Exclusive Care EPO

Exclusive Provider Organization

Summary Plan Document

January 2022

EPO: 2022

2

TABLE OF CONTENTS

INTRODUCTION ..................................................................................................................... 5

SECTION 1: ELIGIBILITY AND ENROLLMENT .................................................................... 7

Health Plan Eligibility ............................................................................................................ 7

Dependent Eligibility ............................................................................................................. 7

Continued Coverage for Disabled Dependents if your employer group provides dependent

coverage .............................................................................................................................. 8

Plan Enrollment Identification Card ...................................................................................... 8

Mid-Year Changes ............................................................................................................... 8

Termination of Benefits and Re-Enrollment .......................................................................... 9

Reinstatement .................................................................................................................... 10

Keeping Enrollment Information Up-to-Date ....................................................................... 10

Cost of Enrollment in the Plan ............................................................................................ 10

SECTION 2: HOW THE EPO PLAN WORKS ...................................................................... 11

Choice of Providers ............................................................................................................ 11

Changing Primary Care Providers ...................................................................................... 12

Scheduling Appointments ................................................................................................... 12

Referrals to Specialists ....................................................................................................... 13

Second Medical Opinion .................................................................................................... 13

SECTION 3: EPO PLAN BENEFITS .................................................................................... 14

Schedule of Benefits .......................................................................................................... 14

SECTION 4: EXPLANATION OF COVERED SERVICES ................................................... 18

Inpatient Services ............................................................................................................... 18

Emergency Care/Urgent Care/Urgently Needed Services ................................................. 19

Outpatient Services ............................................................................................................ 20

Other Services.................................................................................................................... 22

SECTION 5: PLAN EXCLUSIONS AND LIMITATIONS ...................................................... 23

General Exclusions ............................................................................................................ 23

Specific Exclusions ............................................................................................................. 24

EPO: 2022

3

Limitations .......................................................................................................................... 29

SECTION 6: OUTPATIENT PRESCRIPTION DRUG PROGRAM ....................................... 30

How The Program Works .................................................................................................. 30

The Drug Formulary ........................................................................................................... 30

Pre-Authorization of Non-Formulary Drugs ........................................................................ 31

Maintenance Drug Dispensing ........................................................................................... 31

Mandatory Generic Substitution ......................................................................................... 32

Mail Order Service .............................................................................................................. 32

Exclusions and Limitations ................................................................................................. 33

Dispensing Quantity Limitations ......................................................................................... 34

SECTION 7: MENTAL HEALTH/SUBSTANCE ABUSE SERVICES ................................... 34

Covered Services ............................................................................................................... 34

What To Do In Emergencies .............................................................................................. 35

Exclusions And Limitations ................................................................................................. 35

SECTION 8: CHIROPRACTIC CARE BENEFIT .................................................................. 37

How The Chiropractic Care Benefit Works ......................................................................... 37

Covered Services ............................................................................................................... 37

Exclusions And Limitations ................................................................................................. 37

SECTION 9: OUT-OF-AREA COVERAGE FOR QUALIFIED DEPENDENTS .................... 38

How the Out-of-Area Coverage Works ............................................................................... 38

Choice of Providers ............................................................................................................ 38

Second Medical Opinion .................................................................................................... 38

SECTION 10: PLAN GENERAL PROVISIONS ................................................................... 43

Claim Payment Procedures ................................................................................................ 43

Member Grievence Procedure ........................................................................................... 44

COBRA Continuation of Coverage ..................................................................................... 51

Health Insurance Portablility and Accountability Act (HIPAA) ............................................ 54

SECTION 11: PAYMENT BY THIRD PARTIES ................................................................... 59

SECTION 12: HEALTH PLAN ADMINISTRATION AND INTERPRETATION ..................... 61

SECTION 13: DEFINITION OF TERMS ............................................................................... 62

EPO: 2022

4

Alternative formats of this publication can be made available upon request. Please contact

Member Services at (800) 962-1133

EPO: 2022

5

INTRODUCTION

The Exclusive Care Exclusive Provider Organization (EPO) is a Health Plan provided for

employees and under age 65 retirees of the County of Riverside, their Eligible Dependent(s) and

for the employees and dependents of other Qualified Public Employer Groups.

Exclusive Care provides comprehensive health care services through a Network of Participating

Hospitals, Medical Groups and Physicians. This Network is called an Exclusive Provider

Organization (EPO). The Plan’s Benefits include preventative care and services, specialty

services, hospitalization and prescription drugs, with only a low Copay required from you. You

must receive all your services through the Network for Benefits to be paid (except in certain

emergencies, described in this Summary Plan Document). Members of Exclusive Care will

receive an identification card that must be presented each time a Member receives services.

This plan does provide an Out-of-Area Schedule Of Benefits under Exclusive Care’s Out-of-Area

coverage for your eligible qualified dependents living outside the EPO Plan Service Area. The

qualified dependent may receive treatment and services and seek reimbursement through the

Plan according to the Member Coinsurance and limitations indicated in the Summary Plan

Document. Plan Benefits are paid according to the reimbursements and limitations shown in

the “Out-of-Area Schedule of Benefits” section.

This Summary Plan Document (SPD) provides a description of how the Plan works and an

explanation of what is and is not covered. The SPD is the primary governing document for all

Plan coverage decisions and will be the basis for final determination for the provision of Benefits.

It is the Plan’s intent to comply with all laws and regulations that are applicable, regardless of

whether they are specifically described in this SPD.

Beginning in 2014, the Affordable Care Act requires most people of have health care coverage

that qualifies as “minimum essential coverage”. This plan meets or exceeds the requirements

for minimum essential coverage.

In addition, the Affordable Care Act establishes a minimum standard of benefits for a health plan.

The plan must pay a minimum of 60% of the cost of benefits. This plan meets or exceeds the

requirements for minimum value standard.

The County of Riverside is pleased to provide this Exclusive Care EPO Health Plan for you and

your Eligible Dependent(s). If you have any questions about Benefits provided by the Plan, a

Representative is available to assist you at the Member Services Department phone number

listed below.

EPO: 2022

6

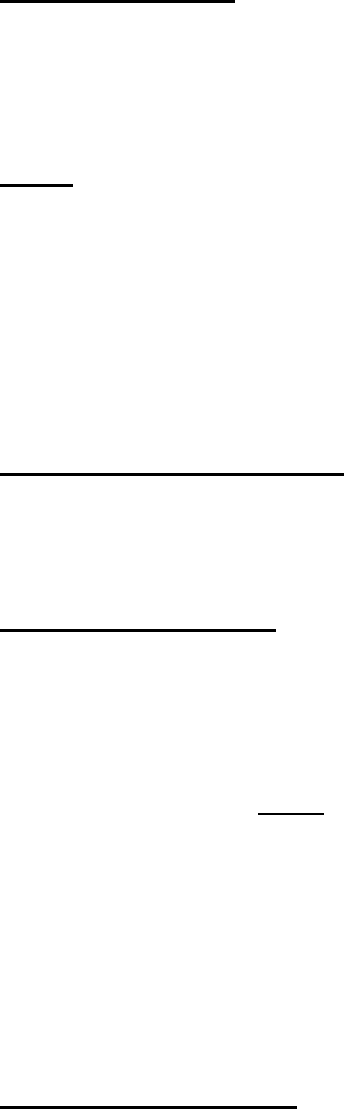

Exclusive Care EPO

Plan Sponsor

The County of Riverside and any other Qualified Public

Employer Group for its own Members

Plan Administrator

Assistant CEO, Director of Human Resources

County of Riverside, Human Resources

4080 Lemon Street, 7

th

Floor

Riverside, CA 92502

(951) 955-3510

Plan Mailing

Address

Exclusive Care

P.O. Box 1508

Riverside, CA 92502-1508

www.exclusivecare.com

Member Services

(800) 962-1133

Monday through Friday

8:00 a.m. - 5:00 p.m. Pacific Coast Time

Type of Plan

The Plan is a welfare benefit plan established and

operated by the County of Riverside that provides health

care Benefits for eligible M

embers of participating

Qualified Public Employer Groups.

Type of Funding

The Plan is self-insured and unfunded. In other words, the

Plan is funded through premium contributions that are

made by its Members and participating Qualified Public

Employer Groups, and Benefits are paid from Plan assets

which are maintained by the County of Riverside. The

Plan Administrator may also establish a trust for the

payment of Benefits.

Plan Year

The Plan year begins on January 1 and ends on December

31. The Plan’s financial records are based on the Plan’s

fiscal year.

Plan Establishment

The Plan was established for the exclusive benefit of its

Members in 1999.

SPD Effective Date

The effective date of this SPD is January 1, 2022

The Plan Administrator reserves the right to change, modify or terminate, in whole or in part, this

Plan at any time.

EPO: 2022

7

SECTION 1: ELIGIBILITY AND ENROLLMENT

Health Plan Eligibility

You are eligible to enroll in the EPO Health Plan if:

• you are an employee or Eligible Dependent of the County of Riverside or of a Qualified

Public Employer Group that offers the Exclusive Care EPO Plan, and you reside or

work in the Exclusive Care EPO Plan Service Area;

• you are a County of Riverside retiree under age 65.

You are eligible for the Out-of-Area Schedule Of Benefits if:

• you are a qualified, Eligible Dependent of a County of Riverside employee or

Qualified Public Employer Group employee living outside the EPO Plan Service

Area

Eligibility requirements are established by your employer group and are detailed in the Group

Healthcare Services Agreement signed by your employer group. Contact your employer group

for the dependent eligibility requirements including any age limits for dependents. County of

Riverside eligibility requirements are detailed in employee benefits medical plan eligibility

requirements available through Human Resources.

Dependent Eligibility

If your employer group provides dependent coverage and you are enrolled in the Health Plan

option applicable to you, your legal spouse or Domestic Partner and Eligible Child (ren) may

also enroll in the same Health Plan, subject to the following:

• Domestic Partners must sign, agree, and meet the requirements specified in the

Employers Declaration of Domestic Partnership and a signed Statement of Financial

Liability to the satisfaction of the County of Riverside or the Qualified Public Employer

Group;

• Your children, or those of your legal spouse or Domestic Partner, who are under the

employer group’s limiting age may enroll in the same Health Plan if they meet one of the

eligibility requirements as set forth below:

i) They must be natural born children, or children placed for the purposes of foster

care or adoption or legally adopted children; or

ii) They must be children for whom you, or your legal spouse or Domestic Partner are

appointed a legal guardian by a court; or

iii) They must be children for whom you or your legal spouse or Domestic Partner are

required to provide health coverage pursuant to a qualified medical child support

order (“QMCSO”) or who reside with you (generally in the absence of the natural

or adoptive parent) and who are economically dependent upon you; or

iv) They must be children that reside with you, generally in the absence of the natural

or adoptive parent; for whom you have legal custody or guardianship. A copy of

the court-ordered custody must be on file.

EPO: 2022

8

Dependent enrollment and eligibility shall not be denied because the dependent:

• Was born to a single person or unmarried couple; or

• Is not claimed as a dependent on your federal income tax return.

Continued Coverage for Disabled Dependents if your employer group provides

dependent coverage

Children who are over your employer group’s limiting age, who reside with either you or your

separated or divorced spouse, are incapable of self-sustaining employment by reason of mental

handicap, debilitating Chronic Condition, or physical handicap that existed continuously prior to

your employer group’s limiting age and who are dependent upon you for support and

maintenance, and who would otherwise be eligible to enroll as Eligible Children except for the

fact that they are older than the limiting age, may enroll or continue enrollment beyond the

limiting age, provided proof of such incapacity is provided within sixty (60) days of the onset of

the Disability, or attainment of the limiting age.

The Plan may require ongoing proof of the dependent’s incapacity and dependency, but not

more frequently than annually following the first two years following the attainment of the limiting

age or the onset of the Disability. Such proof shall include a written statement by a licensed

psychologist, psychiatrist, or other Physician to the effect that such dependent is incapable of

self-sustaining employment by reason of mental handicap, debilitating Chronic Condition, or

physical handicap.

Plan Enrollment Identification Card

Once you are enrolled in the Plan, you and any enrolled dependent(s) will receive a new

Member packet with identification cards, identifying you as a Member of the Exclusive Care

Plan. Carry your identification card with you at all times. Present your identification card

whenever you receive services.

Mid-Year Changes

Enrollment changes that are permitted during a Calendar Year are called qualified status

changes and include:

• Marriage;

• Divorce or legal separation;

• Birth or adoption of a child;

• Death of an Eligible Dependent;

• Change in an Eligible Spouse’s employment that would affect medical coverage or a

significant change in an Eligible Spouse’s employer-offered medical coverage;

• Loss of a dependent’s eligibility under another plan; or

• Entitlement to Medicare.

EPO: 2022

9

You must notify your employer group within the timeframe established by your employer

group from the date of the qualified status change; usually thirty (30) days.

Coverage designation may be changed during the Calendar Year for any of the qualified status

changes listed above. Failure to notify your employer group in a timely manner may result in the

inability to correct and/or refund premium payments. Documentation that substantiates the

qualified change must accompany the paperwork required by your employer group. Coverage

for mid-year changes becomes effective the first day of the month following the date you notify

your employer group of the status change; however, newborns or newly adopted dependents

are covered as of the date of their birth or adoption contingent upon the timely completion of the

enrollment paperwork.

If you wish to change your election based on a qualified status change, you must establish that

the change is on account of and corresponds with the qualified status change. The employer

group shall determine whether a requested change is on account of and corresponds with a

qualified status change. As a general rule, a desired election change will be found to be

consistent with a qualified status change event if the event affects coverage eligibility. In addition,

you must also satisfy the following specific requirements in order to alter your election based on

that qualified status change:

• Loss of Dependent Eligibility: If your Eligible Spouse or Eligible Dependent Child(ren)

lose coverage for any of the following reasons, you may only cancel coverage for the

affected dependent:

i. Your divorce, annulment or legal separation from your Eligible Spouse; or

ii. The death of your Eligible Spouse or your Eligible Dependent; or

iii. Your dependent ceases to satisfy the eligibility requirements for coverage.

For example, if your Eligible Child reaches the limiting age and no longer meets the Plan’s

eligibility requirements, you may cancel that child’s coverage mid-year, but you may not cancel

your Eligible Spouse’s coverage too.

• Gain of Coverage Eligibility Under Another Employer’s Plan: If you, your spouse, or

your dependent child becomes eligible for coverage under another employer’s plan (or

qualified benefit plan) as a result of a change in your marital status or a change in your

spouse’s or your dependent child’s employment status, your election to cancel or

decrease coverage for that individual under the Plan would correspond with that qualified

status change only if coverage for that individual becomes effective or is increased under

the other employer’s plan.

Termination of Benefits and Re-Enrollment

A Member’s coverage may be terminated if the Member:

• becomes deceased;

• ceases to be eligible for coverage based on the employer group’s rules of eligibility;

• voluntarily cancels coverage;

• becomes Medicare eligible as a result of age or Disability;

EPO: 2022

10

• fails to pay the required premium;

• was never eligible for membership;

• engages in fraud or deception;

• permits misuse of identification card;

• fails to cooperate with Exclusive Care’s Third Party Lien and Non Duplication of Benefits

Rights;

• has his/her coverage terminated at the request of the employer group;

• engages in an act of gross misconduct, which causes the interruption of the normal

operations of the Plan.

Plan coverage and eligibility for Benefits stop on the date coverage ends. Any Member who is

hospitalized when his/her enrollment terminates for any reason other than the voluntary

termination of coverage shall be granted a continuation of Benefits with respect to medical

conditions that were present or preexisting at the time of hospitalization or occurred during the

hospitalization and which require continued hospitalization. This continued coverage should not

extend beyond the 91st day following the termination.

If for any reason the Plan terminates your coverage, the effective date of the coverage

termination will be the date determined by the Plan.

Reinstatement

A Member may be reinstated at the discretion of Exclusive Care under the following

circumstances:

i. At the request of your employer group (along with payment of premiums).

ii. Payment of premium in arrears by you.

The maximum retroactive reinstatement period is 60 days.

Keeping Enrollment Information Up-to-Date

The Plan maintains enrollment information in order to communicate with you. Please help by

keeping this information up-to-date. If there are any changes in your name, marital status,

address, or phone number, please contact your employer group so your records may be updated

and the updated information forwarded to the Plan. Most importantly, the Plan requires up-

to-date information in the event your coverage ends, in order to send COBRA

continuation of coverage information as well as your “Prior Credible Coverage”

certificates to the correct address, and to any dependents that may not be living at the

same address.

Cost of Enrollment in the Plan

You are responsible for the payment of the entire premium for health care coverage for yourself

and your enrolled dependents. It is your responsibility to stay informed about your payroll

premium deductions and your benefit elections. If you have questions about these, contact your

employer’s human resources, payroll or designated department.

EPO: 2022

11

SECTION 2: HOW THE EPO PLAN WORKS

The Plan provides Covered Services to Plan Members with virtually no paperwork. To obtain

services, contact your Primary Care Provider (PCP), schedule an appointment, and show your

Member identification card. If additional care or specialty services are needed, your Primary

Care Provider will coordinate with Exclusive Care for approval, authorization and claim

processing.

Choice of Providers

PLEASE READ THE FOLLOWING INFORMATION SO YOU WILL KNOW THOSE

PROVIDERS (OR GROUP OF PROVIDERS) THROUGH WHICH YOU MAY OBTAIN HEALTH

CARE SERVICES. IT IS YOUR RESPONSIBILITY TO KNOW WHERE TO OBTAIN

SERVICES. THIS WILL ENSURE THAT NO OUT-OF-POCKET EXPENSES WILL BE

INCURRED BY YOU.

A unique feature of the Plan is your ability to choose a private practice Physician who practices

in your community, a County of Riverside-employed Physician at Riverside County Regional

Medical Center, or a County of Riverside Public Health Clinic, as your Primary Care Provider

(PCP). You may choose whichever PCP you prefer from the provider Network. The provider you

choose can be convenient to your home or workplace. Our Member Services staff can assist

you with finding your nearest PCP.

To be covered, services must be provided by Exclusive Care Physicians, Hospitals, Specialists

or other medical facilities assigned to you (except in the case of life-threatening emergency

services).

All Exclusive Care providers are listed in the Exclusive Care provider directory. You select a

PCP from the provider directory, and this provider coordinates all your health care services. You

may obtain a copy of the provider directory by contacting Exclusive Care’s Member Services

Department, or by accessing the Plan’s website at www.exclusivecare.com.

When selecting your PCP:

• The PCP you choose must be a Participating Provider and within a 30-mile radius of your

primary residence or workplace;

• You and your Eligible Dependents may each choose a different PCP;

• The name of the PCP you choose must be indicated using the provider ID number listed

in the directory on your Benefit Election Form/Enrollment Form;

• If you do not select a PCP at the time of your enrollment, one will be selected for you.

Please refer to the “Changing Primary Care Provider” section of this document for detailed

information about changing your provider after your initial enrollment;

• Your PCP will be listed on your identification card. Always present your card wherever

you attend appointments or receive treatment.

EPO: 2022

12

The Plan contracts with Medical Groups and individual Physicians to provide primary care

services to Members, and with Hospitals to provide hospitalization services. These Participating

Medical Groups, Physicians and Hospitals, in turn, may employ or contract with individual

Physicians.

The Plan’s Participating Hospitals are paid on a discounted fee-for-service or fixed charge basis

for Covered Services. Most acute care, sub-acute care, transitional Inpatient care and Skilled

Nursing Facilities are paid on a fixed charge basis for each day of Inpatient care.

Changing Primary Care Providers

You may change your Primary Care Provider (PCP) by calling the Member Services Department

at (800) 962-1133, ext 1. Your change will be effective the same business day.

Requests for a change of Primary Care Provider may be denied if:

• The Plan determines the transfer would have an adverse effect on the quality of care

given to you;

• The requested provider is closed to new patients.

The Plan may require that you select a new Primary Care Provider if there is a breakdown in

resolving conflicts between you and your existing Primary Care Provider. In this event, you will

be required to select a new Primary Care Provider within thirty-one (31) days of receiving notice

from the Plan. If it is determined by the Plan’s Medical Management Unit that a provider change

would adversely impact your medical care, the Plan will make every effort to enable you to

continue your relationship with your current Primary Care Provider wherever possible.

IT IS IMPORTANT TO KNOW WHEN YOU ENROLL IN THE EPO PLAN THAT SERVICES ARE

PROVIDED THROUGH THE PLAN’S DELIVERY SYSTEM OF PARTICIPATING PROVIDERS

AND FACILITIES. THE CONTINUED PARTICIPATION OF ANY INDIVIDUAL PHYSICIAN,

HOSPITAL, OR OTHER PROVIDER CANNOT BE GUARANTEED.

Scheduling Appointments

Once you have selected your PCP, appointments are simply a phone call away. For routine

office visits, call for an appointment at least 48 hours in advance. For preventative care

appointments, such as a periodic health evaluation, or a well woman care visit, call at least four

weeks in advance. These appointments are scheduled based on availability.

If you need more immediate attention, call your PCP and request the next available appointment.

If your PCP is unavailable, please refer to your provider directory or contact the Member Services

Department for assistance locating contracted urgent care facilities. If you use a non-Network

urgent care facility, the services may not be covered by the Plan and you will be responsible for

the Billed Charges.

If you need to cancel an appointment, please contact your PCP as soon as possible.

EPO: 2022

13

Referrals to Specialists

Your PCP will coordinate all of your health care needs. If your PCP determines that you need to

see a Specialist, he/she will request an appropriate Specialist referral on your behalf by

contacting the Plan’s Medical Management Unit. A member of this unit’s staff will contact your

PCP with the outcome of the request. You will also receive notification from the Plan of approval

for a Specialist appointment, along with the address and phone number for scheduling your

appointment, and any other necessary instructions.

The Specialist is usually pre-authorized to treat you for a specific number of visits for a given

condition, but may request additional visits or diagnostic studies if needed.

IMPORTANT: Prior authorization is not required for many services, and your PCP may

make a direct referral to a contracted provider. Annual well woman exams, OB/GYN

consultations and office visits, mammograms, bone mineral density testing, initial

chiropractic evaluation, mental health services, family planning, and several other

services may be referred directly by your PCP without prior authorization. The direct

referral form and a list of services covered under the direct referral policy may be viewed

at:

http://www.exclusivecare.com/Portals/19/DirectReferralrev052316.pdf?ver=2016-05-23-

1355757-327

A referral request may also be reviewed by the Plan’s Physician Review Committee. The

Physician Review Committee meets on a regular basis, depending on the volume of special

requests or care issues, and authorization or referral requests that require review. Decisions

may be made by the Medical Management Unit and/or Exclusive Care’s Medical Director,

outside of a formal committee meeting to assure a timely response to emergency or urgent

requests.

Second Medical Opinion

You, or your treating PCP, may request a second medical opinion by submitting a referral

request in writing to the Medical Management Unit. The Medical Management Unit will provide

you with a list of Specialists from which you and your PCP may choose a provider for your

second medical opinion. The Plan reserves the right to submit any request to the Medical

Director or Physician Review Committee for review. Non-covered treatments or conditions are

subject to the “Member Grievance Procedure” (described later in this SPD) and will not be

reviewed by the committee.

Second medical opinions can only be rendered by a Physician qualified to review and treat the

medical condition in question. “Out-of-Network” referrals will be approved only when the services

requested are not available within the EPO Network. If a second medical opinion is deemed to

be not Medically Necessary and the request is denied, you may appeal the denial by following

the procedures outlined in the “Member Grievance Procedure” section of this SPD. For more

information, please contact the Member Services Department.

EPO: 2022

14

SECTION 3: EPO PLAN BENEFITS

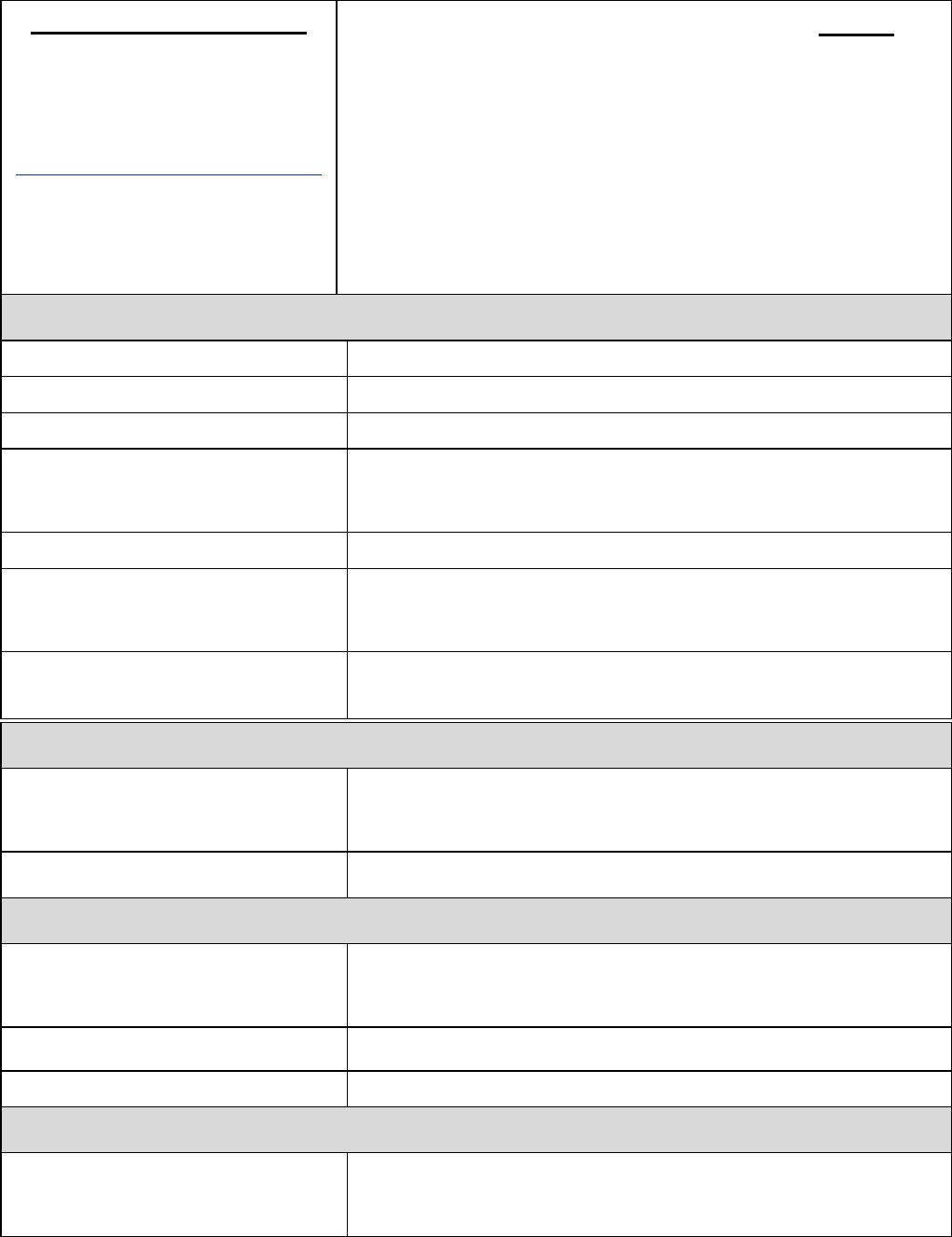

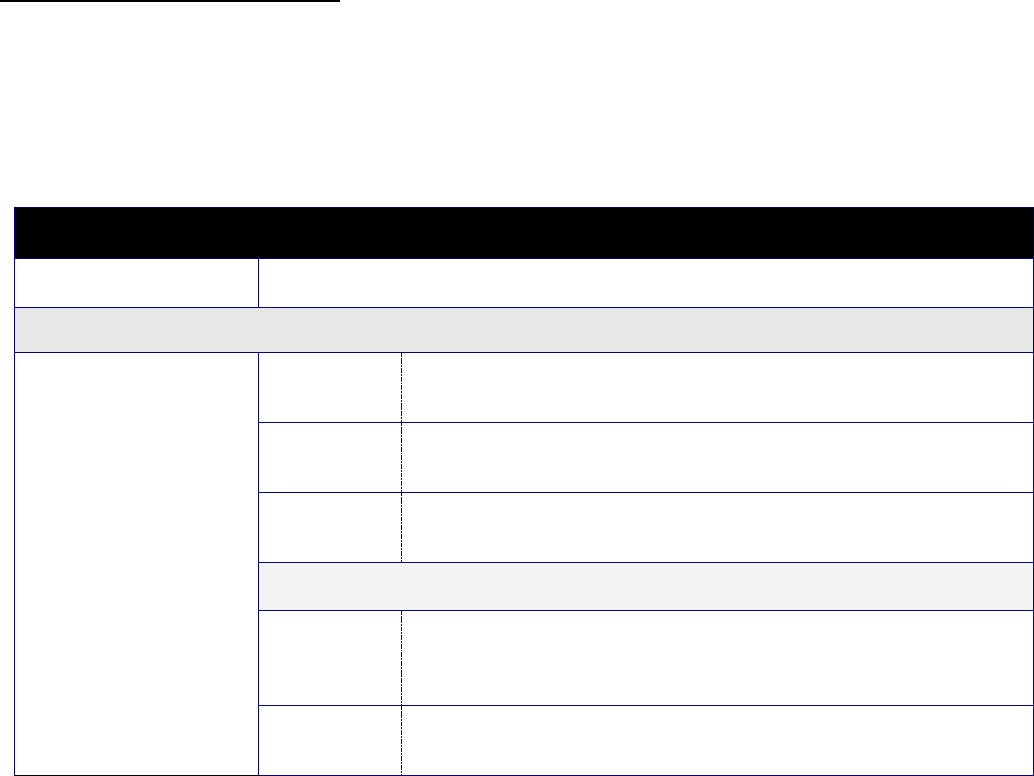

Schedule of Benefits

As a Member of the Plan, you should coordinate all your health care services through your

Primary Care Provider (PCP). The Schedule of Benefits below summarizes the services that

are covered, the amount the Plan will pay, and your Copay amounts.

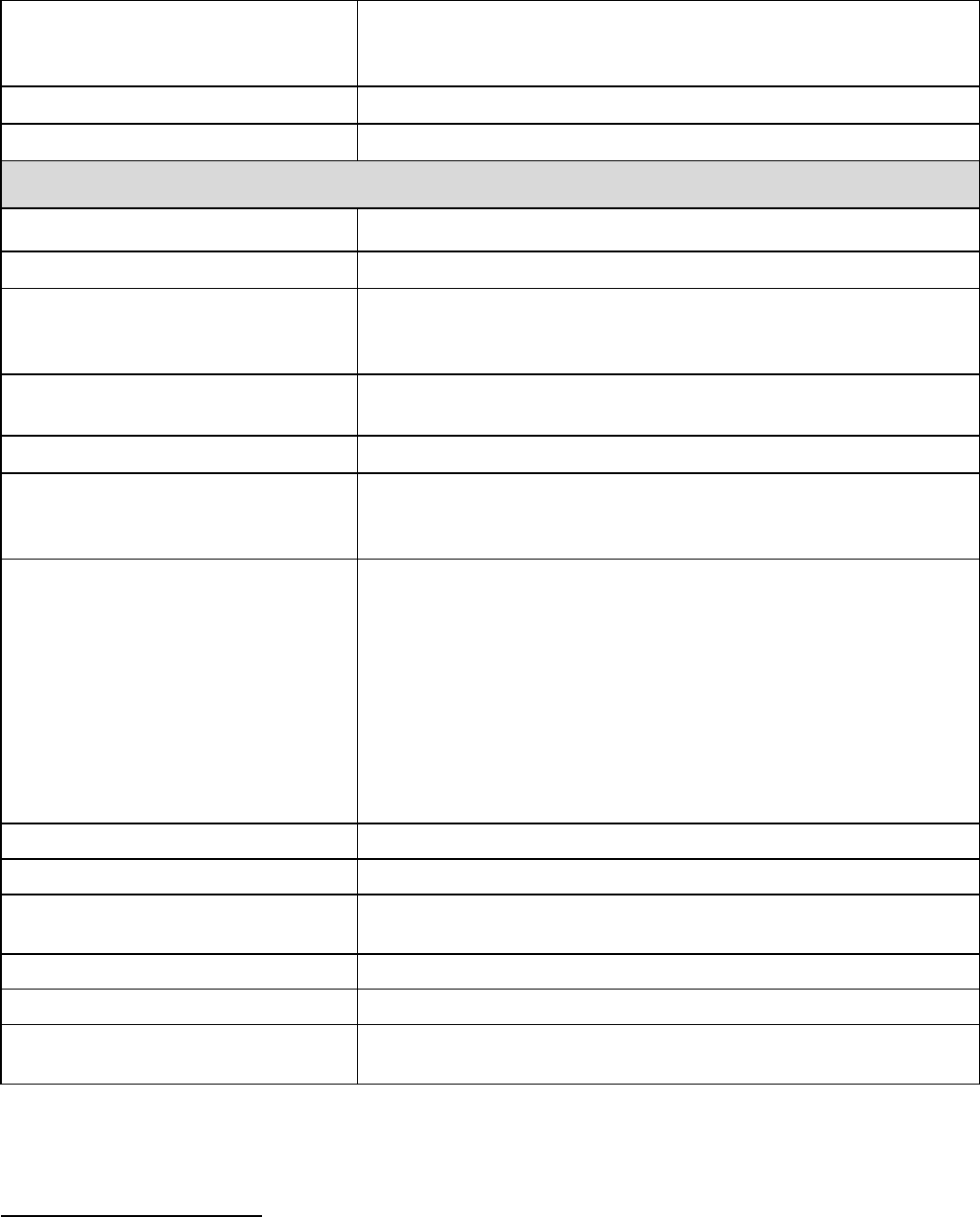

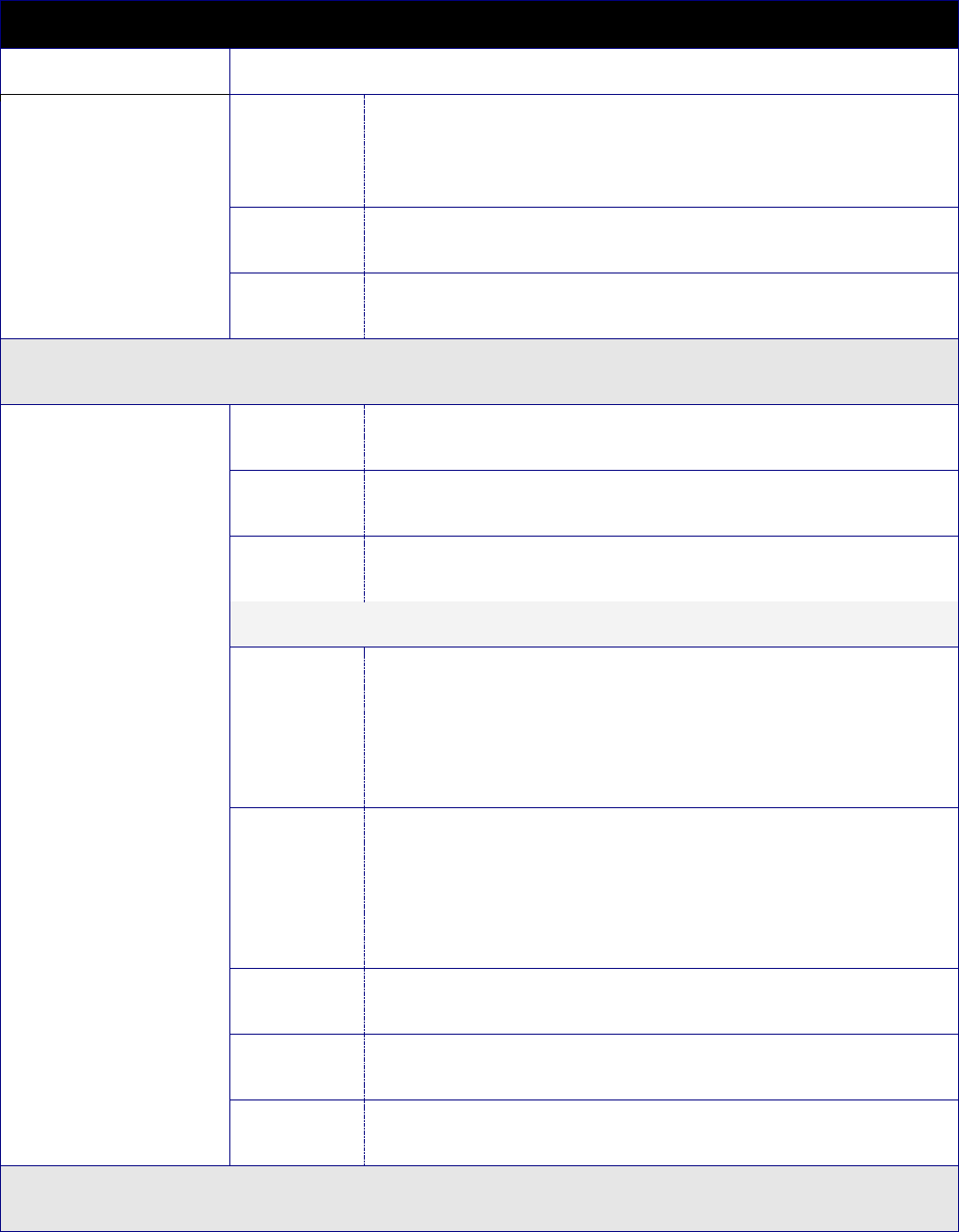

Schedule of Benefits – EPO Plan

Choice of Physician Any Participating Primary Care Physician

Deductible – Individual None

Deductible – Family None

Out-of-Pocket Maximum $1,500/Member, maximum $3,000/Family per Calendar Year

Lifetime Maximum Benefit Unlimited

Pre-existing Condition Fully Covered

Outpatient/Office Visits

Coverage Level

Physician Office Visits 100% after $15 Copay

Hospital Clinic Visits 100% after $15 Copay

Immunizations 100%

Maternity Care 100%

Periodic Health Evaluations 100%

Diagnostic X-ray & Lab

100%

Well Baby Care 100%

Well Woman Care 100%

Vision Exams (screening and

refraction)

100%, 1 Vision Exam per Calendar Year

Outpatient Prescription Drugs

• Prescription Drug Coverage is administered by the Plan’s Pharmacy Benefit Manager (PBM)

•

Pharmacy Benefit Manager (PBM): Navitus Health Solutions. Up to 90 Days

Navitus

www.navitus.com

Phone: (866) 333-2757

FORMULARY DRUGS

1-34 days

35-90 days

Tier 1; Generic Drugs

$10 Copay

$20 Copay

Tier 2; Preferred Brand Name

Drugs

$25 Copay $50 Copay

Tier 3; Non-Preferred Brand Name

Drugs

$50 Copay $100 Copay

Significant or new therapeutic class drugs: 50% copay. Some formulary

and all non-formulary drugs require pre-authorization.

Members with Diabetes and Members who use Antihyperlipidemic and

Antihypertensive drugs have no copays for Tier 1 and Tier 2 Supplies

and Medication.

EPO: 2022

15

RUHS

- Mail Order Service

Medical Center Retail Pharmacy

26520 Cactus Ave.

Moreno Valley, Ca 92555

Phone (951) 486-4515, option 5

www.ruhealth.org/services/pharmacy

(mail order prescriptions only)

FORMULARY DRUGS

90 days

Tier 1; Generic Drugs

$20 Copay

Tier 2; Preferred Brand Name Drugs

$50 Copay

Tier 3; Non-Preferred Brand Name Drugs

$100 Copay

Significant or new therapeutic class drugs: 50% copay. Some formulary

and all non-formulary drugs require pre-authorization.

Members with Diabetes and Members who use Antihyperlipidemic and

Antihypertensive drugs have no copays for Tier 1 and Tier 2 Supplies

and Medication.

Hospital & Emergency Room

Ambulance 100%

Ambulatory Surgical Center 100% at Network facility only

Physician Hospital Visits 100%

Inpatient Hospital Services

$100 per admission at Network or non-Network facilities; non-

Network facility coverage for emergency only (services subject to

medical review)

Outpatient Hospital Services 100% at Network facility only; non-Network facilities not covered

Hospital Emergency Room (Copay

waived if admitted)

100% after $100 Copay at Network or Non-Network facilities; non-

Network facility coverage for emergency only (services subject to

medical review)

Urgent Care/Urgently Needed

Services

100% after $20 Copay at Network or non-network facility.

(services subject to medical review)

Severe Mental Health Treatment

Inpatient Care

$100 per admission at Network or non-Network facilities; non-

Network facility coverage for emergency only (services subject to

medical review)

Outpatient Care 100% after $15 Copay

Non-Severe Mental Health Treatment

Inpatient Care $100 per admission at Network or non-Network facilities; non-

Network facility coverage for emergency only (services subject to

medical review)

Outpatient Care - Individual 100% after $15 Copay

Outpatient Care - Group 100% after $15 Copay

Substance Abuse Treatment

Inpatient Care

$100 per admission at Network or non-Network facilities; non-

Network facility coverage for emergency only (services subject to

medical review)

EPO: 2022

16

Inpatient Detoxification

$100 per admission at Network or non-Network facilities; non-

Network facility coverage for emergency only (services subject to

medical review)

Outpatient Hospital Services 100% at Network facility only

Outpatient Office Visit 100% after $15 Copay

Other Benefits

Allergy Testing & Treatment 100% after $15 Copay

Chiropractic Care 100% after $15 Copay; benefits limited to 12 visits/Calendar Year

Members Requiring Diabetes Care

Pharmacy Copays are waived for all Generic and Preferred Brand

Name injectable and oral antidiabetic medications and diabetic

supplies (testing strips, syringes, etc.)

Members taking Antihyperlipidemic

and Antihypertensive Drugs

Pharmacy Copays are waived for all Generic and Preferred Brand

Name antihyperlipidemic and antihypertensive

drugs

Durable Medical Equipment 50% Copay (services subject to medical review)

Other Medical Equipment (As

defined in Section 4: Outpatient

Services)

100%

Family Planning

Elective Pregnancy Termination

Infertility Services

Tubal Ligation

Vasectomy

100% after $50 Copay for 1

st

trimester; $100 Copay for 2

nd

trimester; (3

rd

trimester only covered if pregnancy life threatening to

mother)

50% Copay; up to a maximum of $10,000 lifetime benefit (services

subject to medical review)

100%

100%

Home Health Care 100%

Hospice Care 100%

Physical Therapy 100% after $15 Copay up to 30 visits/Disability within a 90-day

period

Skilled Nursing Facility

$100 per admission up to 100 days/Disability

Hearing Aid Instrument $3,000/Member; once every 36 months

Bariatric Surgery $100 per admission at Network facility only (services subject to

medical review)

An explanation of terms used in this Schedule of Benefits follows below, to help you get

the most out of your coverage:

Pre-Existing Conditions

EPO: 2022

17

The Plan has no pre-existing conditions limitation. Therefore, there are no limitations, waiting

periods or exclusions for being treated for any diagnosis or condition currently on record for you

or your enrolled dependents as long as services are Covered Services.

Medically Necessary

The Plan only covers Medically Necessary health care services. See Section 13 - Definition of

Terms, for a more detailed explanation. Certain services provided by non-Network facilities

require a medical review by the Plan’s Medical Management Unit, to establish whether or not

the services were Medically Necessary.

Copay

These are the amounts that you pay for certain Covered Services. For office visits, prescription

drugs and other basic services, you are required to pay a dollar amount at the time you receive

services (e.g. $15 Copay for an office visit). After you pay this Copay, the Plan pays for Covered

Expenses up to the Allowed Charge, subject to all other terms and limitations described in the

Schedule of Benefits, General Provisions, or Exclusions and Limitations sections of this SPD.

For Inpatient services and some Copays you pay that are a percentage of the cost, you normally

pay your share after the provider bills the Plan and the Plan has paid its portion of the covered

costs.

Deductible – Individual/Family

The Deductible is the portion of the cost of medical expenses you must pay each Calendar Year

before the Plan will pay any Benefits. There are no individual or family Deductibles required

with the Exclusive Care EPO Plan.

Out-of-Pocket Maximum

The Plan helps protect you from costly medical expenses by limiting the total amount you pay

out of your own pocket for certain services in any one Calendar Year. When the amount that

you or any enrolled dependent has paid for these services reaches the designated level (the

Out-of-Pocket Maximum), that covered member will pay nothing further for Covered Services for

the rest of the Calendar Year (up to any benefit maximums that may apply). Out-of-Pocket

amounts you pay which do not count towards each Member’s Out-of-Pocket Maximum include:

• Deductibles (in the case of the EPO Plan, there are no Deductibles);

• Charges in excess of the Allowed Charges covered by the Plan;

• Charges for services that are not covered by the Plan, such as a charge for a service

listed as an exclusion;

• Charges for services for which no benefit is payable because the dollar or benefit limit

has been exceeded;

Lifetime Maximum Benefit

Unlimited

EPO: 2022

18

SECTION 4: EXPLANATION OF COVERED SERVICES

The Plan reserves the right to review all claims submitted for payment to verify the validity of

services based on Medical Necessity. Emergencies are subject to Medical Necessity review,

and all Members of the EPO admitted to a non-Network facility will be transferred to a Network

facility when medically stabilized.

The Plan covers preventative, certain wellness services, and other Medically Necessary health

care services and supplies provided to you. Covered Services include:

Inpatient Services

Room and Board

Semi-private room, intensive care unit (private room), operating, recovery and special treatment

rooms

Additional Inpatient Services

Laboratory services, X-rays, drugs, anesthesia, medications and biologicals. All other Medically

Necessary Inpatient services such as Physical, Speech, Occupational and Respiratory Therapy,

hemodialysis and administration of blood and blood plasma, including the collection and storage

of autologous blood, nursing care and Durable Medical Equipment;

Physician, Surgeon and Anesthesiologist Services

Skilled Nursing Facility or Convalescent Care

Administration of Blood and Blood Plasma

The processing and storage of autologous blood for scheduled medical procedures;

Maternity Care

Hospital and other related services, Physician and medical services for normal vaginal delivery,

Caesarean Section, and complications of pregnancy. Elective termination of pregnancy

coverage is limited to first and second trimester; no coverage during the third trimester unless

mother’s life is in jeopardy.

The Plan will not restrict Benefits for any Hospital length of stay in connection with childbirth for

the mother or eligible newborn child to less than forty-eight (48) hours following a normal vaginal

delivery, or less than ninety-six (96) hours following a Caesarean Section, or require that a

provider obtain authorization from the Plan for prescribing a length of stay not in excess of the

above periods. However, Federal law generally does not prohibit the mother’s or newborn’s

attending provider, after consulting with the mother, from discharging the mother or the newborn

earlier than 48 hours (or 96 hours as applicable). In any case, the Plan may not, under Federal

law, require that a provider obtain authorization from the Plan for prescribing a length of stay not

in excess of 48 hours (or 96 hours);

EPO: 2022

19

Newborn Care

If your employer group provides spousal dependent coverage, newborns who are born while the

mother is covered under the Plan are also covered by the Plan for up to 30 days after birth.

These newborns will be identified using the mother’s Member ID. Newborn dependent coverage

will only be extended beyond the first 30 days after birth if the child is enrolled in the Plan as a

dependent within the first 60 days after birth.

Breast Reconstructive Surgery

Coverage will be provided to a Member who is receiving Benefits for a Medically Necessary

mastectomy and who elects breast reconstruction after mastectomy for:

Reconstruction of the breast on which a mastectomy has been performed;

Surgery and reconstruction of the other breast to produce a symmetrical appearance;

Prostheses; and treatment of physical conditions of all stages of mastectomy, including

lymphedemas;

This coverage will be provided in consultation with the attending Physician and the patient, and

will be subject to the same Deductibles, Copays, and maximums, if any, that apply to the

mastectomy;

Inpatient Dental Care

Inpatient services associated with dental procedures under the following circumstances:

the Member is a child, up to 6 years old, with a dental condition (such as baby bottle

syndrome) that requires administration of general anesthesia in a hospital setting for

dental repairs of significant complexity (e.g., multiple amalgam and/or resin-based

composite restorations, pulpal therapy, extractions or any combinations of these noted

or other dental procedures); or,

the Member exhibits physical, intellectual, or medically compromising conditions, is in

need of dental treatment that requires administration of general anesthesia and for

whom administration of a general anesthesia can only be safely performed in a hospital

setting. Conditions include but are not limited to: mental retardation, cerebral palsy,

epilepsy, cardiac problems and hyperactivity (verified by appropriate medical

documentation).

Limited to Inpatient Hospital and anesthesiologist charges; charges for the actual dental

procedure performed by a dentist or an oral surgeon are not covered.

Emergency Care/Urgent Care/Urgently Needed Services

Ambulance Service

Land or air;

Emergency Care Services

EPO: 2022

20

Emergency Care Services are medical, emergency room or Hospital services required as the

result of a medical condition, manifesting itself by the sudden onset of sufficient severity, which

may include severe pain, such that a reasonable person would expect the absence of immediate

medical attention to result in:

Placing your health in serious jeopardy;

Serious impairment to bodily functions; or

Serious dysfunction of any bodily organ or part;

Examples of emergencies include heart attacks, strokes, poisonings, and sudden inability to

breathe;

Urgent Care/Urgently Needed Services

Urgent Care or Urgently Needed Services are Medically Necessary services required after

regular business hours to prevent serious deterioration of your health resulting from unforeseen

illness or injury manifesting itself by acute symptoms of sufficient severity which may include

severe pain, such that the treatment cannot be delayed until your Primary Care Provider is

available;

Urgent Care or Urgently Needed Services are provided for less serious medical conditions than

Emergency Care Services, such as:

Non life-threatening cuts which nevertheless require immediate suturing to ensure proper

healing;

Acute illnesses where a delay in care would result in a serious deterioration in your health;

Follow-Up Care

If you require additional services following Emergency Care or Urgent Care/Urgently Needed

Services, you must obtain these services from your Primary Care Provider. If additional services

or a referral to a Specialist is necessary, your Primary Care Provider can make this request on

your behalf. Follow-up care provided in an emergency room is not a covered expense;

Non-Qualifying Services (EPO Plan ONLY)

Medical or Hospital services which do not qualify as Emergency Care or Urgent Care/Urgently

Needed Services received from non-Participating Providers are not covered by the Plan. For

example, medical care provided outside the Plan’s Service Area will not be covered if the need

for care is for a known or Chronic Condition that is not manifesting itself by acute symptoms as

defined Emergency Care or Urgent Care/Urgently Needed Services section;

Outpatient Services

PCP Office Visits

Periodic Health Evaluations (gender-specific, age-specific), Well Baby Care and Well Woman

Care visits;

EPO: 2022

21

Specialist and Consultant Visits

Home Health Care Visits

Prenatal and Postnatal Care

Allergy Testing and Treatment

Hearing Screening when performed in a Physician’s office.

Ambulatory Surgical Center

Diagnostic X-Ray and Laboratory Services

Procedures consistent with established medical practices.

Durable Medical Equipment

Rental (but not to exceed the purchase price) or purchase of Durable Medical Equipment used

in your home.

Other Medical Equipment

Corrective appliances, artificial aids, Prosthetics and Orthotics that are part of a corrective

appliance; therapeutic footwear (limits may apply);

Urinary catheters (covered for a Member who has permanent urinary incontinence or

permanent urinary retention).

Physical and Occupational Therapy limited to treatment only where short-term therapy is

expected to result in a near-term significant improvement.

Charges for Second Medical Opinion

Immunizations

Childhood immunizations, Hepatitis B and certain adult immunizations when Medically

Necessary or when required for employee safety in the workplace.

Hearing Aid Benefit

To access your hearing aid benefit, first consult your Primary Care Provider who will determine

if an evaluation is needed and will submit the referral request on your behalf. Once authorized,

you may schedule an appointment with an audiologist. Covered Expenses include:

An audiological evaluation to measure the extent of hearing loss;

Hearing aid evaluation to determine the most appropriate make and model of hearing aid;

Limited to once every thirty-six (36) months for the hearing aid instrument (monaural or

binaural), ear mold(s), the initial battery, cords and other ancillary equipment, or

maintenance and repair of current hearing aid device. Includes visits for fitting,

EPO: 2022

22

counseling, adjustments, and repairs at no charge for a one-year period following the

provision of a covered hearing aid.

You may be asked to pay the full cost of the hearing aid at the time of purchase. Should this

occur, you can receive prompt reimbursement (up to any benefit limitations that apply) by

submitting a copy of the provider’s bill and your receipt to the Plan’s Claims Department.

Family Planning Services

Infertility testing and treatment - procedures consistent with established medical practices

in the treatment of Infertility when authorized through your Primary Care Provider, but

limited to diagnosis, diagnostic tests, medication and surgery;

Physician visits for contraceptive devices and oral contraceptive prescriptions;

Vasectomy;

Tubal ligation;

Injectable contraceptives;

Implantable contraceptives.

Well Woman Care

Annual pelvic examination and PAP smear based on current recommendations from the

US Preventive Services Task Force and your PCP’s assessment of need (subject to

medical review);

Periodic clinical breast examination and annual clinical breast examination for women

age 40 and above; and,

Baseline mammogram for women of average risk starting at age 40, and annually

thereafter. Mammograms may be performed earlier if clinically indicated.

Other Services

Hospice Care

Hospice Care services are covered up to the benefit level described in the Schedule of Benefits

if the Member:

Has been certified by the attending Physician to have 180 days of life expectancy or less;

Decided to no longer pursue aggressive medical treatment; and,

The goal of treatment is to provide supportive nursing care and counseling to the Member

during the terminal phase of illness, social services evaluation, and Home Health aid services.

Organ Transplants

Cost of organ procurement - when the organ is harvested from a living donor, the Plan will cover

Medical and Hospital services and other costs of a donor or prospective donor when the recipient

is a Member:

EPO: 2022

23

Medical expenses incurred by the organ donor for the surgical procedure and

associated Hospital stay for harvesting of the donated organ if expenses incurred

exceed any benefits available through any other insurance plan. Expenses are limited to

the donor’s Inpatient Hospital stay for the organ harvesting, and related follow-up care

for sixty (60) days following the organ harvesting.

Costs related to a donor search - limited to a maximum benefit of $15,000 for each

organ transplant when the search is conducted by a special transplant facility, or $5,000

for each organ transplant when the search is conducted by other facilities.

Travel expenses - limited to a maximum lifetime benefit of $7,000 for organ transplants

performed at a special transplant facility, or $3,000 for organ transplants performed at

other facilities. Travel expenses associated with an organ transplant are covered if the

facility at which the transplant is performed is more than 100 ground miles from the

organ recipient’s home address. Child care or charges for house-sitting are not covered

by the Plan. Benefits paid will be based on actual incurred costs. Covered travel

expenses include:

• Coach airfare on a public airline for the organ recipient and one companion (two

companions if the organ recipient is a minor child) to travel to and from the site of

the transplant. A “companion” includes the organ recipient’s legal spouse, legal

parent(s) or legal guardian(s);

• Reimbursement for mileage at the federal maximum rate for use of a personal

car or rental car used to travel to and from the site of the transplant;

• Up to $200/day for reasonable and necessary lodging and meals for the organ

recipient (while not confined) and companion(s). The $200/day maximum applies

to the organ recipient and companion(s) collectively, not individually.

Bariatric, Gastric Bypass and other Weight Reduction Surgeries

For additional Plan Exclusions and Limitations, refer to Weight Control Programs section.

SECTION 5: PLAN EXCLUSIONS AND LIMITATIONS

General Exclusions

All services not specifically included in the preceding “Schedule of Benefits” and “Explanation Of

Covered Services” sections of this document;

Any services requiring approval and authorization by the Plan and/or your Primary Care Provider

where pre-authorization was not obtained (except for Emergency Care or Urgent Care/Urgently

Needed Services);

All services prior to your effective date of coverage or subsequent to your coverage termination

date;

If you are a Member of the EPO Plan, Services rendered by non-Participating Providers where

you have refused treatment available, or where authorized by the Plan and/or your Primary Care

Provider within the Plan Service Area;

EPO: 2022

24

Services received that, based on Medical Management review, are not Medically Necessary, in

accordance with professionally recognized standards of proven and effective medical practice

recognized within the organized medical community;

Services which are part of a plan of treatment for a Non-Covered Service. This may include

services and supplies to treat medical conditions which are recognized by the organized medical

community in the State of California, in conformance with professionally recognized standards

of practice, to be direct and predictable consequences of such non-Covered Services; Medically

Necessary services required to treat medical conditions that may arise but are not predictable in

advance, such as unexpected complications of surgery are not subject to this exclusion;

Charges incurred while on active duty with the Army, Navy or Air Force of any country or

international organization;

Charges submitted for which the Member is not obligated to pay, or for which the Member would

not have been billed had insurance coverage not existed.

Specific Exclusions

Acupuncture, Acupressure, Biofeedback

Ambulance Service (except when Medically Necessary or necessitated by a life-threatening

emergency)

Bone Marrow Transplants (when Experimental or Investigational)

Cosmetic Surgery

Services or supplies related to cosmetic surgery, unless required as a result of an illness

or injury sustained while covered under the Plan, or to correct a functional defect resulting

from a congenital abnormality or developmental anomaly;

Complications of cosmetic surgery or drugs prescribed for cosmetic purposes;

Surgery to alter and improve your physical appearance or to improve your self-esteem,

which provides no improvement to a functional impairment;

Custodial Or Domiciliary Care

Homemaker services, Respite Care, convalescent care or extended care not requiring skilled

nursing;

Dental Care, Dental Appliances

All services required for prevention and treatment of diseases and disorders of the teeth,

including, but not limited to:

Oral exams, X-rays, routine fluoride treatment, plaque removal, tooth decay, dental

embryonal tissue disorders, periodontal disease;

EPO: 2022

25

Anesthesia, repair and restoration, tooth extraction, replacement of missing teeth, dental

implants, dentures and other oral prosthetic devices;

Dental services rendered more than six months after an accidental injury to sound natural

teeth;

Treatment, prevention or relief of pain for dysfunction of the temporomandibular joint or

the muscles of mastication;

Disabilities Connected To Military Services

Treatment for disabilities connected to military service for which you are legally entitled through

a Federal government agency, and to which you have reasonable access;

Durable Medical Equipment, Corrective Appliances, Prosthetics:

Replacement of lost Durable Medical Equipment, corrective appliances, or prosthetics;

Additional optional accessories to Durable Medical Equipment, corrective appliances, or

prosthetics, which are primarily for your comfort or convenience;

Personal comfort items such as electric heating or cooling units, orthopedic mattresses

or support chairs, blood pressure instruments, scales, elastic bandages or stockings,

waterbeds, exercise equipment and swimming pools including home and car remodeling

or modification. This includes prosthetics that require surgical connection to nerves,

muscles or other tissues (bionic) and prosthetics that have electric motors to enhance

motion (myoelectronic);

Emergency Care Services - Non-Network Facility

If you are enrolled in the EPO, Emergency Care services are covered in a non-Network facility

only as long as a life-threatening condition exists, and a transfer to a Network facility would be

medically inappropriate. Routine follow-up care, including treatments, procedures, X-rays, lab

work, Physician visits, Rehabilitation, and skilled nursing care will not be authorized once it is

determined by the Plan that it is medically reasonable for you to obtain these services from a

Participating Provider. Members should contact the Plan within twenty-four (24) hours of

receiving treatment in the event of an Emergency Care situation. Failure to do so may result in

a reduction or denial of Benefits;

Experimental Or Investigational Treatment

Unless otherwise dictated by Federal or state law, decisions as to whether a particular treatment

is Experimental or Investigational, and therefore not a covered Benefit, are determined by the

Plan’s Medical Director or his/her designee, based upon criteria established pursuant to the

following guidelines:

• Any drug, device, treatment, or procedure shall be deemed as Experimental or

Investigational treatment if, as determined solely by the Plan, any one or more of the

following criteria are met:

It cannot be lawfully marketed without the approval of the United States Food and

Drug Administration (“FDA”) and such approval has not been granted at the time of its

use or proposed use;

EPO: 2022

26

It is the subject of a current investigational new-drug or new-device application on file

with the FDA;

It is being provided pursuant to a written protocol that describes among its objectives

determinations of safety and/or efficacy as compared with the standard means of

treatment;

It is being delivered or should be delivered subject to the approval and supervision of

an institutional review board as required and defined by Federal regulations and other

official actions and publications issued by the FDA and the HHS;

The predominant opinion among experts as expressed in the published authoritative

literature is that usage should be substantially confined to research settings;

The predominant opinion among experts as expressed in the published authoritative

literature is that further research is necessary in order to define safety, toxicity,

effectiveness or effectiveness compared with conventional alternatives;

It is not investigational or experimental in itself pursuant to the above, and would not

be Medically Necessary, but for the provision of a drug, device, treatment, or

procedure which is Investigational or Experimental.

• The exclusive sources of information to be relied upon by the Plan in determining whether

a particular treatment is Experimental or Investigational, and therefore not a Covered

Service under the Plan, are limited to the following:

The Member’s medical records;

The protocol(s) pursuant to which the drug, device, treatment, or procedure is to be

delivered;

Any consent document the Member, or his/her representative, has executed or will be

asked to execute, in order to receive the drug, device, treatment, or procedure;

The published authoritative medical or scientific literature regarding the drug, device,

treatment, or procedure at issue as applied to the medical condition at issue;

Opinions of other agency/review organizations e.g., ECRU Health Technology

Assessment Information Service, HAYES New Technology Summaries or AHCPR

(Agency for Health Care Policy and Research);

Expert medical opinion; and

Regulations and other official actions and publications issued by the FDA and HHS.

A terminally ill Member may be entitled to an expedited hearing in cases in which a proposed

treatment is denied as Experimental or Investigational (refer to the “Member Grievance

Procedure” section of this SPD for more information);

Eye Surgery

Surgery to correct refractive error, such as, but not limited to radial keratotomy, refractive

keratoplasty;

Foot Care

EPO: 2022

27

Routine foot care, such as removal or reduction of corns and calluses, clipping of toenails,

treatment for flat feet, fallen arches, and chronic foot strain, except as determined to be Medically

Necessary;

Genetic Testing

If not related to a specific medical diagnosis for a covered Member;

Institutional Services And Supplies - Non-Eligible

Any services or supplies furnished by a non-eligible institution, which is defined as other than a

legally operated Hospital, Ambulatory Surgical Center, or Medicare-approved Skilled Nursing

Facility, or which is primarily a place of rest, a place for the aged, a nursing home, or any similar

institution, regardless of how denominated;

Non-Licensed Professionals

Treatment for any illness or injury when not attended by a licensed Physician, surgeon or other

licensed Health Care Professional;

Nursing - Private Duty

Unless determined to be Medically Necessary and ordered by your Primary Care Provider and

approved by the Plan’s Medical Director;

Nutritional Supplement Formulas

Phenylketonuria (PKU) formula is limited to under age thirteen (13), or as Medically Necessary;

Organ Donor Services

Medical and Hospital services and other costs of a donor or prospective donor when the recipient

is not a Member of the Plan;

Organ Transplants

Organ transplants that are not Medically Necessary and organ transplants considered

Experimental or Investigational as defined herein;

Outpatient Prescription Drugs

The “Outpatient Prescription Drug Program” section of this SPD describes how Outpatient

prescription drugs are covered by the Plan;

Out-Of-Area Emergency Care services

For EPO Plan Members, coverage is limited to the Benefits outlined in the “Emergency Care

and Urgently Needed Services” section of this document. The Member will be responsible for

the bill if services are obtained out-of-area and are not determined to be a life-threatening

emergency.

Physical Examinations

Routine physical examinations for insurance, licensing, employment, school, camp, recreational

or organizational, including appearances at hearings or court proceedings, examinations

EPO: 2022

28

precedent to engaging in travel, or other non-preventative purposes, pre-employment physicals

or vocational Rehabilitation, or for pre-marital and pre-adoption purposes;

Pregnancy Of Covered Dependent

Services related to a non-spousal dependent’s pregnancy are limited to prenatal care/normal

delivery of the covered dependent. Charges for all services provided to the newborn, incurred

after the birth/delivery of the dependent’s newborn are excluded, including pediatric services;

Private Rooms And Comfort Items

Personal or comfort items and private rooms during Inpatient hospitalization, unless Medically

Necessary, such as cable television, telephones, communication devices, exercise equipment,

air purifiers, humidifiers, saunas, hot tubs, therapeutic mattresses, and supplies or any other

similar devices or appliances;

Public Facility Care

Care of conditions for which state or local law requires treatment in a public facility (however,

the Plan will reimburse you for out-of-pocket expenses incurred by you for any Covered Services

delivered at such public facility);

Injuries or illnesses sustained while incarcerated in a municipal, state or Federal prison;

Emergency Care and Urgent Care/Urgently Needed Services required after participating in a

criminal act (covered only until the Member is stabilized and placed on a police hold);

Notwithstanding the foregoing, in compliance with California Health & Safety Code section

1374.12, nothing in this provision shall be deemed to restrict the liability of the Plan with respect

to Covered Services solely because such services were provided while the Member was in a

state Hospital;

Random Drug Testing

All drug testing for a non-medical diagnosis regardless if court ordered;

Recreational, Educational, Hypnotic Therapy

All treatment and related diagnostic testing, except as provided as part of an otherwise covered

Inpatient hospitalization);

Rehabilitation

Long term, maintenance, or chronic- level Rehabilitation services such as Physical,

Occupational and Speech Therapy provided on an Inpatient or Outpatient basis;

Reversal of Voluntary Sterilization

Sexual Dysfunction

Treatment for sexual dysfunctions or inadequacies unless pre-authorized by the Plan;

Skilled Nursing Care/Transitional Care

EPO: 2022

29

Skilled Nursing Facility room and board charges incurred beyond the limits outlined in the

“Schedule of Benefits” section for each qualifying condition. A qualifying condition is a medical

condition which requires skilled nursing services, which as a practical matter, determined by the

Plan and the Member’s Primary Care Provider, cannot be delivered in a setting other than a

Hospital or a Skilled Nursing Facility. A medical condition will not be considered a qualifying

condition if during the 60 days preceding the medical condition, the Member has received skilled

nursing services.

Social Disorders

Services which are primarily oriented towards treating a social, educational or learning disorder,

rather than a medical diagnosis, including treatment for dyslexia, and behavioral modification

therapy;

Surrogate Pregnancy

Third-Party Liability Services

Please refer to the “Payment by Third Parties” section of this document;

Vision Care

Eye refractive examination, corrective lenses and frames, contact lenses, contact lens fitting and

measurements (except post cataract extraction, keratoconus, aphakic or corneal bandages);

Weight Control Programs (Inpatient or Outpatient)

Eating disorder programs for dietary control, or other treatment of obesity such as food and

proprietary food supplements, vitamins and laboratory tests in association with weight reduction

programs. The Plan does cover certain Medically Necessary Bariatric Surgery procedures

ordered by your Primary Care Provider and approved by the Plan’s Medical Director.

Work-Related Illnesses/Injuries

Injury, sickness or disease which arises out of or in the course of any employment, or which is

covered under any workers’ compensation law or similar law.

Limitations

Circumstances Beyond Control

If, due to circumstances not reasonably within the control of the Plan, such as complete or partial

destruction of facilities, war, riot, civil insurrection, or similar causes, the provision of Covered

Services is delayed or rendered impractical, neither the Plan nor its Participating Providers have

any liability or obligation for such delay or failure to provide services;

Major Disaster Or Epidemic

In the event of any major disaster or epidemic, Participating Providers shall provide or attempt

to arrange for the provision of Covered Services insofar as is practical, according to their best

judgment, within the limitations of such facilities and personnel as are then available, but neither

EPO: 2022

30

the Plan, nor its Participating Providers have any liability or obligations for delay or failure to

provide any such services or personnel if such lack is the result of such disaster or epidemic.

SECTION 6: OUTPATIENT PRESCRIPTION DRUG PROGRAM

Refer to this section of this Summary Plan Document for details of how all Outpatient prescribed

and non-prescribed medications are covered.

The Plan provides Benefits for Outpatient prescription drugs on the Navitus (The Plan’s

Pharmacy Benefit Manager) Formulary (“Drug Formulary” or “Formulary”), when prescribed by

a Participating Physician or licensed dentist, or a non-Participating Physician in certain

emergency situations, or for a Member with Out-of-Area coverage.

How The Program Works

• Present your prescription and Navitus identification card at any Participating Pharmacy;

• Pay your Copay for each 30-day supply of prescription drugs you have filled, or the retail

cost of the prescription, whichever is less.

• Receive your medications.

The Drug Formulary

The Drug Formulary is a list of Outpatient prescription drugs that will be covered by the Plan

without preauthorization when a prescription is filled at a Participating Pharmacy. The Formulary

is created and regularly updated by a Pharmacy and Therapeutic Committee that consists of

practicing Physicians and pharmacists. The Formulary is revised periodically to incorporate new

developments in pharmaceutical care. A limited number of formulary drugs require pre-

authorization.

The evaluation of the products included in the Formulary is a continuous process resulting in the

review of new and existing medications to ensure the Formulary is up-to-date and meets the

needs of Members and their providers.

The Formulary is extensive and covers all therapeutic classes of drugs, including medications

that treat both Acute and Chronic Conditions. Acute Conditions include, but are not limited to,

the flu, colds and other short-term illnesses. Chronic Conditions include, but are not limited to,

glaucoma, diabetes, high blood pressure, heart disease, and asthma. The Formulary includes:

• Federal Legend Drugs: Any medicinal substance which bears the legend: “Caution:

Federal law prohibits dispensing without a prescription”;

• State Restricted Drugs: Any medicinal substance that may be dispensed by prescription

only according to state law;

• Compounded Medication: Any medicinal substance that has at least one ingredient that

is Federal Legend or State Restricted in a therapeutic amount;

EPO: 2022

31

• Generic Drugs: Generic Drugs will be automatically substituted for Brand- Name Drugs if

available, unless the Physician has indicated “Dispense as Written” on the prescription;

• Insulin, insulin syringes, blood glucose test strips, lancets, inhaler extender devices,

epipens and anakits;

• Federal Legend oral contraceptives, prescription diaphragms.

If you would like additional information about the Formulary, contact Navitus Customer Care at

(866) 333-2757.

Pre-Authorization of Non-Formulary Drugs

If a non-Formulary drug is prescribed, it will not be covered unless the non-Formulary drug is

pre authorized. All pre authorization requests for non-Formulary drug treatments may be initiated

by your Physician. Non-Formulary drugs that are not otherwise excluded from coverage will be

authorized in the following instances:

• No Formulary alternative is appropriate and the Plan determines the drug is Medically

Necessary for your individual needs;

• The Formulary alternative has failed after therapeutic trial. Your prescribing Physician

will be asked to provide a copy of your medical chart notes that specifically state treatment

failure with the Formulary drug;

• You have been under treatment and remain stable on a non-Formulary prescription drug

and conversion to a Formulary drug would be medically inappropriate;

• You have experienced a typical allergic reaction or medically established adverse

reaction which are effects related to the chemical properties of the Formulary drug. These

allergies and/or adverse effects are attributed to formulations or differences in absorption,

distribution or elimination; and,

• Your Physician provides evidence in the form of documents, records or clinical tests,

which demonstrate that use of the requested non-Formulary drug over the Formulary drug

is Medically Necessary, as determined by the Plan.

Authorizations for non-Formulary medications will be given for a time period varying from six

months to indefinitely, upon request for the prescribed medication.

Note: The Plan reserves the right to expand the pre authorization requirement for any drug

product to assure adherence to FDA-approved indications and national practice standards. The

Formulary has medications added and deleted throughout the year based on the

recommendations of the Pharmacy and Therapeutic Committee’s quarterly review.

Maintenance Drug Dispensing

Maintenance drugs will be dispensed for up to a 90-day supply through Navitus Participating

Pharmacies, or mail order service. These products include, but are not limited to:

• Antiarthritics

• Antiasthmatics

EPO: 2022

32

• Anti-clotting drugs

• Antiepileptic drugs

• Antihypertensives

• Anti-Parkinson drugs

• Birth control pills

• Cardiac drugs

• Cholesterol and lipid lowering agents

• Diuretics

• Gastrointestinals

• Glucose test strips

• Hormones

• Insulin and Insulin syringes

• Oral contraceptives

• Oral hypoglycemics

• Prenatal vitamins

• Psychotropics

• Thyroid suppressants or replacements

You may receive up to a 90-day supply of these medications through a participating pharmacy

or mail order service for two Copays (saving you one Copay). It is your responsibility to pay the

Copay amount required each time a prescription is filled.

Mandatory Generic Substitution

All prescriptions will automatically be filled with a Generic Drug where one is available, unless

your Physician indicates the Brand Name Drug must be dispensed (by writing “Dispense as

Written” or “DAW” on your prescription). If your Physician does not indicate “Dispense as Written”

on the prescription for the Brand-Name Drug, and you specifically request the Brand-Name

Drug, you’ll be responsible for paying any difference in cost between the Brand-Name Drug and

the Generic Drug, as well as the Brand-Name Drug Copay.

Mail Order Service

Having your prescriptions filled by mail is easy - Just follow these steps:

For Mail Order: Please dial the RUHS Medical Center Pharmacy main line at 951-486-

4515 and choose Option 5. Mail order turnaround time is usually 3 to 5 business days.

Online Order: Click for Online Order

For the nearest Participating Pharmacy in your area, or additional information regarding the mail

order service, please contact Navitus Customer Care at (866) 333-2757 or the Plan’s Member

Services Department at 800-962-1133 ext. 1.

EPO: 2022

33

Exclusions and Limitations

The Outpatient Prescription Drug Program excludes drugs, medicines and/or related items which