GUIDE TO

CAREERS IN

FINANCIAL

PLANNING

ADDITIONAL SUPPORT HAS BEEN PROVIDED BY

SUPPORTING SPONSORS

CENTER FOR FINANCIAL PLANNING FOUNDING SPONSORS

SIGNATURE SPONSOR

2

THE CFP BOARD CENTER FOR FINANCIAL PLANNING WOULD LIKE TO THANK THE

FOLLOWING COMPANIES FOR THEIR GENEROUS CONTRIBUTIONS TO THIS GUIDE:

SPONSORS

WELCOME

CHAPTER 1: INTRODUCTION

How to Use This Guide

What Do Financial Planners Do?

What is the Financial Planning Process?

What Makes Financial Planning an Attractive Career?

A Rapidly Growing Field

CHAPTER 2: CAREERS IN FINANCIAL PLANNING

Financial Planning Practice Career Track

The Financial Planning Practice

Typical Structure of a Financial Planning Department or Division Within a Financial Services Company

Starting a Financial Planning Career in Operations

Starting a Financial Planning Career in a Virtual Advice Center

Starting a Financial Planning Career in a Branch Oce

Specialist Positions

Exploring Other Financial Services Careers

CHAPTER 3: COMPANIES THAT HIRE FINANCIAL PLANNERS

Company Characteristics

Financial Planning Services Within Large and Small Companies

Licensing to Start Your Career

Centralized and Decentralized Companies

Financial Planner Compensation Methods

Financial Services Industry Channels

2

5

6

14

30

3

TABLE OF CONTENTS

4

55

54

42 CHAPTER 4: WHAT’S THE RIGHT FINANCIAL

PLANNING CAREER PATH FOR ME?

Financial Planning as Your First Career

Financial Planning as a Career Change

Obtaining Your CFP® Certification

Exploring Financial Planning Careers

Where to Find Financial Planning Jobs

What Can I Expect in the Early Years?

Where You Start Isn’t Where You Have to Stay

KEY TAKEAWAYS

APPENDIX

Questions to Ask in a Job Interview

Participating Companies and Professionals

Members of the CFP Board Center for Financial Planning’s Workforce Development Advisory Group

About the Research

About the Researchers

About the Contributor

About CFP Board

About the CFP Board Center for Financial Planning

Choosing a profession—whether you are

just graduating from school or are making a

career change—can be equal parts exciting

and overwhelming. There are countless

opportunities to consider, each with their

own unique advantages, challenges and

pathways to success.

You are likely reading this guide because

you are considering a career in the financial

planning profession but want to know

more about what it means to be a financial

planner and the dierent types of jobs

available to you.

You have come to the right place.

The Guide to Careers in Financial Planning

provides you with guidance on beginning

and sustaining a successful financial

planning career. Based on interviews with

77 professionals across 42 companies,

the guide examines dierent types of

financial planning positions, typical career

tracks and employers that oer jobs in

financial planning—ranging from individual

practices to large financial services firms.

It also includes information on how to get

started, whether you’re a student or a career

changer; where to find jobs; and what to ask

employers in order to find a career that best

fits your strengths and interests.

The CFP Board Center for Financial Planning

published this guide as part of our ongoing

eorts to cultivate a quality workforce and

ensure the financial planning profession can

recruit and retain the talented professionals

on whom the American public relies to

guide their financial future. Families and

households across our country need more

people like you—young, eager to learn and

driven to succeed—to join the financial

planning profession and provide the

competent, ethical financial planning advice

that more Americans increasingly demand.

We hope this guide inspires you to choose

a financial planning career and that you will

use it as a resource to map your professional

path and support your advancement within

our profession.

We would like to thank the guide’s Signature

Sponsor BNY Mellon Pershing and The

Ensemble Practice for their generous

support of the guide’s development. We are

also grateful to Supporting Sponsors Merrill

Lynch and Facet Wealth, as well as the

Center’s Founding Sponsors Northwestern

Mutual, Envestnet and Charles Schwab

Foundation, in partnership with Schwab

Advisor Services.

We stand ready to assist you in joining this

rewarding profession and wish you success

in your professional journey.

Sincerely,

WELCOME

KEVIN R. KELLER, CAE

Chief Executive Ocer

CFP Board

KEVIN R. KELLER, CAE

Chief Executive Ocer

CFP Board

D.A. ABRAMS, CAE

Managing Director

CFP Board Center

for Financial Planning

D.A. ABRAMS, CAE

Managing Director

CFP Board Center for

Financial Planning

5

This guide will help you:

INTRODUCTION

CHAPTER ONE

Students in high school or

college who are deciding on

their professional career

Career changers or recent

graduates considering a

career in financial planning

Financial services

professionals interested in

becoming financial planners

Learn more about the financial

planning process and what financial

planners do

Understand the broad range of

career opportunities in the financial

planning profession

Find financial planning careers that

match your strengths and interests

6

How to Use This Guide

Financial planning is a fulfilling career, and demand for

financial planners is quickly outpacing supply. Now is

the perfect time to begin your journey into the financial

planning profession.

The Guide to Careers in Financial Planning is designed

to introduce you to the wide range of career

opportunities in the financial planning profession.

It introduces typical entry points and career tracks,

companies that hire financial planners, and provides

guidance on finding the right opportunity. The guide is

a useful resource for developing an action plan that will

help you begin a successful financial planning career.

This guide is intended for:

We encourage you to read the entire

guide to fully understand the opportunities

available in the financial planning profession,

but you can use the recommendations

below to find the most relevant sections

for you to review.

7

IF YOU ARE A... READ...

What Do Financial Planners Do? pages 8-9

What is the Financial Planning Process? page 10

Financial Planning Practice Career Track pages 15-18

Financial Planning as Your First Career pages 43-44

Financial Planning Degree Option page 47

Student in High School or College

Deciding on your career after school

Financial Planning Practice Career Track pages 15-18

Starting a Financial Planning Career (Operations,

Virtual Advice Center, Branch Oce) pages 24-26

Companies That Hire Financial Planners pages 30-40

Financial Planning as a Career Change page 44

Certificate Option page 47

Recent Graduate or Career Changer

Seeking your first career, a transition into

a more satisfying career or reentering the

workforce

Financial Planning Practice Career Track pages 15-18

Specialist Positions page 27

Companies That Hire Financial Planners pages 30-40

Certificate Option page 47

Financial Services Professional

Employed by a financial services firm or

other financial institution and interested

in becoming a financial planner

At a Glance

What Do Financial

Planners Do?

Financial planning is a collaborative process

that helps maximize a client’s potential for

meeting life goals through financial advice

that integrates relevant elements of the

client’s personal and financial circumstances.

Financial planners work with individuals

and families to make sound financial and

investment decisions to help maximize their

chances of achieving critical life goals based

on their priorities and fundamental values.

They may advise and assist clients on a

broad spectrum of tasks, such as saving for

retirement, investing money to purchase

a home or start a business, paying for the

education of children or other loved ones,

and preserving family wealth so it can be

passed to future generations. Financial

planners also may help businesses design

and manage retirement plans and other

financial welfare programs for the benefit of

their employees.

Financial planners are trained to use a

structured financial planning process to

guide clients toward prudent financial

decisions. Employing knowledge of personal

finance, budgeting, taxes, financial products,

investments and investment markets, and

with the ability to use robust analytical tools

and data with the power to illustrate various

outcomes, financial planners are able to make

recommendations to help their clients reach

informed conclusions about the right path to

take toward their desired financial futures.

Many financial planners work with clients

within the structure of a long-term, ongoing

relationship. Knowledge of the client’s

situation, needs, goals and values allows

the financial planner to not only respond to

present circumstances and the immediate

decisions that need to be made, but also

to anticipate future needs and situations.

Much like doctors who are able to treat the

whole patient, financial planners are valuable

because they can oer or provide their

clients with comprehensive financial advice.

8

The CERTIFIED FINANCIAL PLANNER™

certification is the standard of excellence

in the financial planning profession. While

the CFP® certification mark is not required

for professionals to call themselves financial

planners, the more than 90,000 CFP®

professionals in the U.S. have proven their ability

to provide competent and ethical financial

planning service to their clients because of the

high standard of competence required to pass

the CFP® exam, their demonstrated education

and experience, and the commitment they

make to CFP Board, as part of their certification,

to meet high ethical standards, including the

fiduciary duty to act in clients’ best interests

whenever providing financial advice.

It is common for financial planners to work

as a team. Within a single organization, a

client relationship may be assigned to a

cadre of financial planning professionals, with

one financial planner focusing on analysis

and another financial planner focusing on

communicating and collaborating with the

client. Financial planners also may collaborate

with allied professionals who are members

of a client’s team outside of the organization

such as tax experts, attorneys and risk

management specialists, in order to develop

comprehensive strategies to help the client

maximize their potential for meeting their

financial goals.

Many dierent types of organizations

employ financial planners, from financial

services firms such as banks and broker-

dealers to accounting firms, insurance firms,

independent financial planning firms and

investment firms. While these organizations

are dierent in many ways, they all can use

the financial planning process in their work

and make a commitment to helping clients

make sound financial decisions.

Financial planners work under many dierent

titles, including Financial Advisor, Investment

Advisor, Wealth Manager, Financial Consultant

and, of course, Financial Planner. Such terms

vary based on the preference of the company

oering the service.

9

What is the Financial

Planning Process?

A financial planner uses the financial

planning process to guide clients through

complicated financial decisions, such as

how much to save for retirement and

how to invest those savings with the goal

of reaching their desired retirement age

and level of income.

Certified Financial Planner Board of

Standards, Inc. (CFP Board), which sets

and enforces standards for financial

planners who hold the CFP® certification,

has established a 7-step financial

planning process that may be used to

consider all aspects of a client’s personal

and financial situation when formulating

financial planning strategies and making

recommendations.

At its foundation, financial planning is

about supporting individuals and families,

especially to plan for crucial moments

in their lives. It is a process of close

collaboration between a client and a

financial planning professional who the

client has selected and entrusted with their

most private financial details, ambitions

and anxieties.

UNDERSTAND the client’s personal and financial

circumstances. The financial planner must obtain the

information needed to fulfill the engagement, and

then analyze the information to assess the client’s

circumstances.

IDENTIFY and select goals. The financial planner

must help the client identify goals, and then select and

prioritize goals.

ANALYZE the client’s current course of action and

potential alternative courses of action. The financial

planner analyzes the client’s current course of action,

and where appropriate, considers and analyzes one or

more alternative courses of action, whether each action

maximizes the potential for meeting the client’s goals,

and how each goal integrates the client’s personal and

financial circumstances.

DEVELOP financial planning recommendations.

The financial planner selects one or more

recommendations designed to maximize the

client’s potential for meeting the client’s goals.

PRESENT financial planning recommendations

to the client. The financial planner presents the

recommendations to the client, including the

information that the financial planner considered

when developing the recommendation.

IMPLEMENT financial planning recommendations.

The financial planner establishes with the client

whether the financial planner has implementation

responsibilities. A financial planner with implementation

responsibilities must identify and analyze actions,

products and services designed to implement the

recommendations, recommend one or more actions,

products, and services to the client, and help the client

select and implement the actions, products and services.

MONITOR the client’s progress, review the

client’s situation and update the financial planning

recommendations. The financial planner establishes

with the client whether the financial planner has

monitoring and updating responsibilities, and if so,

what are those responsibilities. A financial planner with

monitoring responsibilities must analyze, at appropriate

intervals, the progress toward achieving the client’s

goals, and obtain from the client current information

concerning the client’s circumstances. When the

financial planner has updating responsibilities, and

circumstances warrant changes, the financial planner

must update as appropriate.

CLEARLY, FINANCIAL

PLANNING IS MUCH MORE

THAN SPREADSHEETS,

BUDGETS, SALES AND

STOCK TICKERS.

10

7-STEP FINANCIAL

PLANNING PROCESS

Visit CFP.net to learn more

about the benefits of financial

planning careers and hear

CFP® professionals talk about

why they love their job.

11

1. 2020 InvestmentNews Adviser Compensation & Stang Study

FINANCIAL REWARDS

PERSONAL FULFILLMENT

MENTAL STIMULATION

FLEXIBILITY

WORK

BALANCE

LIFE

What Makes Financial

Planning an Attractive

Career?

A financial planning career can provide:

• Personal fulfillment of helping others:

You can enjoy the personal satisfaction of

making a dierence in your clients’ lives

as you guide them through building

wealth, managing financial challenges and

securing their families’ financial futures.

• Financial rewards: Experienced financial

planners, also known as Lead Advisors,

who have 5 to 10 years of experience

make $126,945 to $213,126 per year,

according to compensation data from

InvestmentNews.

1

• Mental stimulation: Good financial

planners must be proficient in a wide

range of financial areas, from retirement

planning and estate planning to insurance,

taxation and investments. It also helps to

have a solid understanding of client

psychology.

• Work-life balance: Talk to successful

financial planners and you will learn that

what they value the most in their work is

the freedom and flexibility to balance their

personal and professional lives. The

variety of career options enables you to

build the work-life balance you want.

• Career flexibility: Financial planning is not

a one-size-fits-all career. As you will read

in this guide, there is a wide variety of

career paths—from striking out on your

own to working at firms big and small.

A Rapidly Growing Field

A perfect storm of demographic trends and

industry developments has made this a great

time for newcomers to enter the financial

planning profession. The combination of the

aging baby boomer generation, increasing

life spans and the shift away from pensions

toward individual retirement plans means

more Americans are looking for competent,

ethical financial planning advice. What’s

more, part of this aging wave includes

advisors themselves, many of whom—about

37%—are expected to retire over the next

decade.

2

As a result, there is an abundance of

career opportunities for the next generation

of financial planners.

Additionally, the changing demographics of

wealth in the U.S. mean that more women

and people of color are accumulating wealth

and need financial planning advice. As a

result, the financial planning profession needs

more financial planners from populations

that are currently underrepresented in the

profession. For example, only about 4% of

CFP® professionals in the U.S. are Black or

Latino, even though these communities

comprise more than 31% of the U.S.

population,

3

and women comprise only

23% of CFP® professionals.

Recognizing this opportunity, financial

services companies are prioritizing their

diversity, equity and inclusion initiatives in

order to recruit a more diverse financial

planner workforce that can meet the financial

planning needs of increasingly diverse

consumers. This means that there are ample

opportunities for individuals from diverse

backgrounds to become financial planners.

The CFP Board Center for Financial Planning

is focused on creating a more diverse and

sustainable financial planning profession

through innovative solutions and initiatives.

Collectively, these eorts are making an

impact: In 2020, the number of Black and

Latino CFP® professionals rose by more than

12% over 2019, nearly 5 times the growth rate

of all CFP® professionals for the year, while

the number of women CFP® professionals

also increased to an all-time high of 20,633.

4%

23%

CFP® PROFESSIONALS IN THE U.S.

WHO ARE BLACK OR LATINO

THE NEED FOR A DIVERSE

FINANCIAL PLANNER WORKFORCE

CFP® PROFESSIONALS IN THE U.S.

WHO ARE WOMEN

12

2. 37% Of Financial Advisors Expected To Retire Over Next Decade, Financial Advisor, November 2019

3. U.S. Census Bureau, Quick Facts https://www.census.gov/quickfacts/fact/table/US/PST045219

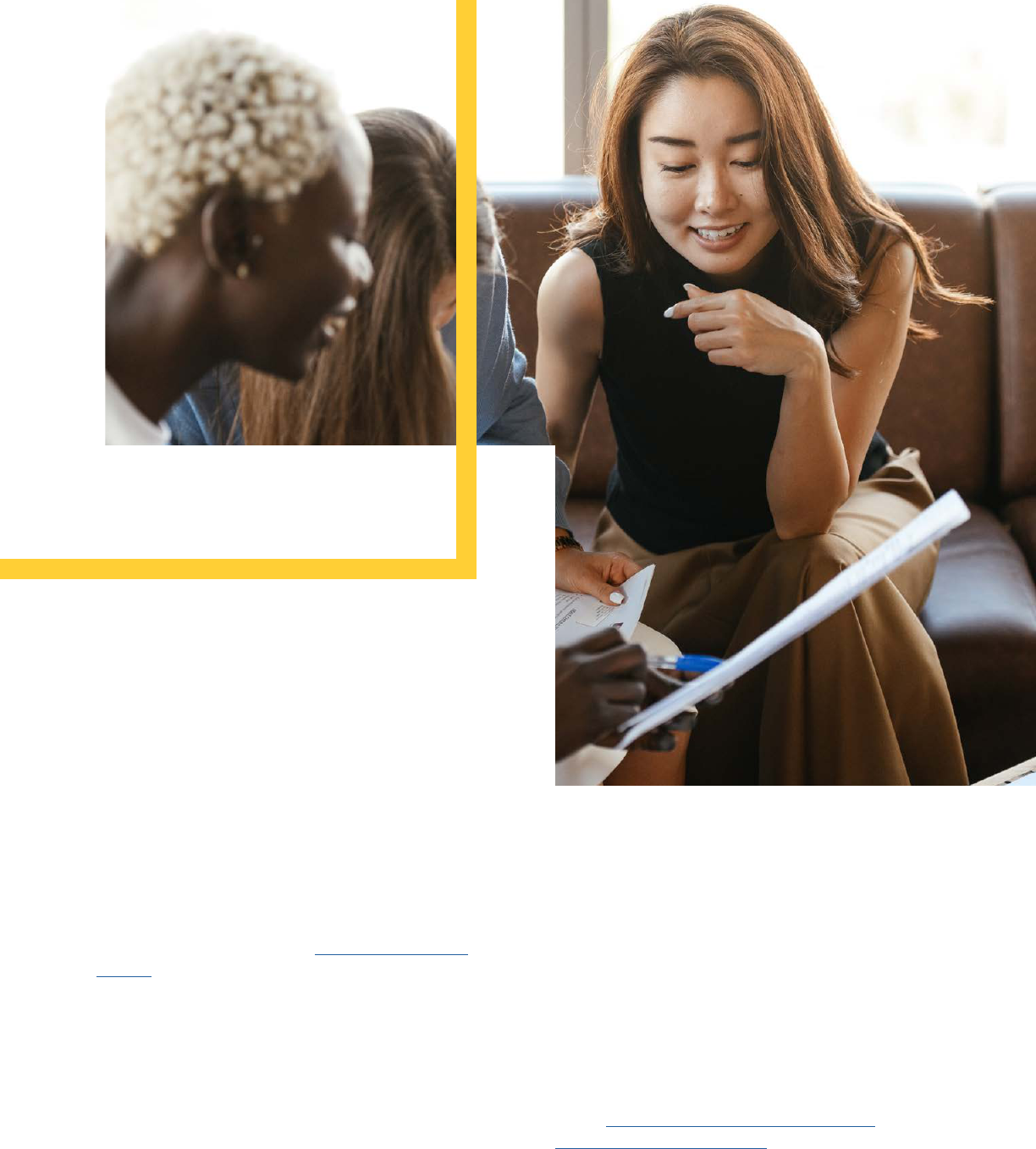

Q. Why did you choose to work in this

particular financial planning business model?

I chose to work for a large investment firm

because of the brand name recognition,

which can be extremely helpful with acquiring

new clients. A large firm can also invest an

enormous amount of money in resources

to assist my clients. The resources provided

by the firm allow me to focus 100% of my

attention on my clients’ future, and not

concern myself with the day-to-day tasks of

operating a business. This model works for

me because it takes some of the stress away

of being an entrepreneur, but you still get the

freedom to build your own business within a

larger business.

Q. What is a typical day like for you at your firm?

Every day is dierent. Some days I spend

most of my time responding to client emails

or phone calls. Another day I could be

prepping for a review for an existing client,

or I might be out to lunch with an existing or

prospective client. You have the flexibility to

structure your day in a way that works for

you. The best part of my job is the financial

LEMAR

WILLIAMS, CFP®,

CPWA®, CTFA, CLU®

planning I get to do for my clients. I really do

get excited when I walk through a financial

plan with a client. It’s a good feeling to tell

a client we are ahead of schedule, so that

they can retire early, or that they can pay for

their child’s college tuition without negatively

impacting their own future.

Q: What do you think is the biggest

misconception about financial planning

careers?

The industry is changing, and I don’t know

anyone anymore that considers themselves

a “stock broker.” Yes, financial planners

do help their clients get invested, but the

investment portfolio is structured in a way to

control the level of risk in order to achieve a

desired objective outlined in a well-structured

financial plan. I think the other misconception

about financial planners is that we are only

investment professionals. Most financial

planners can provide guidance on insurance

planning, estate planning, retirement

income planning, Social Security, retirement

benefits, healthcare, education planning, tax

minimization strategies, as well as investment

strategies. I personally believe everyone

should have a professional with that type of

knowledge in their corner.

Wealth Management Advisor

Merrill Lynch Wealth Management

Heathrow, Florida

13

YOU HAVE THE

FLEXIBILITY

TO STRUCTURE

YOUR DAY IN

A WAY THAT

WORKS FOR YOU.

CAREERS IN

FINANCIAL

PLANNING

CHAPTER TWO

The careers of financial planners

and how they evolve in dierent

types of companies

The milestones and steps in the

career of a financial planner

Starting a financial planning

career in dierent functions within

financial services companies

Specialized careers available within

the financial planning profession

14

If you are interested in financial planning as a

career, we encourage you to consider a company

that provides financial planning and pursue a

financial planning career track. However, there are

also other types of companies and career tracks

that enable you to become a financial planner.

You will find that the financial planning profession

oers fulfilling careers and a plethora of positions

across many dierent business models and

company sizes. Much like a large art gallery, there

are many doors to enter through and many halls

to explore. This chapter will walk you through

some of the most common career tracks and

how you can get started in each one.

Financial planners help their clients make critical

financial decisions; therefore, careers in planning

are ultimately defined by the specific role that

a professional (you) plays in this process. Many

financial planners work directly with clients either

in an in-person or virtual relationship and guide

them through the creating and execution of a

financial plan. Other financial planners contribute

to the process by completing the analysis

necessary to create a plan. Yet others may be

helping with the operational aspects of executing

the plan. There are planners who also specialize in

developing new client relationships and attracting

clients to the company. All these functions are

part of the financial planning profession and

represent a progression of responsibilities that we

call a “career track.”

In this chapter, you will learn about:

Financial Planning

Practice Career Track

While companies formulate a distinct

financial planning career path to fit their

unique strategy and culture, research shows

that there are defined career stages that

most companies share. You can learn about

these career stages and their associated job

descriptions in more detail in the Center’s

Financial Planning Career Paths guide. The

stages of a traditional financial planning

career path vary based on responsibilities

and expertise and are summarized in the

following table.

This is the type of career likely to be

implemented in team-based, financial-

planning-focused companies. We will touch

on some of the variations in the career track

later in this chapter.

15

16

TYPICAL FINANCIAL PLANNING PRACTICE CAREER TRACK

Titles

Client

Responsibilities

Degrees and

Designations

Typical

Range of

Compensation

as of 2020

4

Team

Responsibilities

Typical

Experience

• Analyst

• Support Advisor

• Senior Analyst

• Gather and

maintain client

data

• Enter client

information into

various systems

• Assist the

operations

and investment

teams with client

onboarding

• Answer routine

client questions

and service

requests

Learn firm process,

master the job,

and be responsive

and supportive

to advisors and

clients

0 to 3 years

Bachelor’s

degree

$60,000 to

$70,500

$70,500 to

$79,613

$80,000 to

$122,500

$126,945 to

$213,126

$170,000 to

$346,500

Train Analysts on

the process, tools

and methodology

used by the team

2 to 5 years

(median of 5

years)

Bachelor’s

degree

Assign projects

to Support

and Associate

Advisors and

supervise quality

and timeliness

3 to 7 years

(median of 9

years)

• Bachelor’s

degree

• CFP®

certification

Lead a team

and manage the

responsibilities

and performance

within the team

5 to 10 years

(median of 17

years)

• Bachelor’s

degree

• CFP®

certification

Manage a team

or potentially

multiple teams

7 years or more

(median of 20

years)

• Bachelor’s

degree

• CFP®

certification

• Draft financial

plans

• Perform asset

allocation analysis

• Create custom

analyses of

financial decisions

• Prepare materials

for client meetings

• Perform research

on investments

• Answer routine

client questions

and service

requests

• Draft and deliver

financial plans

for review

• Implement

financial plans

under supervision

of Lead Advisor/

Managing Director

• Work with

investment team

on financial plan

implementation

• Participate in

client meetings

• Take the lead on

answering routine

client questions

• Manage client

relationships,

identifying and

meeting client

needs

• Develop and

present financial

plans to clients

• Oversee the

implementation

of financial plans

• Manage

premier client

relationships

(i.e., the most

complex and

largest in size)

as Lead Advisor/

Managing

Director

• Consult with

Lead Advisors/

Managing

Directors on

complex cases

• Associate Advisor

• Paraplanner

• Senior Associate

• Service Advisor

• Financial Planner

• Planner

• Financial Advisor

• Advisor

• Investment Advisor

• Director

• Lead Advisor

• Managing Director

• Senior Advisor

• Principal

• Partner

ANALYST

PRINCIPAL/

PARTNER

LEAD ADVISOR/

MANAGING

DIRECTOR

SERVICE

ADVISOR

ASSOCIATE

ADVISOR

4. 2020 InvestmentNews Adviser Compensation & Stang Study

Q. Why did you decide to become a

financial planner?

Finances can be a great stress for growing

families, which is something I’ve experienced

firsthand. I knew that in any career my main

mission was to help people reach a goal.

As a financial planner, I find it rewarding to

aid families in reaching their goals so they

can focus on what matters most to them.

Also, I feel that educating people about

the importance of financial planning is

rewarding.

Q. What do you love the most about your

career in this particular business model?

My current firm, Brighton Jones, allows a

clear path for growth within the business

model. As a team, we help build each other

up to help expand the business. Each client

has a team of 3: the Lead Advisor, Associate

Advisor and Analyst. The roles are clearly

defined, but we continue to learn from each

other as duties flex depending on the needs

of the client. An Analyst can develop into

MARIE

PADIONG

a Senior Analyst, an Associate Advisor, an

Advisor, and lastly, a Lead Advisor. It’s also

important to me to oer services for our

advice, rather than sell a product.

Q. Why are you pursuing

CFP® certification?

CFP® certification is a high standard.

Furthermore, fulfilling the commitment I

make to CFP Board, and giving my clients

fiduciary advice that is in their best interest,

allows me to feel like a partner to the

families I work with.

Advisor

Brighton Jones

Seattle, Washington

17

I FIND IT

REWARDING TO

AID FAMILIES

IN REACHING

THEIR GOALS.

Since many readers will likely elect to join a

company at the entry level, we will elaborate

on these positions. Entry-level positions in a

financial planning company have titles such

as Associate Planner or Advisor, Support

Planner or Advisor, Paraplanner, Analyst or

Senior Analyst. These roles typically include

the following responsibilities:

Entry-level financial planning positions

are usually trained and supervised by an

experienced financial planner and present

professionals with many opportunities

for mentoring relationships. While these

positions do not typically require CERTIFIED

FINANCIAL PLANNER™ certification,

many companies partially or fully support

professionals who wish to pursue CFP®

certification by financing the required

education coursework and providing

additional time o to study for the CFP® exam.

Entry-level positions on the financial planning

career track are actively recruited by many

financial planning companies. Job postings can

frequently be found on popular job sites such

as the CFP Board Career Center and LinkedIn

Jobs, as well as on job boards for regional

chapters of the Financial Planning Association®.

• Drafting financial plans

• Performing asset allocation analysis

necessary for client onboarding

and portfolio reviews

• Creating custom analyses of

financial decisions

• Preparing presentations and

other materials necessary for

client meetings

• Performing research on investments

that clients currently hold or

may hold

• Answering routine client questions

and service requests

The Financial Planning

Practice

The practical application of financial

planning as a profession and a career is

closely related to the notion of a “practice.”

A financial planning practice describes the

collection of people, resources, processes

and economic activities that allow a financial

planner to work with and help a group

of clients. A practice is a service unit in

the sense that it contains the resources

necessary to productively engage with

clients in their best interests. A practice

is also a business unit in the sense that

it allows a financial planner to have the

resources needed to take care of clients.

A practice can be somewhat dierent

depending on the company where financial

planners work. In some companies, a

practice is a team of professionals, each

of whom has a dierent specialized

position and dierent level of experience.

In other companies, a practice is simply

one professional who works with clients

in person or virtually and leverages

the technology and capabilities of a

supporting company that employs them

or partners with them. A practice can be

virtual such that the planner interacts with

clients primarily over the phone or web

conferencing, or it can take the traditional

form where the planner meets with clients

in person.

The notion of a practice and the types

of practice that a company creates

and supports tend to shape careers of

financial planners who work there. In most

environments, planners begin by playing a

support role in a practice and then later they

may lead a practice or even own a practice.

18

Returning to the comparison of financial

planners to doctors, a practice would be

the oce and the exam rooms, the doctors,

nurses and administrators, the furniture and

the support system. In short, the practice is

everything the doctor needs to work with

patients. Much like doctors, some financial

planners own and lead their own practices, and

some support the practices of others.

Leading a financial planning practice is both

a privilege and a responsibility. Whether you

own the practice or operate the practice

within a larger company, you have control

and flexibility with regards to client service,

methodology and process. You also have

flexibility when it comes to making business

decisions, selecting resources and deciding

how much and when you want to work.

Finally, owning or operating a practice oers

the potential for financial rewards.

Along with these benefits come increased

responsibilities. Owning or operating a

practice requires the ability to attract and

retain a significant number of clients and

successfully manage the activities of the

practice. Additionally, the more independent

your practice, the more you (and possibly your

partners or teammates) will be responsible

for the expenses of running your business. As

such, people starting a financial planning career

don’t necessarily enter by this path. Instead

they may work toward this type of practice,

building a base of clients over time that will

provide the revenue to support the business.

Owning or operating a practice also means

that you take on more regulatory risk and that

you need to be involved at least on some level

in practice management. The responsibilities

inherent to owning or operating a financial

planning practice include the following:

RETAINING CLIENTS

The financial planning professional must

maintain strong relationships with a group

of clients who are seeking advice and

relying on the professional to make final

recommendations, even if clients are also

taking input from others.

MANAGING RESOURCES

The financial planning professional must

have enough clients to ensure the presence

and sustainability of all the necessary

resources to run the practice, from support

sta to the oces and technology. In other

words, the financial planning professional

must either be able to aord to directly hire

the sta and purchase the requisite tools or

contract with a company on whose behalf

the professional works.

MANAGING ETHICS

AND COMPLIANCE

The financial planning professional

has regulatory responsibility for all the

recommendations made and must ensure

that all client work follows the ethical and

legal standards that apply.

MANAGING THE TEAM

The financial planning professional must

be able to delegate, oversee, train and

coordinate the team so that all client work

is properly completed.

19

Career advancement within the typical

financial planning practice career track

occurs at varying speeds; it is highly

dependent on an individual’s capacity,

skill set, experience level and ability to

attract a client base. The financial planner

may gradually progress through stages of

responsibility and experience illustrated in

the table on page 16, moving from technical

positions, such as Analyst or Paraplanner, to

service positions, such as Financial Planner

or Financial Advisor, to eventually operating

a practice as a Lead Advisor or owning a

practice as a Principal/Partner. This type of

career track can be a very good fit for those

who have little or no work experience in

financial services and who seek to be trained

and mentored more gradually.

Financial planners who excel at business

development and are able to build a client

base rapidly may find that they achieve Lead

Advisor or Principal/Partner status quickly.

This career trajectory is normally the result

of an individual having a lot of experience in

a related field, such as taxes or law, and/or

having an existing client base from a previous

career, perhaps as a teacher or a realtor, that

they could use to launch a new practice.

Many companies provide general training

to aspiring financial planners through

structured programs. This training allows

financial planners to develop the skill set and

experience needed to make well-informed

and strategic decisions regarding the

direction of their careers, whether joining

an existing practice or building a practice of

their own.

20

Financial planning

professionals who wish

to own or operate a

practice spend 2 to 4

years of their careers

acquiring the necessary

technical skills, licenses

and designations before

embarking on the

process of building a

practice. This training

stage corresponds

with the Analyst and

Associate Advisor stages

of the traditional financial

planning career track.

Financial planning

professionals who own

or operate practices

spend many years

attracting clients and

building a process for

servicing those clients.

This practice-building

stage corresponds

to the Lead Advisor/

Managing Director stage

of the traditional financial

planning career track.

Some financial

planning professionals

with large, mature

practices also embark

on the process of

building a team of

professionals that

collectively services

clients. This team-

building stage

corresponds to the

Principal/Partner

stage of the traditional

financial planning

career track.

PRACTICE-BUILDING TEAM-BUILDINGTRAINING/ENTRY

21

TYPICAL STAGES OF BUILDING A FINANCIAL PLANNING PRACTICE

I ENJOY

GETTING TO

KNOW CLIENTS

ON A PERSONAL

LEVEL.

Q. What is a typical day like for you at

your firm?

A typical day consists of me responding

to client emails, placing trades in client

portfolios, team meetings with fellow

advisors and my manager, and phone

or video appointments with clients and

prospective clients. I enjoy getting to know

clients on a personal level and showing them

the value of partnering with me here at

Vanguard. Receiving positive client feedback

regarding our previous experiences is one of

the most rewarding aspects of my role as a

financial planner.

Q. Can you describe a favorite client

experience where you think you made a

dierence in the client’s life?

One of my favorite experiences as a financial

advisor is working with a woman who is

the primary provider and caregiver of her

family. Her husband has had several medical

complications and is not able to help out

much either physically or financially. She

came to me worried that they would not

NEAL

HANSEN, CFP®

have enough saved for retirement and make

it through their lifetimes. I was able to work

with her to come up with a budget and

a financial plan to make sure she and her

family could be financially sound over the

long run.

Q: Why would you recommend the

financial planning profession?

This profession provides a rewarding

career that serves those in need and helps

people accomplish their financial goals. This

profession can be challenging and never has

a dull moment. I recommend it to those who

want to do good, serve others and build

long-lasting relationships.

Financial Advisor

Vanguard Personal Advisor Services

Scottsdale, Arizona

22

Typical Structure of

a Financial Planning

Department or Division

Within a Financial

Services Company

Companies that provide financial planning

services employ many dierent strategies and

serve a diverse group of clients. As a result,

there are a variety of possible organizational

structures. Each major function within a

company or a division creates opportunities

for specialized teams and, consequently,

specialized careers and career paths.

A typical structure has four major

“departments,” teams or functions, as shown

in the graphic above and described here.

Financial Planning: The Financial Planning

department is also called Advisory or Wealth

Management and is the primary destination

for financial planning professionals. Most

financial planning professionals will join the

Financial Planning department and spend the

majority of their careers working on this team.

Investments: Investment management is a

component of financial planning advice. In

an over-simplified explanation, investment

management is working with money and

financial planning is working with the people

who invest the money. Financial planning

cannot be implemented without investment

management. Many companies have a

separate Investments department or team.

Operations: The Operations department

handles accounts, data, reports, forms and

processes. This team supports financial

planners with tools and processes to help

them achieve client service goals. In other

words, this department provides financial

planning in a supporting role.

Company Administration: The Administrative

department manages the company’s

resources, finances and human capital, as

well as other aspects of the business.

FINANCIAL

PLANNING

COMPANY

ADMINISTRATION

INVESTMENTS OPERATIONS

FINANCIAL SERVICES COMPANY

23

Starting a Financial

Planning Career in

Operations

While it is reasonable for aspiring financial

planners to expect to start their careers in the

Financial Planning department, some financial

planning companies believe that financial

planning professionals are more eective

if they have a complete view of the client

service process. Following this philosophy,

they recruit their entry-level professionals at

the Client Support Associate position (CSA)

on the Operations team. CSAs are responsible

for maintaining advisor and client files,

generating client reports, contacting clients

to provide or obtain updated information,

scheduling meetings with professional sta

and troubleshooting.

Professionals intending to start out at the

CSA position as a step toward becoming a

financial planner should make their ambitions

known during the interview process and

ensure that the company oers a career track

leading from CSA to the Financial Planning

department. Many companies consider

the CSA position to be part of a separate

Operations career track, and the transition

may not be easy. Clear dialogue about career

tracks during the interview process is helpful

to both the professional and the company

as it establishes expectations, timelines and

milestones for success.

Starting a Financial

Planning Career in a

Virtual Advice Center

Virtual advice centers are becoming more

and more popular with both consumers and

financial services companies, such as brokerage

firms. Many recent graduates and career

changers are recruited to join such companies,

and they can be a great opportunity to start or

grow a career in financial planning. Typically,

the virtual environment allows planners with

less experience to assume a more active role

with clients sooner than perhaps other types of

companies.

Employers tend to provide very formal and

organized training programs. New employees

tend to be hired in cohorts and complete a

training and onboarding program together.

While these training programs vary by firm,

a new employee can expect to spend their

first few months focused on passing required

licensing exams. New hires will also learn

the company’s client service model, the

steps of the financial planning process and

communication skills for interacting with

clients. This is achieved in part by having the

new hire listen in on client calls.

Once a new hire has obtained the necessary

licenses and completed the company’s basic

training, their primary responsibility is to take

phone calls from existing customers and

assist them with a wide variety of personal

financial matters, such as stock trades,

investment portfolio adjustments and account

distributions. New hires tend to quickly gain

customer service experience and are exposed

to a wide variety of financial planning services

and financial products.

Typically, after reaching skills and experience

benchmarks, new hires get promoted from

general client service to more specialized roles

and services, such as working with specific

groups of clients. As a financial planner develops

more skills and competencies, they have

opportunities to move into a team leadership

role or transition to another part of the company

where they have a specific interest.

24

Q. Why did you decide to become a

financial planner?

To help women become the CFO of their

personal finances, to help more women see

it as a viable career path, and to make an

impact in an area that plays a large role in

the daily lives of each and every individual.

Q. How did you get started in the

profession?

I started with a local credit union as a youth

outreach specialist focused on collegiate

financial literacy. It was through that role

that I developed a skill for making financial

literacy concepts more palatable and fun. It

was also through that role that I developed

an interest in financial planning. From

that role, I transitioned into the wealth

department of the credit union, became fully

licensed and supported 2 financial advisors

for 2 years.

CAMILLE

D. YORK, AAMS®,

CDFA®

Q. Why did you choose this business

model?

After learning and training within the credit

union, I joined Raymond James’ Advisor

Mastery Program (AMP) to further develop

my skill set and industry knowledge. It

is through this program that I gained

access to top leadership, specialized

coaching, advisory board participation and

input, and the opportunity to pilot new

resources, products and services for the

firm. I now have the support, resources and

independence to run my practice how I see

fit and serve my clients in a way that is both

meaningful and impactful on a daily basis.

Financial Advisor

Raymond James

Tampa, Florida

25

I NOW HAVE

THE SUPPORT,

RESOURCES AND

INDEPENDENCE

TO RUN MY

PRACTICE HOW

I SEE FIT.

26

• Train and study for licensing

• Assist clients with opening

accounts or account

transfers

• Answer routine client

questions and service

requests

• Assist clients with more

advanced products and

services

• Assist larger clients and

more complex client

cases

• Manage premier client

relationships and most

complex client cases

• Lead the branch team

and manage the

responsibilities and

performance within

the team

FINANCIAL CONSULTANT

SENIOR FINANCIAL

CONSULTANT

BRANCH MANAGER

Starting a Financial

Planning Career in a

Branch Oce

Financial services companies such as

brokerage firms and banks hire financial

planners to become part of a team at the

company’s local branch oce. The advantage

of working in a branch is the steady flow

of prospective clients that creates an

opportunity to develop a practice faster than

if the planner has to find clients on their own.

The typical career path in a branch oce

progresses from Financial Consultant, to

Senior Financial Consultant and finally to

Branch Manager. The table below lists major

responsibilities that are typical for each role

in a branch oce.

Specialist Positions

In addition to the traditional financial

planning career track, some companies

oer professionals opportunities to become

specialists. The major functions within a

practice can be broken into four major

components, and each component oers

opportunities for specialization.

Relationship support specialty: The

relationship component of a practice

prioritizes empathy, communication skills and

the ability to establish and maintain trusted

relationships. Financial planning professionals

are coaches for their clients. To be eective

coaches, they need to cultivate trusted

relationships with clients, where each client

feels understood, supported and motivated

to implement the advisor’s recommendations.

The relationship support function is part

of the traditional financial planning career

track under the title of Service Advisor or

Financial Advisor. Many professionals choose

to specialize during this step of the career

path. Some planners also remain in this

position long-term, choosing to focus on the

client interaction and collaboration without

the pressure and responsibility of the Lead

Advisor role.

Technical support specialty: Financial

planning professionals systematically gather

knowledge and data and utilize their insights

to make sound recommendations. There are

specialized positions that focus on these

technical aspects of financial planning. These

technical specialists work on behalf of and

in support of other advisors. This specialty

emphasizes advanced technological tools and

the ability to process complex information and

navigate through challenging decisions.

The Paraplanner position oered by some

companies provides specialized technical

support to Lead Advisors and Service

Advisors. Paraplanner responsibilities include

data gathering, modeling, case design,

scenario building, plan development and

presentation development. These activities

can be a step in the training toward becoming

a Lead Advisor, or they can be a good long-

term fit for someone who prefers to focus on

analytical work. Some companies also have

insurance planning specialists who focus on

risk management.

Management specialty: Financial planning

professionals work on a team, using the

help of supporting employees to provide

administrative, technical, compliance and

other services that all ultimately benefit the

client. The ability to create, maintain and

manage such a team is important for the

practical success of a financial planner in their

work with clients.

Some companies oer positions in

management that benefit from but do not

require experience in financial planning.

Such management specialties may exist in

marketing, human resources or technology.

Business development specialty: “Business

development” is an umbrella term used by

many professions to capture all activities

associated with attracting future clients.

Financial planning professionals meet new

clients through a combination of marketing

(undertaken by themselves or their company)

and referrals from existing clients and

trusted professionals (e.g., CPAs). Business

development favors skills in marketing,

networking, and your reputation for

competency and ethics.

Some companies have a Business

Development Ocer position that focuses

exclusively on attracting clients to the

company. Such specialty positions are

typically held by experienced advisors,

although a professional with a significant

reputation in another company may be a

successful Business Development Ocer by

virtue of their access to a client base.

27

Exploring Other

Financial Services

Careers

Finally, there are a variety of businesses

that support financial planners and their

companies by providing tools or services

that allow professionals to more eectively

and eciently serve their clients’ needs.

These companies oer aspiring financial

planning professionals a glimpse of the

financial planning world, allowing them to

determine if a financial planning career is

the right fit. Here are some examples of

these types of companies:

28

FinTech companies: Create

tools, technology or software

that makes time-consuming

tasks more ecient

Custodians and platform

providers:

Consolidate the

operational needs of a large

number of companies to

provide resources for growth

and client service

Asset managers: Provide

asset management solutions to

companies, freeing up advisors

to spend more time with clients

Third-party administrators

and record keepers:

Assist

companies with their own

retirement plan creation,

maintenance, compliance and

fiduciary responsibilities

Industry vendors and

wholesalers:

Market products

and services to companies for

client use

Q. What do you love the most about your

career in this model?

What I love most about the fee-only model

is that it allows me to feel like I am being

transparent about how our firm gets paid.

I would recommend this model because

it’s rewarding to know you’re getting paid

directly by your clients for the services you

provide.

Q. What’s the most rewarding part of

being a CFP® professional?

The most rewarding part of being a CFP®

professional is knowing that the credential

did not come without time and a dedication

to earning it. There are many ways to

become a financial advisor, but there’s only

one way to become a CFP® professional

and that provides added confidence when

discussing with potential clients what makes

me qualified to assist them in reaching their

financial goals.

DARIAN

BILLINGSLEY, CFP®

Q. What elements of the job make it a

satisfying career?

Working with people is the most satisfying

element of being a financial planner. You

get to really see the impact you can make

in a person’s life just by assisting them with

developing a plan for their financial future.

As a financial planner, you get to expand

your knowledge on a regular basis and use

that knowledge to positively impact others.

Advisor

Financial Symmetry

Raleigh, North Carolina

29

YOU GET TO

REALLY SEE THE

IMPACT YOU

CAN MAKE IN A

PERSON’S LIFE.

In this chapter, you will learn about:

COMPANIES

THAT HIRE

FINANCIAL

PLANNERS

CHAPTER THREE

Types of companies that

employ financial planners

How company characteristics

can impact your financial

planning career

Questions to ask when

researching potential

employers

30

The financial services industry is a diverse

ecosystem of companies that assist

consumers with financial products and

services used in the financial planning

process. Within this ecosystem, many

companies oer financial planning services

and hire financial planners (although they

sometimes call them financial advisors) to

deliver these services to clients. An aspiring

financial planner can find a wide variety of

training and career opportunities across

the entire industry. It is important for new

planners to understand the underlying

structure of the industry as well as the

dierent characteristics of potential

employers.

31

Company Characteristics

A career is a long-term commitment.

When looking for a future “home” for your

financial planning career and comparing

various companies, be sure to familiarize

yourself with the nature and strategy

of each company. Here are some key

questions to ask as you conduct your

research or sit for interviews:

• Vision: What will the company look like

in 5 years? In 10 years? What role does

financial planning play in the future of

the company?

• Mission: Why does the company exist?

What does it contribute to the lives of its

clients and team members, and what does

it bring to its community? What is a day

in the life of a financial planner like at

the company?

• Strategy: What makes the company

successful in the marketplace? What

dierentiates it from its competitors?

• Optimal Clients: Which clients does the

company attract? How diverse is its client

base today, and how diverse is it likely to

be tomorrow?

• Growth: How does the company grow and

attract new clients? What role do

individual financial planners have in the

growth of the company?

• Culture: What is the best way to describe

the company culture? Which values

guide it?

These questions are fundamental

to understanding each company

and how it views the financial

planner position in the context

of its overall goals. For additional

questions to ask in a job interview,

go to page 55 in the Appendix.

MISSION

GROWTH

VISION

CULTURE

STRATEGY

OPTIMAL CLIENTS

Financial Planning

Services Within Large

and Small Companies

Financial planners can find many

opportunities for growth and career

satisfaction in large, mid-sized or small

financial services companies. Large financial

services companies are engaged in many

lines of business, providing insurance,

banking, investment, credit and even

technology services under one brand or

through a portfolio of brands. Within this

company structure, financial planning is only

one of the points of contact between the

client and the company. Such companies are

some of the largest employers of financial

planners in the U.S. Mid-sized and smaller

financial services companies may oer fewer

services and lines of business, but there are

still ample opportunities for a successful

financial planning career within these

companies.

32

The strategy of a larger financial services

company can be more complex. It is able to

refer clients from one part of its business to

another so that finding clients for financial

planning may be easier thanks to synergies

across business lines. For example, a

company client who receives investment

products, such as mutual funds, may decide

to get financial planning advice from the

same company. The company invests

in many dierent businesses, including

financial planning services. As a result, the

consumer needs may be fully addressed at

one firm, and the company brand may be a

magnet for more clients.

While financial planners at larger firms may

focus primarily on the financial planning

aspect of the client relationship, financial

planners at mid-sized and small financial

services companies may have opportunities

to serve their clients in a variety of ways.

The mid-sized and smaller financial services

companies are typically not structured in a

way that separates products and services

oered to clients. This means that financial

planners who work at mid-sized and smaller

companies will likely have the opportunity

to expand their knowledge base beyond

the financial planning process, sometimes

handling operational issues, educating

clients on specific product lines, or helping

the client find other financial professionals

that specialize in meeting their needs.

In short, your career will vary based on how

financial planning is integrated into the

company’s business structure and strategic

priorities. Larger companies where financial

planning is oered as one of multiple lines

of business tend to have many dierent

departments and divisions, providing

opportunities for a variety of career tracks.

Aside from financial planning, these tracks

may include financial planning support, asset

management and product management. In

smaller companies where financial planning

may be the primary service, you typically

have an opportunity to develop deep

knowledge of the company, its business and

its financial planning services.

33

As you begin your financial planning career,

your employer will make sure you satisfy these

requirements and will guide you through the

licensing process. Still, we want you to understand

the basic forms of licensing.

Although there is no specific “financial planner”

regulation, many of the services that financial

planners perform are highly regulated to promote

investor protection. Many financial planners provide

investment advice for compensation, which

constitutes “investment advice” that is governed by

the Investment Advisers Act of 1940. A company

providing investment advice with assets above

a certain threshold must be registered as an

investment adviser (RIA) with the federal Securities

and Exchange Commission (SEC). To practice

as an investment adviser representative (IAR), a

financial planner must be registered in the states

where they have a place of business. To become

registered, the financial planner must pass the

Series 65 examination (Uniform Investment Adviser

Law Examination), which is a North American

Securities Administrators Association (NASAA)

examination administered by the Financial Industry

Regulatory Authority (FINRA). An individual who

currently holds a qualifying professional designation

in current and good standing may request a

waiver of the required exam. CFP® certification

is one of the qualifying designations; therefore, a

CFP® professional may waive out of the Series 65

examination (but still would need to meet the other

requirements of licensure).

As an IAR, you have a fiduciary obligation to your

clients, which means that you are required to always

make investment decisions and recommendations

that are in the client’s best interest. This

responsibility, known as the “fiduciary standard,”

creates a bond of trust between clients and their

advisory professionals and is a source of our

industry’s success. The fiduciary standard applies

both to the individual IAR and the RIA firm.

Many financial professionals carry other FINRA

licenses in addition to the Series 65. Most common

is the Series 7 (General Securities Representative)

license, which allows a professional to sell nearly all

types of investment products to clients and receive

commission-based compensation.

Professionals who have a FINRA license are licensed

as registered representatives of a broker-dealer

(i.e., a company that is licensed to trade securities).

The Financial Services Industry Channels section

below provides more information on broker-dealers

and lists several examples of these companies

which may already be familiar to you. FINRA has

an additional layer of regulatory and education

requirements for professionals who carry such

licenses.

It is common for registered representatives of

broker-dealers to also be registered as IARs. Broker-

dealers also may be aliated with RIAs. However,

some RIAs are not aliated with a broker-dealer.

Some of these RIAs refer to themselves as “fee-

only” to signify that they are not aliated with

a broker-dealer and do not receive sales-related

compensation.

Finally, financial planners also may have insurance

licenses that allow them to provide insurance advice

and sell insurance products. Insurance licenses are

regulated by the states and have their own exams

and requirements.

Your company will have an important role in

overseeing your compliance with state and federal

regulations. The company that employs you

will have policies and procedures, and your firm

will require you to abide by those policies and

procedures.

Importantly, the nature of a company and the

company’s relationship with its clients and team

members is not solely determined by the company’s

regulatory structure. Rather, a company’s

approach to client service and employee relations

are functions of leadership, culture, history and

company structure, each of which will be unique

to the company and should be explored during the

interview stage.

34

To practice as a financial

planner, you will also need

to be aware of the licensing

that is required at the state

and federal level, as well as

the relevant regulations.

LICENSING TO START

YOUR CAREER

CFP®

CERTIFICATION

IS THE BEST

PATH FORWARD

TO BECOMING

A FINANCIAL

PLANNER.

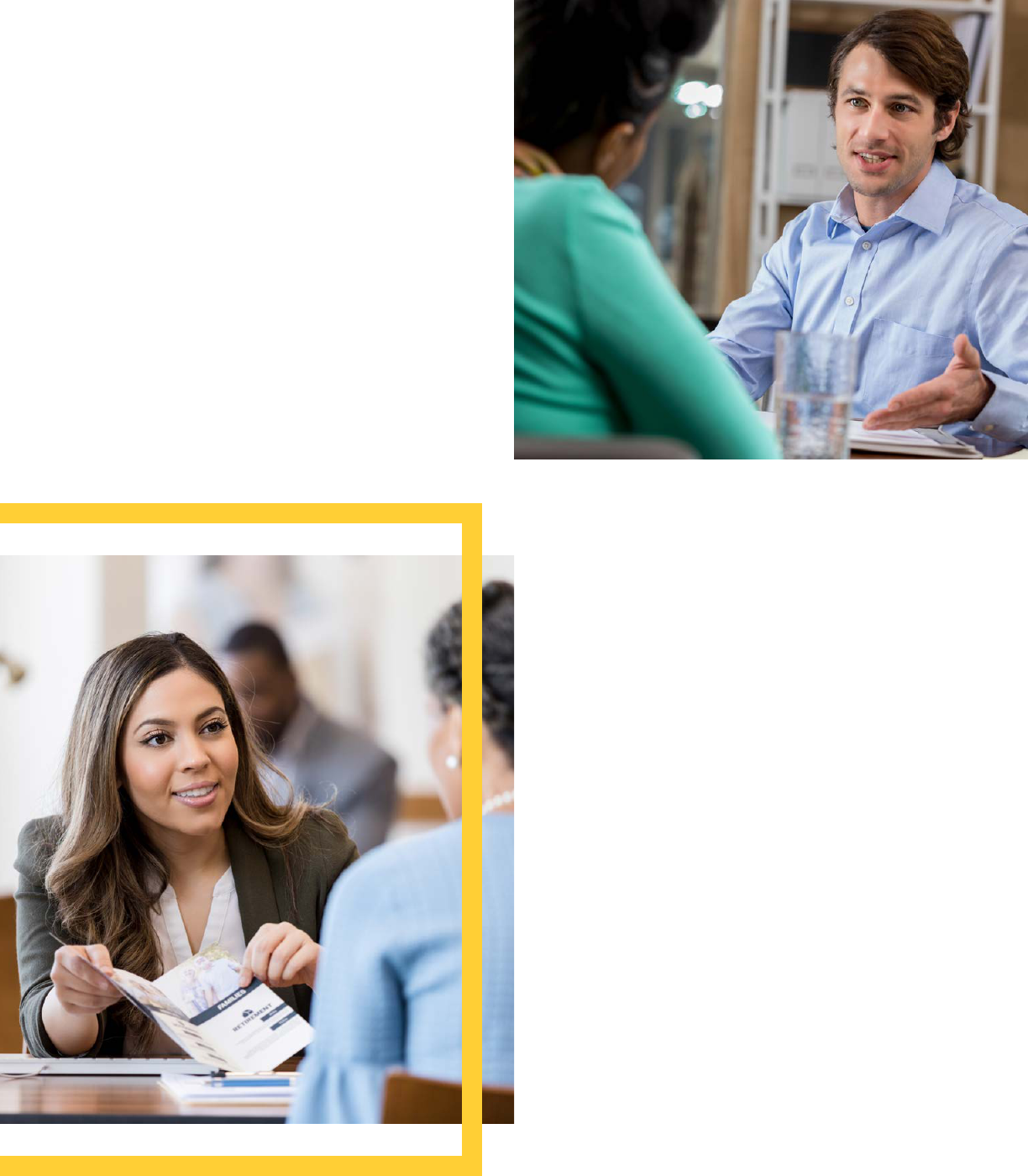

Q. Why did you choose this particular

business model and firm?

We get to help clients almost from cradle

to grave—we’re helping them with college

planning, insurance, mortgages. We’re able

to do everything comprehensively across

the board in one entity, one organization.

It’s also important to me to work at a firm

that agrees to provide financial planning

with a fiduciary standard of care. I enjoy that

we have the independence to be objective

and recommend what’s best for the clients

without having to manage sales-related

conflicts of interest. It just feels much more

genuine, authentic and natural for me and

my personality.

Q. How has CFP® certification made a

dierence in your career?

I chose to pursue the CFP® certification

because it was the next phase in a

commitment to the field of financial planning

and to doing my best for my clients. When

combining the educational component

BRETT

PERLMAN, CFP®,

ChFC®

with the experience requirements, CFP®

certification is the best path forward to

becoming a financial planner. The most

rewarding part of being a CFP® professional

is being part of a group that’s made a

commitment to deliver quality advice and

education to clients.

Q. Why has financial planning been a

satisfying career?

I became a financial planner because

it oered me the opportunity to make

a positive impact in others’ lives while

pursuing something that I truly enjoy. I

am proud of making a positive dierence

in the lives of others. These are dicult

decisions and families are leaning on a CFP®

professional to guide them in the right

direction. It is humbling to be able to share

in those experiences.

Director, Financial Planning

Edelman Financial Engines

Boca Raton, Florida

35

Financial Planner

Compensation Methods

Two of the compensation methods for

financial planners are salaries and payouts.

Many companies hire financial planners as

employees who work on behalf of the company

and receive salaries, incentive compensation

and benefits. The previous Financial Planning

Practice Career Track section contains detailed

compensation information for the typical stages

in a financial planning career on page 16.

Other companies elect to compensate their

financial planners (or at least their senior

financial planners) based on a percentage of

the revenue they generate. This payout method

rewards productivity and business development

success. The most significant risk with the

payout method resides with new advisors.

In the early years when professionals are still

establishing their reputations and client bases,

income may be quite low, though they may

achieve much higher levels of income in the

mature stages of their careers than they could

with a salary.

Most companies oer some period of time

where compensation for new advisors is

guaranteed through salaries. In companies

using the payout method, this period tends

to be short (1 to 3 years) and can vary by

firm. In salary-based companies, guaranteed

compensation is the norm for rookie and

seasoned professionals alike.

Centralized and

Decentralized Companies

One of the most important characteristics

dierentiating companies that oer financial

planning services is the degree to which

management decisions are centralized or

decentralized (i.e., made locally). Large

national companies may allow local oces

to make most of the important business

decisions in accordance with their local

markets. As a result, their local oces may

have diverse strategies, company cultures

and client bases. Decentralization also means

that there can be significant dierences in

the career tracks, training, compensation and

management of financial planning positions

between local oces and even between

teams at the same oce.

In contrast, there are also large companies

where the “home oce” (i.e., headquarters)

makes almost all business decisions. These

companies are very uniform as a result, with

local oces sharing a similar culture and

employment practices.

Centralized versus decentralized decision-

making is a characteristic most useful when

dierentiating between larger companies

with multiple oces, as smaller companies or

companies with only one oce are likely to

have uniform management structures.

36

Financial Services

Industry Channels

The current structure of the financial

services industry is the result of a historical

process shaped by the evolving business

characteristics of the companies making up

the industry. Industry channels (or business

categories) are often used to describe this

structure.

Financial planning as a client service

emerged simultaneously across multiple

industry channels and was embraced by

companies with varied backgrounds. The

table that follows oers further detail on

each of these industry channels.

While having a firm grasp of the

characteristics that define dierent

industry channels can help you better

understand the structure of the companies

you are considering for employment, the

information in the table is not meant to

imply that one business channel is better

than any other. You can find an array of

opportunities to be a financial planner in

any channel.

Additionally, it’s important to understand

that the table reflects the main channel,

but not all industry channels in financial

services, and that some companies

operate in multiple channels.

37

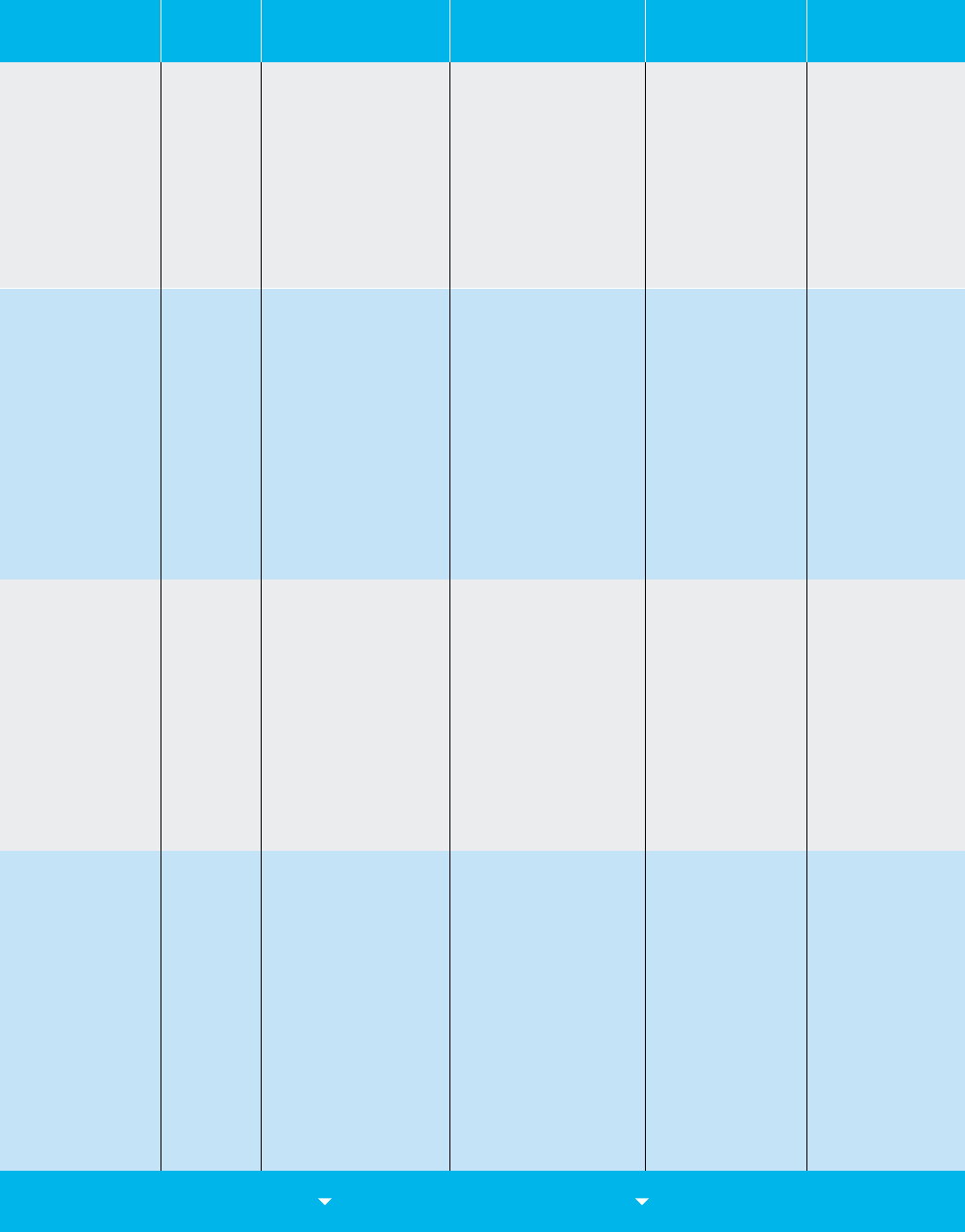

38

FINANCIAL SERVICES INDUSTRY CHANNELS

5

Wirehouse

National

& Regional

Broker-Dealer

Hybrid RIA

Independent

Broker-Dealer

(IBD)

44,949

43,580

28,101

58,419

Four national

broker-dealers with

a large Wall Street

investment banking

and institutional

presence and

strong penetration

in metropolitan

money centers.

National and regional

financial services

companies with retail

financial advisors;

national broker-

dealers targeting

clients with moderate

wealth; and boutique

firms with a localized

presence.

Independent

practices with both a

registered investment

advisor and an

aliation with a

broker-dealer. RIA is

owned and operated

by the advisor, not

the broker-dealer.

Advisors own and

operate independent

businesses and

aliate with a

broker-dealer as

an independent

contractor. Advisor

assumes cost

of running their

practice in return for

a higher payout.

Wide range of firm

sizes, from small

boutiques to 1,000+

advisors. Often have

strong regional and

community ties.

Varied institutional

and investment

banking services,

depending on the

firm. Few or no

proprietary products.

RIA assets are

typically held at an

RIA custodian, but

advisors have the

option to custody

assets with or through