeowners

who use Pros to complete their project or installation. Currently, we offer installation services in a variety of

categories, such as flooring, water heaters, bath, garage doors, cabinets, cabinet makeovers, countertops, sheds,

furnaces and central air systems, and windows. DIFM customers can purchase these services in our stores, online,

or in their homes through in-home consultations. In addition to serving our DIFM customer needs, we believe our

focus on the Pros who perform services for these customers helps us drive higher product sales.

OUR PRODUCTS AND SERVICES

A typical The Home Depot store stocks approximately 30,000 to 40,000 items during the year, including both

national brand name and proprietary products. Our online product offerings complement our stores by serving as an

extended aisle, and we offer a significantly broader product assortment through our websites and mobile

applications, including homedepot.com, our primary website; homedepot.ca and homedepot.com.mx, our websites

in Canada and Mexico; hdsupply.com, our website for our MRO products and related services; blinds.com, our

online site for custom window coverings; and thecompanystore.com, our online site featuring textiles and décor

products.

We believe our merchandising organization is a key competitive advantage, delivering product innovation,

assortment and value, which reinforces our position as the product authority in home improvement. In fiscal 2022,

we continued to invest in merchandising resets in our stores to refine assortments, optimize space productivity,

introduce innovative new products to our customers, and improve visual merchandising to drive a better shopping

experience. At the same time, we remain focused on offering everyday values in our stores and online.

To help our

merchandising organization keep pace with changing customer expectations and increasing desire for innovation,

localization, and personalization, we are continuing to invest in tools to better leverage our data and drive a deeper

level of collaboration with our supplier partners. As a result, we have continued to focus on enhanced

Table of Contents

Fiscal 2022 Form 10-K

2

merchandising information technology tools to help us: (1) build an interconnected shopping experience that is

tailored to our customers’ shopping intent and location; (2) provide the best value in the market; and (3) optimize our

product assortments. Our merchandising team leverages technology and works closely with our inventory and

supply chain teams, as well as our supplier partners, to manage our assortments, drive innovation, and adjust

inventory levels to respond to fluctuations in demand, which helped us navigate the challenges of continuing global

supply chain disruption in fiscal 2022. As cost pressures have risen in several product categories in the current

environment, our tools have helped our merchandising, finance and data analytics teams as they work with our

supplier partners to manage these pressures.

To complement our merchandising efforts, we offer a number of services for our customers, including installation

services for our DIY and DIFM customers, as noted above. We also provide tool and equipment rentals at locations

across the U.S. and Canada, providing value and convenience for both Pros and consumers. To improve the

customer experience and continue to grow this differentiated service offering, we are continuing to invest in more

locations (including piloting rental locations in Mexico), more tools, and better technology.

Sourcing and Quality Assurance

We maintain a global sourcing program to obtain high-quality and innovative products directly from manufacturers in

the U.S. and around the world. During fiscal 2022, in addition to our U.S. sourcing operations, we maintained

sourcing offices in Mexico, Canada, China, India, Vietnam and Europe. To ensure that suppliers adhere to our high

standards of social and environmental responsibility, we also have a global responsible sourcing program. Under

our supplier contracts, our suppliers are obligated to ensure that their products comply with applicable international,

federal, state and local laws. These contracts also require compliance with our responsible sourcing standards,

which cover a variety of expectations across multiple areas of social compliance, including supply chain

transparency, compliance with local laws, health and safety, environmental laws and regulations, compensation,

hours of work, and prohibitions on child and forced labor. To drive accountability with our suppliers, our standard

supplier buying agreement includes a factory audit right related to these standards, and we conduct factory audits

and compliance visits with non-Canada and non-U.S. suppliers of private branded and direct import products. Our

2022 Responsible Sourcing Report, available on our website at https://corporate.homedepot.com under

“Responsibility > Sourcing Responsibly,” provides more information about this program. In addition, we have both

quality assurance and engineering resources dedicated to establishing criteria and overseeing compliance with

safety, quality and performance standards for our private branded products.

Intellectual Property

Our business has one of the most recognized brands in North America. As a result, we believe that The Home

Depot

®

trademark has significant value and is an important factor in the marketing of our products, e-commerce,

stores and business. We have registered or applied for registration of trademarks, service marks, copyrights and

internet domain names, both domestically and internationally, for use in our business, including our proprietary

brands such as HDX

®

, Husky

®

, Hampton Bay

®

, Home Decorators Collection

®

, Glacier Bay

®

, Vigoro

®

, Everbilt

®

and

Lifeproof

®

. The duration of trademark registrations varies from country to country. However, trademarks are

generally valid and may be renewed indefinitely as long as they are in use and/or their registrations are properly

maintained.

We also maintain patent portfolios relating to our business operations, retail services, and products, and we seek to

patent or otherwise protect innovations we incorporate into our business. Patents generally have a term of twenty

years from the date they are filed. As our patent portfolio has been built over time, the remaining terms of the

individual patents across our patent portfolio vary. Although our patents have value, no single patent is essential to

our business. We continuously assess our merchandising departments and product lines for opportunities to expand

the assortment of products offered within The Home Depot’s portfolio of proprietary and exclusive brands.

COMPETITION AND SEASONALITY

Our industry is highly competitive, very fragmented, and evolving. As a result, we face competition for customers for

our products and services from a variety of retailers, suppliers, service providers, and distributors and

manufacturers that sell products directly to their respective customer bases. These competitors range from

traditional brick-and-mortar, to multichannel, to exclusively online, and they include a number of other home

improvement retailers; electrical, plumbing and building materials supply houses; and lumber yards. With respect to

some products and services, we also compete with specialty design stores, showrooms, discount stores, local,

regional and national hardware stores, paint stores, specialty and mass digital retailers, warehouse clubs,

independent building supply stores, MRO distributors, home décor retailers, and other retailers, as well as with

Table of Contents

Fiscal 2022 Form 10-K

3

providers of home improvement services and tool and equipment rental. The internet facilitates competitive entry,

price transparency, and comparison shopping, increasing the level of competition we face.

Both in-store and online, we compete primarily based on customer experience, price, quality, product availability

and assortment, and delivery options. We also compete based on store location and appearance, presentation of

merchandise, and ease of shopping experience. Our Pros also look for a dedicated sales team, competitive credit

and pricing options, project planning tools, and product depth and job lot quantities, particularly for their planned

purchase needs. Furthermore, with respect to delivery options, customers are increasingly seeking faster and/or

guaranteed delivery times, low-price or free shipping, and/or convenient pickup options. Our ability to be competitive

on delivery and pickup times, options and costs depends on many factors, including the success of our supply chain

investments, described more fully under “Our Supply Chain” below.

Our business is subject to seasonal influences. Generally, our highest volume of sales occurs in our second fiscal

quarter, as we move into the spring season in the regions in which we operate.

INTERCONNECTED SHOPPING EXPERIENCE

We continue to enhance our capabilities to provide our customers with a frictionless interconnected shopping

experience across our stores, online, on the job site, and in their homes, focusing on continued investments in our

website and mobile apps to enhance the digital customer experience.

Digital Experience

Enhancements to our digital properties are critical for our increasingly interconnected customers, who often

research products online and check available inventory before going into one of our stores to view the products in

person or talk to an associate and then make their purchase in store or online. While in the store, customers may

also go online to access ratings and reviews, compare prices, view our extended assortment, and purchase

additional products. Our investments in a truly interconnected experience are focused on bringing together the

power of our physical retail presence and the frictionless interaction of our digital capabilities.

A significant majority of the traffic in our digital channels is on mobile devices. Mobile customers expect more

simplicity and relevancy in their digital interactions. As a result, we have made investments to our digital properties

to improve the overall presentation and ease of navigation for the user. We have also enhanced the “shopability” of

an online product by including more information on the product’s landing page, including related products and/or

parts of a collection, as well as various fulfillment options. We believe our focus on improving search capabilities,

site functionality, category presentation, product content, speed to checkout, and enhanced fulfillment options has

yielded higher traffic, better conversion and continued sales growth.

Further, we do not view the interconnected shopping experience as a specific transaction; rather, we believe it

encompasses an entire journey from inspiration and know-how, to purchase and fulfillment, to post-purchase care

and support. Customers expect more personalized messaging, so we are continuing to focus on connecting

marketing activities with the online and in-store experiences to create seamless engagement across channels. From

the inspirational point of the purchase journey to providing product know-how, we continue to invest in the

infrastructure and capabilities needed to deliver the most relevant marketing messages to our customers based

upon what is important to them today.

Store Experience

Our stores remain the hub of our business, and we continue to invest to improve the customer shopping experience

through easier navigation and increased convenience and speed of checkout. In fiscal 2022, we continued to

leverage the investments made in our stores over the past several years to operate effectively and meet changing

customer expectations. These investments include wayfinding signage and store refresh packages; self-service

lockers, online order storage areas at front entrances and curbside pickup to provide convenient pickup options for

online orders; electronic shelf label capabilities; and the re-design of front-end areas, including reconfigured service

desks, improved layouts in checkout areas, and expanded and enhanced self-checkout options. To improve the

customer’s experience in our stores, we have also empowered our customers with additional self-help tools,

including mobile app-enabled store navigation. Our app provides store-specific maps, which allow customers to

pinpoint the exact location of an item on their mobile devices. We believe these investments are driving higher

customer satisfaction scores, and we will continue to invest to improve the customer experience going forward.

Investing in Associate Productivity. We continually strive to improve our store operations for our associates. Our

goal is to remove complexity and inefficient processes from the stores to allow our associates to focus on our

customers. To this end, we have continued to focus our efforts in such areas as optimizing product flow to decrease

the amount of time a store associate spends locating product and to improve on-shelf product availability; creating a

Table of Contents

Fiscal 2022 Form 10-K

4

simpler order management system; expanding in-aisle, real-time mobile learning tools for our associates’ own

development and to assist with customer questions; and using labor model tools to better align associate activity

with customer needs. For several years, our associates have used web-enabled handheld devices to help them

more efficiently meet the needs of the business and serve customers. In fiscal 2022, we began rolling out the next

generation of digital phones to our stores, which we call “hdPhones,” so that each associate will have a digital

device during their shift. The new devices offer enhanced functionality to allow associates to readily query inventory,

access applications that support customer service, and drive on-shelf availability of product.

Investing in Safety. We are committed to maintaining a safe shopping and working environment for our customers

and associates. We empower trained EH&S associates to evaluate, develop, implement and enforce policies,

processes and programs on a Company-wide basis. Our EH&S policies are woven into our everyday operations

and are part of The Home Depot culture. Common program elements include daily store inspection checklists (by

department); routine follow-up audits from our store-based safety team members and regional, district and store

operations field teams; equipment enhancements and preventative maintenance programs to promote physical

safety; departmental merchandising safety standards; training and education programs for all associates, with

varying degrees of training provided based on an associate’s role and responsibilities; and awareness,

communication and recognition programs designed to drive operational awareness and an understanding of EH&S

matters.

OUR SUPPLY CHAIN

We continue to focus on building best-in-class competitive advantages in our supply chain to be responsive to our

customers’ expectations for how, when and where they choose to receive our products and services. As part of

enhancing the interconnected shopping experience, we continue to invest in expanding our supply chain network,

with the goal of achieving the fastest, most efficient and most reliable delivery capabilities in home improvement.

Our efforts are focused on ensuring product availability and increasing the speed and reliability of delivery for our

customers while managing our costs. Our supply chain investments have helped us to operate effectively and meet

our customers’ needs throughout the challenging environment over the past few years.

We centrally forecast and replenish the vast majority of our store products through sophisticated inventory

management systems and utilize our network of distribution centers to serve both our stores’ and customers’ needs.

Our supply chain includes multiple distribution center platforms in the U.S., Canada, and Mexico tailored to meet the

needs of our stores and customers based on types of products, location, transportation, and delivery requirements.

These platforms include rapid deployment centers, stocking distribution centers, bulk distribution centers, and direct

fulfillment centers, among others. As part of the expansion of our supply chain, we have invested to further

automate and mechanize our rapid deployment center network to drive efficiency and faster movement of product.

We are also continuing to expand our fulfillment network, investing in a significant number of new fulfillment facilities

to drive speed and reliability of delivery for our customers and to help us ultimately meet our goal of reaching 90%

of the U.S. population with same or next day delivery for extended home improvement product offerings, including

big and bulky products. These facilities include omni-channel fulfillment centers, which deliver product directly to

customers, and market delivery operations, which function as local hubs to consolidate freight for dispatch to

customers for the final mile of delivery, with a focus on appliances. In fiscal 2022, we realized our goal to control

more of our appliance delivery end-to-end and began managing all of our appliance delivery volume through our

market delivery operations. We have also added flatbed distribution centers, which handle large items like lumber

and building materials that are transported on flatbed trucks. As of the end of fiscal 2022, we have opened a number

of additional fulfillment facilities, and we will continue to build out our fulfillment network to support our business. Our

network is designed to create a competitive advantage with unique, industry-leading capabilities for home

improvement needs for both Pros and consumers.

In addition to our distribution and fulfillment centers, we leverage our stores as a network of convenient customer

pickup, return, and delivery fulfillment locations. Our premium real estate footprint provides a distinct structural and

competitive advantage. For customers who shop online and wish to pick up or return merchandise at, or have

merchandise delivered from, our stores, we have implemented four interconnected retail programs: BOSS, BOPIS,

BODFS, and BORIS. We also provide curbside pickup to complement our BOPIS offerings, in addition to the self-

service lockers at the front entrance of many of our stores. We also offer express car and van delivery service that

covers over 80% of the U.S. population. For fiscal 2022, approximately 50% of our U.S. online orders were fulfilled

through a store. We also continue to focus on developing new capabilities to improve both efficiency and customer

experience in our store delivery program. Our strategic intent is to have a portfolio of efficient, timely and reliable

sources and methods of delivery to choose from, optimizing order fulfillment and delivery based on customer needs,

inventory locations and available transportation options.

Table of Contents

Fiscal 2022 Form 10-K

5

CORPORATE RESPONSIBILITY AND HUMAN CAPITAL MANAGEMENT

We view environmental, social and governance matters through the lens of our business, with an understanding that

if we support our associates, our customers, our supplier partners, and the communities we serve, we also support

our business and create long-term value for our shareholders. As a result, we believe that ESG is fundamentally

embedded in our operations and culture. We organize our efforts around three pillars: (1) Focus on Our People, (2)

Operate Sustainably, and (3) Strengthen Our Communities. Highlights of each of these pillars are set forth below.

For further information on our three pillars and other ESG-related matters, see our annual ESG Report, available on

our website at https://corporate.homedepot.com/responsibility.

Focus on Our People

Our culture and our associates provide intangible and hard-to-replicate competitive advantages, which have been

key to helping us navigate challenging market conditions. Our associates are essential to providing the experience

and service that our customers demand. To preserve and protect that customer experience, we focus on cultivating

a compelling associate experience, which we believe supports our ability to attract and retain our associates. This

includes investing in competitive wages and benefits while also providing the culture, tools, training and

development opportunities that make working at The Home Depot an enjoyable and rewarding experience. These

actions are the foundation of our key tenets of putting customers first and taking care of our associates.

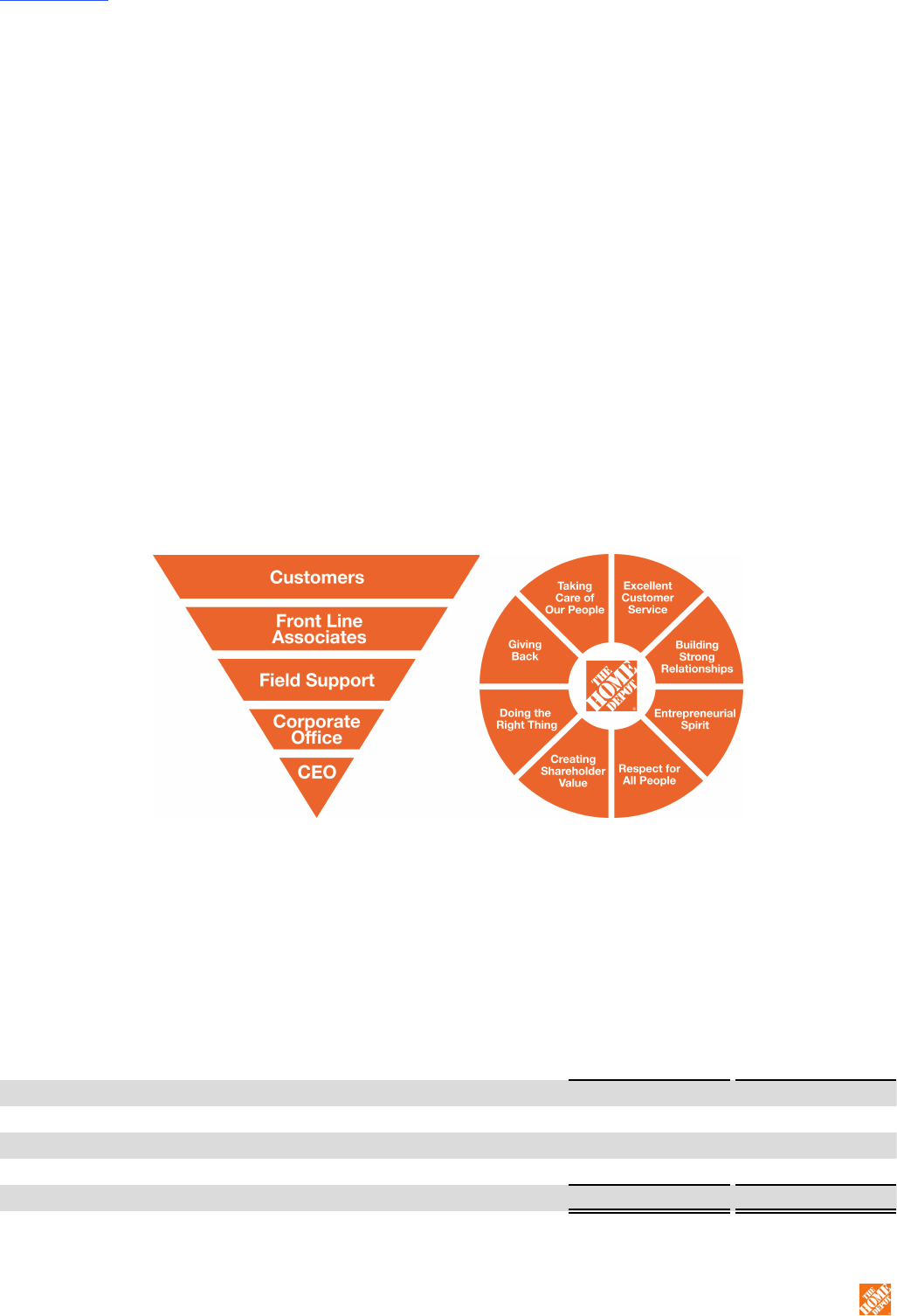

Culture and Values. The Home Depot has a strong commitment to ethics and integrity, and we are a values- and

culture-centric business. Our commitment to our core values drives our approach to human capital management.

Our culture is based on our servant leadership philosophy represented by the inverted pyramid, which puts primary

importance on our customers and our associates by positioning them at the top, with senior management at the

base in a support role. We bring our culture to life through our core values, which serve as the foundation of our

business and as the guiding principles behind the decisions we make every day.

Our values also guide our efforts to create an environment that will help us attract and retain skilled associates in

the competitive marketplace for talent. We empower our associates to deliver a superior customer experience by

living our values, and we position our associates to embody our core values by integrating the importance of our

culture into ongoing development programs, performance management practices, and rewards programs. Leaders

participate in programs designed to build and strengthen our culture, such as training on leadership skills, cross-

functional collaboration, inclusiveness, and associate engagement, and all associates receive annual training on

unconscious bias. Our core values are at the root of our human capital management programs.

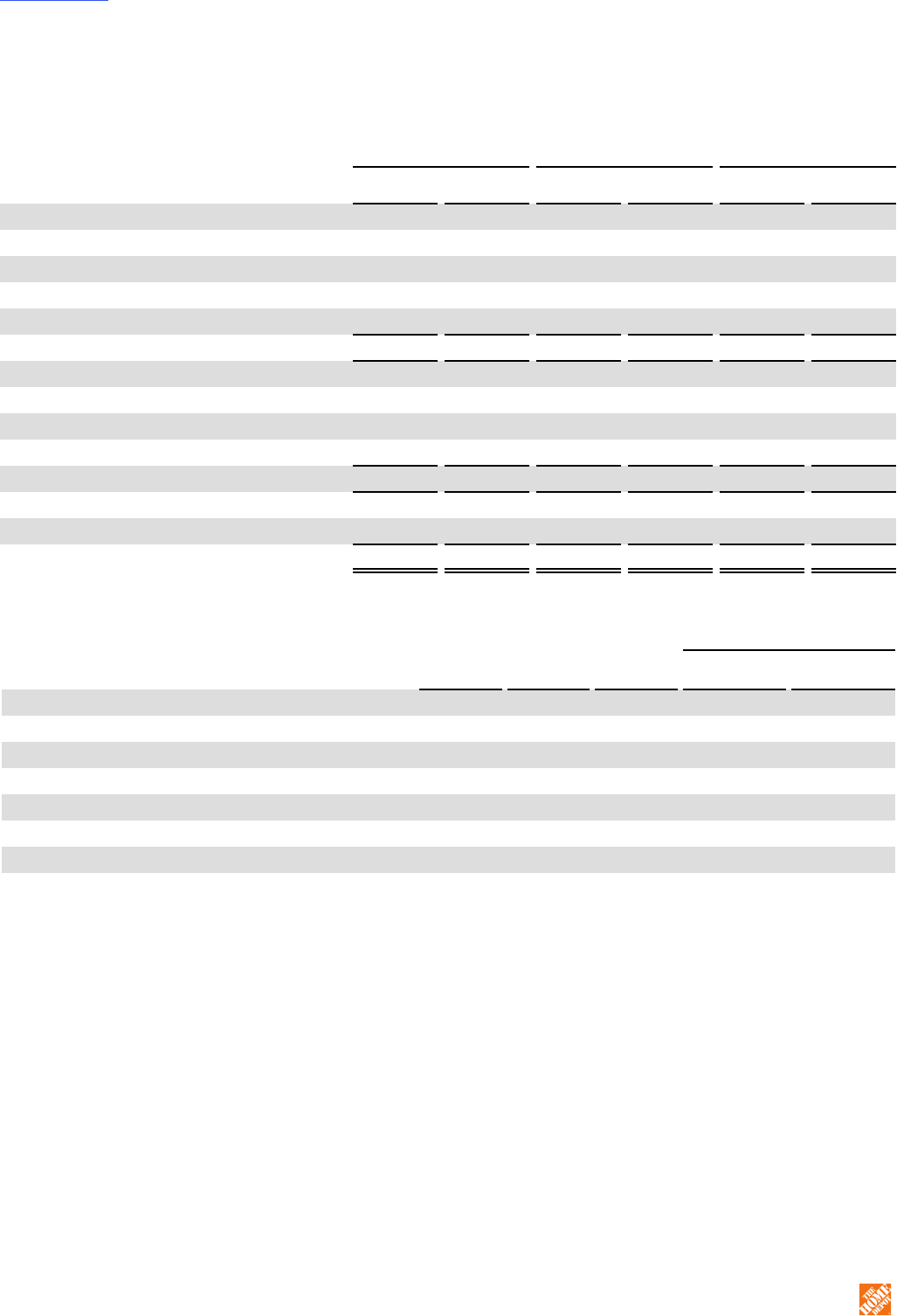

Our Workforce. At the end of fiscal 2022, we employed approximately 471,600 associates, of whom approximately

46,500 were salaried, with the remainder compensated on an hourly basis. Set forth below is the geographic

makeup of our workforce:

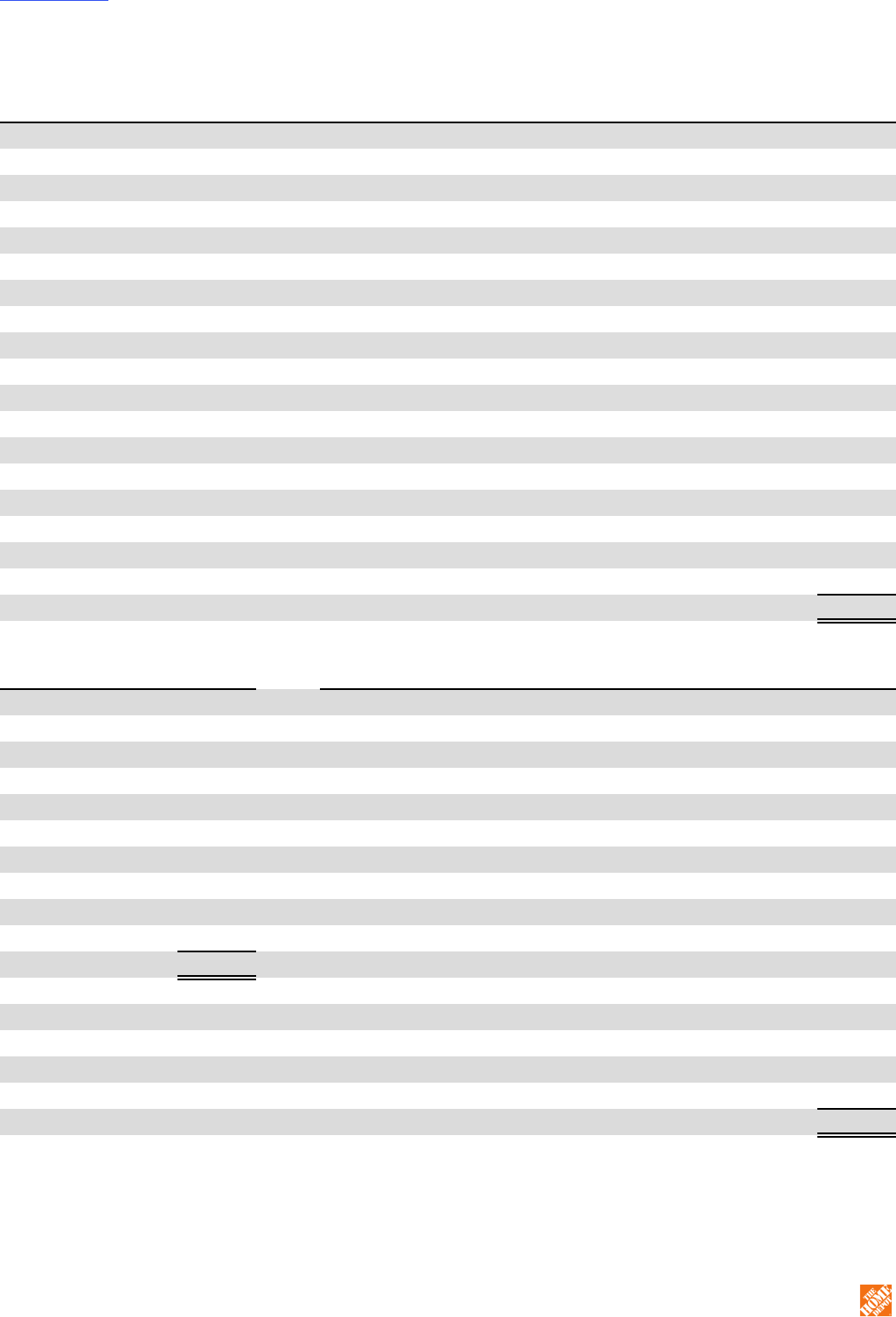

Geographic Location Number of Associates % of Total Workforce

United States 418,900 88.8%

Canada 34,500 7.3%

Mexico 17,900 3.8%

Other

(1)

300 0.1%

Total 471,600 100%

————

(1) Includes associates in our sourcing organization located in China, Vietnam, India, Italy, Poland and Turkey.

Table of Contents

Fiscal 2022 Form 10-K

6

Talent Attraction and Development. As we attract and hire new associates, we strive to create a customer-like

experience for jobseekers as they progress through the steps of our recruiting process by focusing on speed and

personalization. We employ targeted marketing practices through our careers website, which personalizes the

user’s experience based on jobseeker location and searching behavior. Jobseekers can also apply for roles from

anywhere using desktop or mobile devices. Once a jobseeker has applied for a role and has been selected to move

forward in the recruiting process, we provide self-service by allowing candidates to schedule or reschedule pre-hire

activities directly from their mobile device. Lastly, we created a quick hiring process for candidates by leveraging

job-matching automation that matches candidates to jobs that fit their needs.

We offer all of our associates the opportunity to benefit from robust development opportunities. Our Home Depot

University, or “HDU,” program, is a key part of this development, offering relevant content through multiple

platforms, including instructor-led classes, e-learning, mobile learning, and additional online resources. We invest in

ongoing growth and development by integrating our culture and values into our performance management

practices, providing coaching through continuous leader support, and empowering our associates to learn new skills

at their own pace through mobile applications our associates can access at any time. We equip our leaders with the

tools they need to develop themselves and their teams through several programs designed to help them lead

inclusively, empower their teams, and serve as mentors for our associates.

In fiscal 2022, we supported both associate development and engagement by starting the year with a new store

leadership structure. We created new management positions in our stores focused on the customer service

experience, increasing the number of managers on the floor at any given time. This new structure frees up time for

other store leaders to devote to associate training and development. The result is an improved customer and

associate experience, while also providing new career paths for associates.

Associate Engagement. Associate engagement is the emotional commitment associates have to The Home

Depot. It is vital to our culture and to our success. We create an engaging workplace by continuously listening to

and acting on associate feedback. We provide several pulse check surveys to associates throughout the year that

help us determine how emotionally connected those associates are to our customers, the Company, their jobs,

fellow associates, and leaders. In addition, our annual Voice of the Associate survey, which includes all associates,

serves as our primary means of gauging associates’ level of engagement within their roles. We use the feedback

from these surveys to help improve the overall associate experience. We also maintain a digital associate

engagement platform that links associates with common interests and fuels connections to co-workers and

Company leaders. Additionally, we have a number of programs to recognize stores and individual associates for

exceptional customer service and demonstrating our core values.

Diversity, Equity and Inclusion. Guided by our core values and grounded in our culture, we believe that having a

diverse, equitable and inclusive Company is key to our success. We are focused on building a workplace and retail

space that reflect the customers and communities we are proud to serve. We strive to maintain a Company where

our associates are valued and respected and feel a sense of belonging in the workplace, so that they can provide

the customer experience that supports our business. Our Office of Diversity, Equity and Inclusion supports our focus

on associate diversity, supplier diversity, and engagement with our communities. Below is the fiscal 2022 diversity

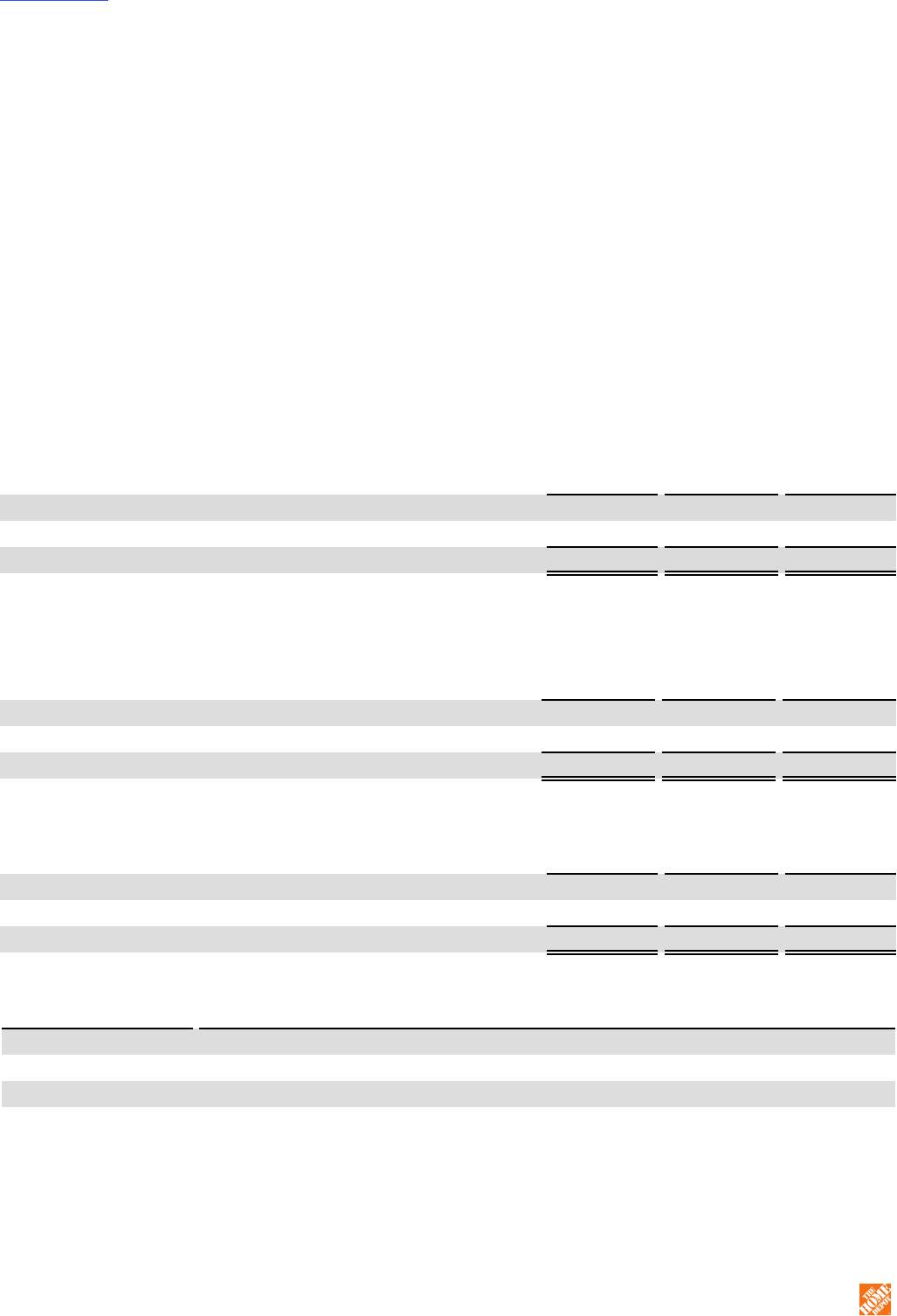

data for our U.S. associates:

Associate Population

Race/Ethnicity Gender

% Minority % White % Undisclosed % Female % Male % Undisclosed

U.S. Workforce 48% 50% 2% 38% 62% 1%

U.S. Managers & Above

(1)

39% 60% 1% 35% 65% 0%

U.S. Officers 26% 73% 2% 29% 69% 2%

————

(1) Does not include officers.

Note: Certain percentages may not sum to totals due to rounding.

As a Company, we have identified several priorities designed to guide our efforts to enhance diversity, equity and

inclusion. We believe these associate-, supplier- and community-focused priorities will further enhance our

customers’ experience and make a sustainable difference within the workplace, marketplace, and community:

• Associate Engagement

◦ Increase diverse representation throughout our organization

◦ Create an environment where every associate feels included and valued for who they are

◦ Promote equal opportunity in recruitment, hiring, training, development and advancement

Table of Contents

Fiscal 2022 Form 10-K

7

• Supplier Diversity

◦ Increase use of and spend with diverse suppliers

◦ Develop diverse suppliers by providing mentorship and sharing resources

• Community Engagement

◦ Partner with organizations on programs designed to close the wealth gap

◦ Support programs that advance education for all

Compensation and Benefits. Consistent with our core values, we take care of our people by offering competitive

compensation and comprehensive benefits programs. We continuously make wage investments to ensure our

compensation packages reflect the evolving circumstances across our markets, and our profit-sharing program for

hourly associates provides semi-annual cash awards for performance against our business plan. We transitioned

from the enhanced pay and benefits we provided for our associates in fiscal 2020 to alleviate some of the

challenges presented by the COVID-19 pandemic to permanent compensation enhancements for our frontline,

hourly associates, which we have continued to make since fiscal 2020. Our associates can take advantage of a

range of benefits, including healthcare and wellness programs, vacation and leave of absence benefits including

parental leave and paid sick/personal time off, a 401(k) match, our ESPPs, personal finance education and advisory

services, assistance programs to help with managing personal and work-life challenges, family support programs,

and educational assistance.

Operate Sustainably

We have a long-standing and substantial commitment to sustainable business operations, understanding that if we

make our operations more efficient and sustainable, we can support both our business and the environment. This

philosophy extends from the products and services we offer to our customers; to our store construction,

maintenance and operations; to our supply chain and packaging initiatives; to our ethical sourcing program. As we

strive to operate sustainably, we have focused on efforts that help protect the climate, reduce our environmental

impact, and source products responsibly, and we have set goals to drive progress in these areas.

Our 2022 ESG Report, available on our website at https://corporate.homedepot.com/responsibility, includes more

information on our goals, as well as specific initiatives we have in place to help achieve these goals. Below are

highlights of our sustainability strategy.

Our Environmental Goals. We currently have several goals to help address climate impact and reduce our

environmental footprint:

Year Announced Goal Goal Date Status

2018

Cleaning Products Chemical Reduction: Eliminate certain

added chemicals from residential household cleaning products

sold in-store or online by the end of fiscal 2022

2022 Complete

(1)

2018

Science-Based Carbon Emissions Targets: Reduce Scope 1

and 2 carbon emissions by 2.1% per year, with the goal to

achieve a 40% reduction by the end of fiscal 2030 and a 50%

reduction by the end of fiscal 2035

2030; 2035 In Process

2019

Recyclable Packaging: Exclude expanded polystyrene foam

(EPS) and polyvinyl chloride (PVC) film from the packaging of

private-brand products we sell, replacing them with easier-to-

recycle materials by the end of fiscal 2023

2023 In Process

2020 Renewable/Alternative Energy Sources: Produce or procure,

on an annual basis, 335 megawatts of renewable or alternative

energy by the end of fiscal 2025

2025 In Process

2021

100% Renewable Electricity: Produce or procure renewable

electricity equivalent to the needs for all Home Depot facilities

worldwide by the end of fiscal 2030

2030 In Process

————

(1) A de minimis number of suppliers are still in the process of reformulating and transitioning their product assortment.

These goals follow the completion of a number of previously announced goals, including goals related to reducing

store electricity use, eliminating certain chemicals from products we sell, and helping customers reduce their

greenhouse gas emissions and water use and save on electricity costs.

Table of Contents

Fiscal 2022 Form 10-K

8

Our Environmental Programs and Initiatives. In order to progress against our goals, we have a number of

environmentally-focused programs and initiatives, including:

• Store Operations and Renewable/Alternative Energy. We have reduced store energy consumption through

initiatives such as LED lighting upgrades; installation of energy-efficient HVAC systems; participation in

demand mitigation; on-site alternative or renewable energy projects such as fuel cells and solar panels; and

contracts with off-site wind and solar power providers. We have continued to work toward our goal to

produce or procure renewable electricity equivalent to the electricity needs for all Home Depot facilities by

the end of fiscal 2030. We have also continued our focus on saving water, implementing smart irrigation

systems capable of reducing irrigation-related water use in more than 500 U.S. stores.

• Product Offerings. Through our Eco Actions

TM

program, we have helped our customers more easily identify

products related to five areas: carbon emissions, circularity, responsible chemistry, sustainable forestry, and

water use. Under our Eco Actions program, we sell ENERGY STAR

®

certified appliances; WaterSense

®

-

labeled bath faucets, showerheads, aerators, toilets, and irrigation controllers; LED light bulbs; tankless

water heaters; and many other products. These products, through proper use, help our customers save

money on their utility bills and reduce their environmental impact. Through Eco Actions, we also provide

customers with resources, such as project tutorials, to take individual action on environmental issues.

• In-Store Recycling Programs. We offer customer-facing recycling programs in the U.S., including in-store

recycling programs for compact fluorescent light bulbs, rechargeable batteries, and lead acid batteries.

• Chemical Strategy. We are committed to increasing our assortment of products that meet high

environmental standards, and we encourage our suppliers to invest in developing environmentally-

innovative products. We periodically evaluate our Chemical Strategy to ensure our approach and goals are

appropriate.

• Sustainable Packaging. In addition to our goal related to eliminating EPS and PVC from our private-brand

products, we are continually working with our suppliers to find ways to make product packaging more

recyclable or simply use less materials, such as through the reduction of single-use plastics.

• Supply Chain Optimization. Through our supply chain initiatives such as space sharing and optimization

technology, we are working to maximize our use of every mile to make our supply chain more efficient. We

also utilize hydrogen fuel cell technology in a number of our forklifts to make our supply chain even more

environmentally responsible.

• CDP Participation. We are a long-standing participant in the annual CDP Climate Change reporting

process. CDP is an independent, international, not-for-profit organization providing a global system for

companies and cities to measure, disclose, manage, and share environmental information. In February

2023, we received a score of “B” from CDP. We have also announced that we plan to begin participating in

CDP’s Forests reporting process.

• Assessment of SBTi Goals. In fiscal 2021, we announced plans to adopt, by the end of fiscal 2023, new

Science Based Targets Initiative (SBTi) goals to reduce Scope 1, 2 and 3 emissions in line with Paris

Agreement goals. Adoption of SBTi goals would build on our current science-based goals to reduce Scope

1 and 2 carbon emissions by 2.1% per year, to achieve a 40% reduction by the end of fiscal 2030 and a

50% reduction by the end of fiscal 2035. In fiscal 2022, we continued to work on evaluating potential SBTi

goals.

Over the past several years, our commitment to sustainable operations has resulted in a number of environmental

awards and recognitions. In 2022, we received the following awards: an EPA WaterSense

®

Partner of the Year

Award for our commitment to offering and promoting water-efficient products; an EPA SmartWay High Performer

Award, which recognized us as an industry leader in improving freight efficiency and environmental performance; an

EPA Safer Choice Partner of the Year Award, which recognizes achievement in products with safer chemicals that

furthers innovative source reduction; and an EPA ENERGY STAR

®

Partner of the Year Award for our contribution to

promoting energy efficiency.

Strengthen our Communities

One of our core values is “Giving Back,” and we support our communities in a number of ways. The Home Depot

Foundation focuses on improving the homes and lives of U.S. veterans, assisting communities affected by natural

disasters, and training skilled tradespeople to fill the labor gap. The Company and The Home Depot Foundation are

partnering with industry leaders on training programs to train the next generation of skilled tradespeople and help

them find careers in the home improvement industry through our Path to Pro program, which includes a new career

networking site to connect skilled tradespeople to industry Pros. Our Team Depot associate volunteers also extend

Table of Contents

Fiscal 2022 Form 10-K

9

the mission of the Home Depot Foundation in communities across the country, donating thousands of volunteer

hours each year on a wide variety of projects.

We partner with diverse suppliers and organizations to further support our diversity, equity and inclusion efforts. As

noted above, our Office of Diversity, Equity and Inclusion partners with community organizations on programs

designed to close the wealth gap and enhance education outcomes across underserved and underrepresented

communities. To further advance diversity, equity and inclusion in our communities, we have a supplier diversity

program through which we provide supplier development and other resources to our diverse suppliers, and in fiscal

2021 we launched a Tier II supplier diversity program that aims to drive more spending from our direct suppliers to

diverse suppliers. In fiscal 2022, the Company joined the Billion Dollar Roundtable Inc., or BDR, a not-for-profit

organization that promotes supplier diversity excellence and best practices. The BDR consists of U.S.-based

corporations that spend $1.0 billion or more annually with minority- and woman-owned suppliers. We are working to

cultivate a supplier base that creates long-lasting growth and mutual business success, while reflecting the diversity

of our customers and strengthening the communities in which our customers and associates live.

Please see our 2022 ESG Report for additional information about our efforts to support the communities we serve.

GOVERNMENT REGULATION

As a company with both U.S. and international operations, we are subject to the laws of the U.S. and foreign

jurisdictions in which we operate and the rules and regulations of various governing bodies, which may differ among

jurisdictions. Compliance with these laws, rules and regulations has not had, and is not expected to have, a material

effect on our capital expenditures, results of operations, or competitive position as compared to prior periods.

AVAILABLE INFORMATION

Our internet website is www.homedepot.com. We make available on the Investor Relations section of our website,

free of charge, our Annual Reports to shareholders, Annual Reports on Form 10-K, Quarterly Reports on Form 10-

Q, Current Reports on Form 8-K, Proxy Statements, and Forms 3, 4 and 5, and amendments to those reports, as

soon as reasonably practicable after filing such documents with, or furnishing such documents to, the SEC.

We include website addresses throughout this report for reference only. The information contained on these

websites is not incorporated by reference into this report.

Item 1A. Risk Factors.

Our business, results of operations, and financial condition are subject to numerous risks and uncertainties. In

connection with any investment decision with respect to our securities, you should carefully consider the following

risk factors, as well as the other information contained in this report and our other filings with the SEC. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business

operations. Should any of these risks materialize, our business, results of operations, financial condition and future

prospects could be negatively impacted, which in turn could affect the trading value of our securities. You should

read these Risk Factors in conjunction with Part II, Item 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations and our consolidated financial statements and related notes in Item 8.

STRATEGIC RISKS

Strong competition could adversely affect prices and demand for our products and services and could

decrease our market share.

Our industry is highly competitive, highly fragmented, and evolving. As a result, we face competition for customers

for our products and services from a variety of retailers, suppliers, service providers, and distributors and

manufacturers that sell products directly to their respective customer bases. These competitors range from

traditional brick-and-mortar, to multichannel, to exclusively online, and they include a number of other home

improvement retailers; electrical, plumbing and building materials supply houses; and lumber yards. With respect to

some products and services, we also compete with specialty design stores, showrooms, discount stores, local,

regional and national hardware stores, paint stores, specialty and mass digital retailers, warehouse clubs,

independent building supply stores, MRO distributors, home décor retailers, and other retailers, as well as with

providers of home improvement services and tool and equipment rental. The internet facilitates competitive entry,

price transparency, and comparison shopping, increasing the level of competition we face.

We compete primarily based on customer experience, price, quality, product availability and assortment, and

delivery options, both in-store and online. We also compete based on store location and appearance, presentation

of merchandise, and ease of shopping experience. Our Pros also look for a dedicated sales team, competitive credit

Table of Contents

Fiscal 2022 Form 10-K

10

and pricing options, project planning tools, and product depth and job lot quantities, particularly for their planned

purchase needs. Furthermore, customers are increasingly shopping online and seeking faster and/or guaranteed

delivery times, low-price or free shipping, and/or convenient pickup options. Our ability to be competitive on delivery

and pickup times, options and costs depends on many factors, including leveraging the momentum of our strategic

investments in our supply chain and our interconnected retail capabilities to further enhance the customer shopping

experience. Failure to successfully manage these factors and offer competitive delivery and pickup options could

negatively impact our profit margins and the demand for our products.

We use our marketing, advertising and promotional programs to drive customer traffic and compete more effectively,

and we must regularly assess and adjust our efforts to address changes in the competitive landscape. Intense

competitive pressures from one or more of our competitors, such as through aggressive promotional pricing or

liquidation events, or our inability to adapt effectively and quickly to a changing competitive landscape, could

adversely affect our prices, our margins, or demand for our products and services. If we are unable to timely and

appropriately respond to these competitive pressures, including through the delivery of a superior interconnected

customer experience or through maintenance of effective sales and marketing, advertising or promotional programs

leveraging both our digital and physical platforms, our market share and our financial performance could be

adversely affected. In addition, we are operating in a highly inflationary environment. If inflation increases beyond

our ability to control our related costs, we may not be able to adjust prices to sufficiently offset the effect of the

various cost increases without negatively impacting consumer demand, or it may adversely affect our ability to

compete based on price.

We may not timely identify or effectively respond to consumer needs, expectations or trends, which could

adversely affect our relationship with our customers, the demand for our products and services, and our

market share.

The success of our business depends in part on our ability to identify and respond promptly to evolving trends in

demographics; shifts in consumer preferences, expectations and needs; and unexpected weather conditions, public

health issues (including pandemics and related impacts), natural disasters, or changes in the macroeconomic

environment that impact our customers, while also managing appropriate inventory levels in our stores and

distribution or fulfillment centers and maintaining an excellent customer experience. It is difficult to successfully

predict the products and services our customers will demand. As our customers expect a more personalized

experience, our ability to collect, use and protect relevant customer data is important to our ability to effectively meet

their expectations. Our ability to collect and use that data, however, is subject to a number of external factors,

including the impact of legislation or regulations governing data privacy and security and customer expectations

around data collection and use. In addition, each of our primary customer groups has different needs and

expectations, many of which evolve as the demographics in a particular customer group change. Customer

preferences and expectations related to sustainability of products and operations are also changing. If we do not

successfully differentiate the shopping experience to meet the individual needs and expectations of or within a

customer group, we may lose market share with respect to those customers.

Customer expectations about the methods by which they purchase and receive products or services are also

becoming more demanding. Customers routinely and increasingly use technology and a variety of electronic

devices and digital platforms to rapidly compare products and prices, read product reviews, determine real-time

product availability, and purchase products, and new channels and tools to expand the customer experience appear

and change rapidly. Our Pros also look for additional capabilities, including a dedicated sales team, competitive

credit and pricing options, project planning tools, and product depth and job lot quantities, particularly for their

planned purchase needs. Once products are purchased, customers seek alternate options for delivery of those

products, including advance ordering through digital platforms for Pros, and they often expect quick, timely, and low-

price or free delivery and/or convenient pickup options. We must continually anticipate and adapt to these changes

in the shopping and purchasing process by continuing to adjust and enhance the online and in-store customer

experience as well as our delivery options. The coordinated operation of our network of physical stores, distribution

facilities, and online platforms is fundamental to the success of our interconnected strategy. We cannot guarantee

that our current or future fulfillment options will be maintained and implemented successfully or that we will be able

to meet customer expectations on delivery or pickup times, options and costs. In addition, as our customers

continue to leverage our enhanced interconnected shopping and fulfillment options, a greater concentration of

online sales with direct fulfillment could result in a reduction in the amount of traffic in our stores, which would, in

turn, reduce the opportunities for cross-selling of merchandise that such traffic creates and could reduce our overall

sales and adversely affect our financial performance. A greater concentration of online sales with direct fulfillment

could also result in higher costs for delivery, potentially impacting our profit margins.

Table of Contents

Fiscal 2022 Form 10-K

11

Failure to provide a relevant or effective online customer experience in a timely manner that keeps pace with

technological developments and dynamic customer expectations; to maintain appropriate inventory; to provide quick

and low-price or free delivery alternatives and convenient pickup options; to differentiate the customer experience

for our primary customer groups; to effectively implement an increasingly localized merchandising assortment; or to

otherwise timely identify or respond to changing consumer preferences, expectations and home improvement needs

could adversely affect our relationship with our customers, the demand for our products and services, and our

market share.

A positive brand and reputation are critical to our business success, and, if our brand and reputation are

damaged, it could negatively impact our relationships with our customers, current and potential associates,

suppliers, vendors, and shareholders, and, consequently, our business and results of operations or the

price of our stock.

Our brand and reputation are critical to attracting customers, current and potential associates, suppliers and

vendors to do business with us. We must continue to manage and protect our brand and reputation. Negative

incidents can erode trust and confidence quickly, and adverse publicity about us could damage our brand and

reputation; undermine our customers’ confidence in us; reduce demand for our products and services; affect our

ability to recruit, engage, motivate and retain associates; attract regulatory scrutiny; and impact our relationships

with current and potential suppliers and vendors. Further, our actual or perceived position or lack of position on

social, environmental, governance, political, public policy, economic, geopolitical, or other sensitive issues, and any

perceived lack of transparency about those matters, could harm our reputation with certain groups. Customers are

also increasingly using social media to provide feedback and information about our Company, including our

products and services, in a manner that can be quickly and broadly disseminated. Negative sentiment about the

Company shared over social media, or misinformation from fraudulent accounts impersonating the Company, could

impact our brand and reputation, whether or not it is based in fact.

The execution of initiatives to expand our supply chain and enhance the interconnected shopping

experience could disrupt our operations in the near term, and these initiatives might not provide the

anticipated benefits or might fail.

We continue to invest in our interconnected retail strategy, including by making significant investments to expand

our supply chain. These investments are designed to streamline our operations to allow our associates to continue

to provide high-quality service to our customers; simplify customer interactions; provide our customers with a more

interconnected shopping experience; better address Pro planned purchase needs; and create the fastest, most

efficient delivery network for home improvement products. Failure to choose the right investments and implement

them in the right manner and at the right pace could disrupt our operations. Executing our interconnected retail

strategy requires continual investment in our operations and information technology systems, as well as the

development and execution of new processes, systems and support. Building out our supply chain also involves

significant real estate projects as we expand our distribution network, requiring us to identify and secure available

locations with appropriate characteristics needed to support the different types of facilities. If we are unable to

effectively manage the volume, timing, nature, location, and cost of these investments, projects and changes, our

business operations and financial results could be materially and adversely affected. The cost and potential

problems, defects of design, and interruptions associated with the implementation of these initiatives, including

those associated with managing third-party service providers, employing new online tools and services,

implementing new technologies, implementing and restructuring support systems and processes, securing

appropriate facility locations, and addressing impacts on inventory levels, could disrupt or reduce the efficiency of

our operations in the near term, lead to product availability issues, and impact our profitability.

In addition, our stores are a key element of our interconnected retail strategy, serving as the hub of our customers’

interconnected shopping experience. We have an aging store base that requires maintenance, investment, and

space reallocation initiatives to deliver the shopping experience that our customers desire. We also need to identify

and secure available locations with appropriate characteristics for new stores to ensure we can continue to serve

our customers effectively. Our investments in our stores may not deliver the relevant shopping experience our

customers expect or fully support an interconnected shopping experience. We must also maintain a safe store

environment for our customers and associates, as well as protect against loss or theft of our inventory (also called

“shrink”), including as a result of organized retail crime. High rates of shrink, which we continue to experience, or an

unsafe store environment, requires operational changes that may increase costs and adversely impact the customer

and associate experience.

Our investments to enhance our interconnected shopping experience and expand our supply chain might not

provide the anticipated benefits, might take longer than expected to complete or realize anticipated benefits, or

Table of Contents

Fiscal 2022 Form 10-K

12

might fail altogether, each of which could adversely impact our competitive position and our financial condition,

results of operations, or cash flows.

If we are unable to effectively manage and expand our alliances and relationships with certain suppliers of

both brand name and proprietary products, we may be unable to effectively execute our strategy to

differentiate ourselves from our competitors.

As part of our focus on product differentiation, we have formed strategic alliances and exclusive relationships with

certain suppliers to market products under a variety of well-recognized brand names. We have also developed

relationships with certain suppliers to allow us to market proprietary products that are comparable to national

brands. Our proprietary products differentiate us from other retailers and generally carry higher margins than

national brand products. If we are unable to manage and expand these alliances and relationships, maintain

favorable terms with current suppliers, or identify alternative sources for comparable brand name and proprietary

products, we may not be able to effectively execute product differentiation, which may impact our sales and gross

margin results.

Our strategic transactions involve risks, which could have an adverse impact on our business, financial

condition and results of operations, and we may not realize the anticipated benefits of these transactions.

We regularly consider and enter into strategic transactions, including mergers, acquisitions, investments, alliances,

and other growth and market expansion strategies. We generally expect that these transactions will result in sales

increases, cost savings, synergies, enhanced capabilities or various other benefits. Assessing the viability and

realizing the benefits of these transactions is subject to significant uncertainty. For each of our acquisitions, we need

to determine the appropriate level of integration of the target company’s products, services, associates, and

information technology, financial, human resources, compliance, and other systems and processes, and then

successfully manage that integration into our corporate structure. Integration can be a complex and time-consuming

process, and if the integration is not fully successful or is delayed for a material period of time, we may not achieve

the anticipated synergies or benefits of the acquisition. In addition, the integration of businesses may create